Canada’s Employment Situation: Is The Glass Half Empty Or Half Full?

Looking at Canadian employment numbers for April, one comes away with a rather unsatisfactory feeling about the quality of economic growth. April witnessed no net job growth, no change in the unemployment rate of 5.8 per cent and no sense that the various components of the labor market have improved at all since the end of 2017. Granted one month does not make a pattern, so, if we look at the employment performance over the last six months, a clearer picture comes into focus.

Canada's Employment Picture

The reader will recall that at the end of 2017, although economic growth was slowing from its rapid pace earlier in the year, the outlook for 2018 was very positive. The Bank of Canada at its regular policy meetings spoke about how business investment would be the backbone of the a stronger 2018. Despite the uncertainties emanating from various shifts in U.S. trade and policy, the Canadian economy would continue to expand as it moved towards fuller employment. More importantly, there was a lot interest in the fact that the economy was nearing full capacity and that this was the reward for a decade of monetary ease. Economic growth in the early months of 2018 was tepid, at best, with a mixture of monthly contraction and expansion. Many economists anticipated future rate hikes, although Governor Poloz discouraged adopting any specific time frame for future rate changes.

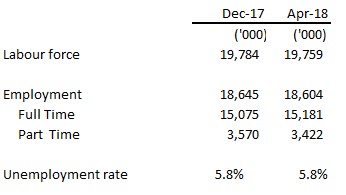

The release of the April job figures promoted some analysts to point out that the economy has reached its capacity limits. Proof of this assertion is that the labor force growth has stalled at 19.7 million available workers; that job creation has stalled at 18.6 million employed persons; and both full-time and part-time work has also stalled. Naturally, the unemployment rate remains unchanged, but nonetheless, elevated, at 5.8 per cent[1].

The glass-half-full argument is that growth is strong, the labor market is tight as wage gains exceed 3 per cent and that unemployment is at the lowest level in over 30 years. The glass-half-empty argument is that there are lots of pockets of unused labor and space capacity; with a growing population, driven by young immigrants, job growth is not adequate. Canada should be adding jobs at a rate of 1.5 per cent a year, at least. That is why, when polled, most economists forecast monthly increases of 15,000 jobs on average.

The challenge before the Bank of Canada is to interpret whether the glass is half full or half empty. So far, Bank of Canada has not shown any willingness to set out a path for future rate increases. Although Governor Poloz has spoken that the economy is nearing full capacity utilization, he does recognize that monetary accommodation has to remain in place to support growth. The employment results for the first four months of 2018 support that position. This economy is stalled and needs to be supported by the current interest rate environment.

[1] Using the U.S. measuring techniques, the Canadian unemployment rate is 4.9 per cent.