Canadian Bond Investors Overreact To The Bank Of Canada’s Rate Hike

So often investors take one move on the part of a central bank as a signal that the universe has changed fundamentally. This is the case with the knee-jerk reaction on the part of bond investors and currency speculators following the Bank of Canada’s decision to hike its overnight rate by 25pbs. Now, there are a spade of analyses speculating on the Bank’s next move this year and beyond. Mortgage analysts sound the alarm bells that rates are going to go up and homeowners had better start locking in financing to avoid having to pay much more in the coming months.

To the Governor Poloz’s credit, the policy statement did not set a path for future rate hikes. In fact, he was careful to note that the evolution of policy will be data dependent, i.e. quarter-by-quarter depending on how well the economy performs. Nonetheless, the debt and currency markets decided that further rate increases were in the cards.

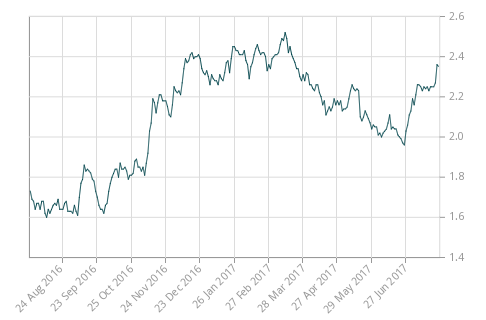

The bond market reaction was swift as demonstrated in Figures 1 and 2. The short end of the market, 1-3 years, moved up over 60bps, starting in late June as rate hike fever developed. The longer end did move as well, although by a smaller 30bps. One reason restraining longer- term yields was that annual CPI for June increased by a mere 1.0 %, well-below the Bank’s target of 2%. The Bank officials had a difficult time explaining the need for rate hikes in the face of a deceleration in the inflation rate.

Figure 1 Govt of Canada 1-3 Yr Bond Yield

Figure 2 Govt of Canada Long Term Bond Yield

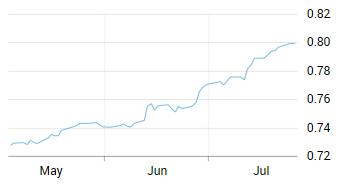

The currency markets reacted sharply in the wake of the rate hikes (Figure 3). The Canadian dollar rose more than 4 cents and now sits at high for the year. Clearly, currency speculators anticipate further rate hikes that will attract an inflow of overseas funds.

Figure 3 Surge in the Canadian Dollar (Cdn/US)

The combination of higher interest rates and a stronger Canadian dollar is a powerful form of monetary tightening. Exporters borrowing money to expand operations at a time when the currency is appreciating will face much higher costs ( lower profits) than existed prior to the rate hike. The situation in Alberta is a perfect case in point where the combination of soft oil prices and a rising currency hurt export revenues, just when the province is starting to show signs of recovery.

This development is now starting to attract the attention of Canadian government officials. Customarily, officials do not comment on Bank policy, however a recent article in Bloomberg.com cited officials expressing concern that the rate hike was too early and that any future rate hikes will hurt the consumer, depress housing prices and add to cost of household debt.[1] As pointed out in my earlier article, inflation is nowhere to be found. Starting to tighten in the absence of inflation could be a policy error.[2] Perhaps, it is too early to know whether this recent rate hike is a prelude to subsequent hikes or just a false start

[1] Trudeau Officials Fear the Impact of Speedy Poloz Hikes

Disclosure: None.

o'Canada noooo