Canadian Banks Widen The Mortgage Market

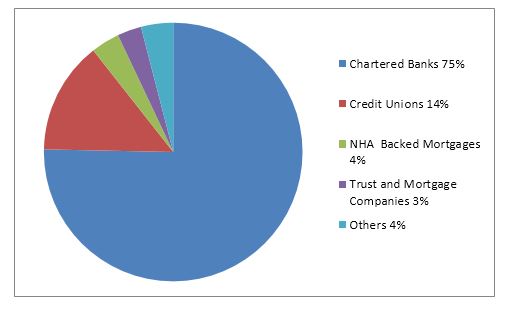

Commercial banks in Canada have long dominated the mortgage market and they now are making their mortgages available directly to investors. The banks own the mortgage market, holding 75% of all residential mortgages and dwarfing the amounts held by competing institutions such as credit unions, trust companies and private lenders (Chart 1). Now, the banks want to take advantage of their market strength by securitizing their uninsured mortgages, providing individual investors with the opportunity to participate directly in this strong housing market.

Chart 1: Distribution of Residential Mortgages by Institution, 2016

The banks have long packaged federally insured mortgages into bonds. Mortgage bonds have traditionally been backed by the Canadian Mortgage and Housing Corporation, a Federal agency. However, recently the Canadian government pressured the banks to bear some of the risks of insuring mortgages as part of an overall policy aimed at cooling the red-hot Canadian housing market, especially in Toronto and Vancouver.

Now, uninsured mortgages are been brought to the MBS market for the first time. The Bank of Montreal is first off the mark to bundle uninsured mortgages. The bond issue is backed by C$1.96-billion of prime residential mortgages. According to Moody’s, 95 per cent of the securities in the transaction will be rated Aaa. The bank believes it has found a way in which to release more value from its mortgage portfolio to help meet its funding needs in the future. The bank is anticipating shifting some of the risks of its mortgage portfolio onto the private investors who are looking for greater yields along with safety.

The timing of this new venture is interesting. The housing market in Toronto, especially, has been soaring. Year –over-year price increases are in excess of 30 per cent in 2016. Buyers are facing bidding wars and many first –time buyers are been shut out completely. At the same, there is a chorus of analysts who anticipate a significant downward correction. They argue that wages increases have greatly lagged the increases in housing costs. Many are forecasting a market that will end only in tears. So, for the bank to launch an investment product at this time when many are anticipating a severe downturn in housing bears careful watching.

The Canadian mortgage market has been one of the most stable and resilient markets in the developed world. Even after these significant increases in home prices, Toronto and Vancouver housing costs are far below those of major urban centers in the United States and Europe. The rest of the world views Canadian house prices as a bargain. Right now, the bankers are confident that there is considerable pent-up demand for their mortgage products. Notwithstanding the prognosis of a market crash, early indications support their view.

Disclosure: None.