Canada’s Mercuric Economy

Just like the chemical mercury, the Canadian economy expands or contracts depending on the external temperature. We started the new year off on a very strong footing with January’s GDP growth of 0.6 per cent. The January report falls close on the heels of the 2.6 per cent expansion for the last quarter of 2016. Little wonder some economists begin to cheer that “we have liftoff” and many returned to their desks to revise upward forecasts for 2017. The consensus is convinced that the recent upturn in the GDP is a sign that the worse effects of the oil price collapse and the recession in Alberta are behind us.

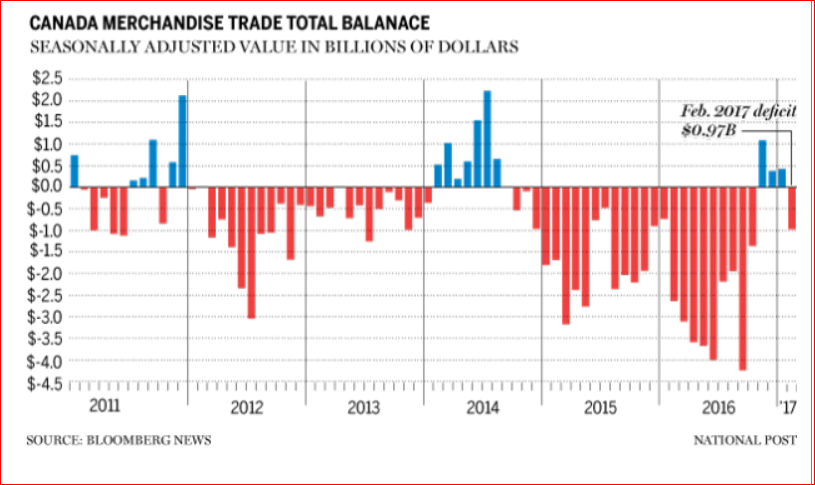

But Canada is one of the most “open” economies in the world, in the sense that exports represent 30 per cent of national income, greater than China’s ratio, a country we so often associate as a major world exporter. So, when our export sales decline, the mercury contracts and the economy catches a chill. In fact, the accompanying chart unmistakably proves that for the past five years our trade balance has been deep in the red with only a handful of months in which a surplus was recorded. Trade deficits are a negative when adding up the nation’s GDP, so, in the case of Canada these deficits have been a steady reduction in national income. The balancing item, of course, is the inflow of capital which has been adequate, although the overall effect has been the decline in the value of the Canadian dollar, especially since 2014 when oil prices plummeted.

After a brief interlude of surpluses the past 3 months, Canada’s trade balance resumed a deficit to the tune of $972 million, a swing of $1.5 billion from the prior month. The culprit continues to be the poor export performance where 8 out of 11 subsectors were lower. No longer is it just a case of weak energy exports, as exports of just about everything decreased, including agricultural, intermediate food products, aircraft and other transportation equipment and parts, as well as consumer goods. Once again, the non-resource sector has failed to pick up the slack created by decline in oil and gas exports.

The weakness in non-resource exports figure prominently in the deliberations of the Bank of Canada in their assessments of the balance of risks facing the economy. An additional layer of risks has been added by the Trump administration’s hard line on NAFTA. If we record deficits under the current trade agreements, then there is real concern that these deficits will persist, and maybe worsen, if the Trump administration has its way.

Disclosure: None.