Despite Higher Interest Rates And Tighter Mortgage Markets, Canadian Housing Starts Remained Quite Strong In March

“Robust residential construction activity continues, led by the major markets. The correction we’re seeing (Toronto now and Vancouver recently) still remains largely an asset price phenomenon at the higher end of the market, with underlying demographic demand still strong.” (Robert Kavcic, March Canadian Homebuilding Still Buoyant, April 10, 2018)

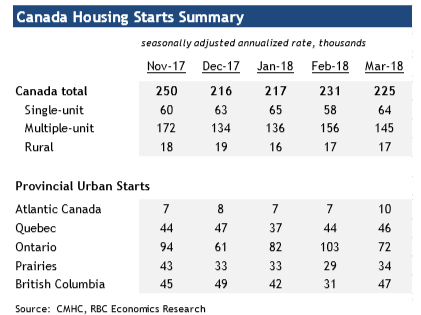

Canadian housing starts declined marginally in March to 225.2K from 231.0k in February. The March start level was quite strong, especially considering the rising interest rate environment, the newly restrictive mortgage lending regulations, and the affordability issues in some of the more expensive cities.

New start construction is expected to decelerate in coming months as financial conditions tighten further.

As the following table indicates, the moderation in starts in March centered in urban multiple units, which dropped 7.3% to 144.6k.

The regional weakness in March was centered in Ontario, where starts dropped 30.4% to 71.6k. It should be pointed out that multiple unit constructions in Ontario is still running very strong, as the new start levels in January and February of this year were unusually strong.

One should also note that the strong multi-unit starts boom (particularly in Toronto) continues to outpace single-detached starts by a roughly 2-to-1 ratio.

On a regional basis, new start activity in Ontario pulled back in March, while B.C. starts rebounded. These two geographically distant provinces often seem to be out of phase in this way.

Disclosure: None.