Canadian Housing Market Continues To Draw Attention

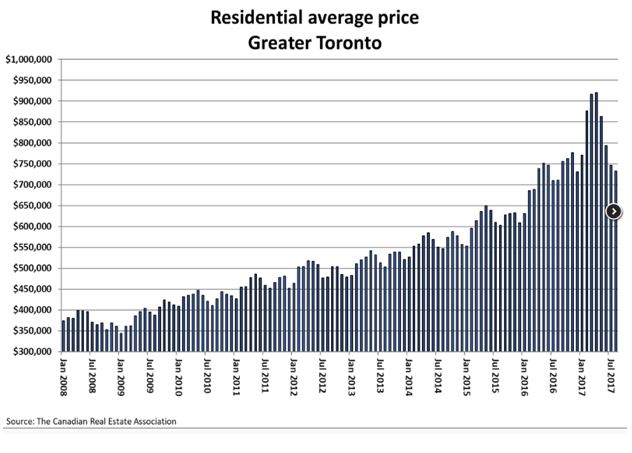

Housing prices in Canada have garnered interest well beyond its borders as prices continue to surprise the experts on the upside. Earlier this year, the Canadian housing market caught the attention of the International Monetary Fund. The Fund warned of "significant" risks to future growth due to the potential for a housing market decline that would ultimately impair bank balance sheets and spread to the broader economy. [1] Canadian banks’ portfolios of uninsured mortgages and home equity loans are nearly 4 times regulatory capital, a figure that some consider too high in such a frothy market. Despite all the hand-wringing about household debt in Canada, Toronto housing prices have been on a very steady, but aggressive, upward motion. And, despite a temporary retreat this past summer, average prices in Vancouver and Toronto remain at very elevated levels

The most recent study by the Federal agency, the Canadian Mortgage and Housing Corporation (CMHC), concludes, oddly, that there are “puzzling” dynamics in the Toronto market. [2] According to the CMHC study, “while price increases in Vancouver have largely been supported by economic fundamentals, a more puzzling result points to the state of the Toronto market, where fundamentals haven’t been as strong.” What is really puzzling is this last statement.If anything, the Toronto market is totally driven by fundamental forces, not speculative forces as hinted in the CMHC report.

Realtors and developers will argue that there are a constant set of fundamental factors that drive the market in both major cities:

- These major cities exhibit all the characteristics of wealth-generation and high incomes so much a part of the large cities throughout the world; industry clusters, especially in the financial and technology sectors, attract high-wage earners who then bid up the prices of homes; this phenomenon is apparent in London, New York, San Francisco, and other U.S. major industrial hubs;

- These two cities received more than half of the 350-400,000 immigrants to Canada each year. On this basis, alone, the demand for new housing units exceeds 150,000 which then must be added to the demand from the local population; and,

- Serviced land is in tight supply; Toronto, much to the frustration of local developers, enforces strict zoning regulations that have been cited as a major factor in rising house prices; unlike, some U.S. mega-cities which have relatively lax zoning laws (e.g. Houston, South Florida), the maintenance of green spaces and density restrictions operate to curtail supply in the face of growing demand.

Correctly, the CMHC report rejects the use of monetary policy to deal with the rapid growth in housing prices.The use of interest rates is a blunt instrument that will not likely curtain demand, but more importantly, will have the unintended consequence of negatively affecting other economic sectors. Governments at all levels—Federal, provincial and municipal—are under pressure to ‘do something’ to make housing more ‘affordable’. However, these fundamental pressures leave little room for the government to intervene effectively. The CMHC, with some frustration, concludes that “no one simple measure emerges as an obvious candidate for addressing the challenges posed by high-priced markets”.

[1] IMF warns of ‘significant’ risks from Canada’s housing market

[2] ‘Puzzling’ Toronto real estate market could frustrate push for price fix, CMHC says

Disclosure: None.