Caterpillar Is The Poster Child For Overvalued Market

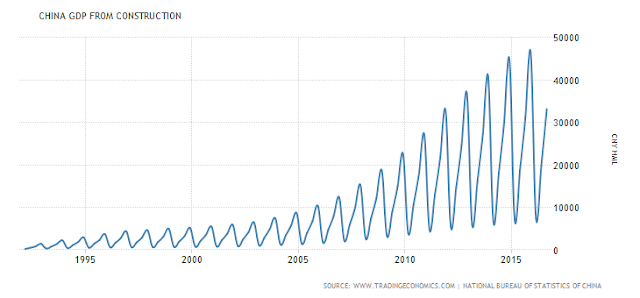

We discuss China`s credit bubble, real estate bubble, and non performing loans bubble in relation to CAT; a stock up $30 on a substantial decline in earning`s and revenue growth. We think ultimately CAT will cut their dividend like a lot of E&Ps will also be forced to come to terms with.

Current Institutional owners of this stock should be dumping this over-valued stock, not to mention any retail holders, as we think CAT is going to retest the $60 a share level over the next two years.

CAT could very easily be a $20 stock in five years as the ZIRP free money party comes to an end, taking stocks with declining revenues where they would otherwise trade without central bank excesses.

Video length: 00:09:13

Disclosure: None