Canada’s Economic Outlook Has Suddenly Become Much Gloomier

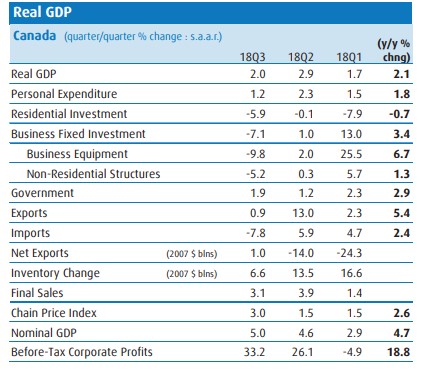

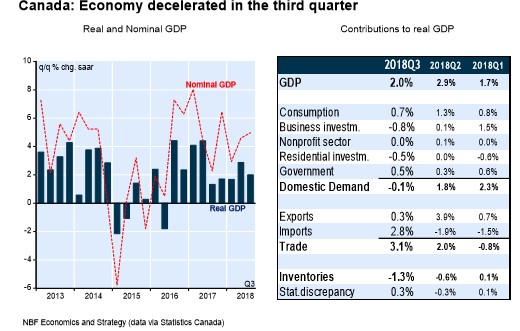

The Canadian economy decelerated in the third quarter to a 2% annual rate of growth.

While a third-quarter slowdown from the 2.9% pace in the second quarter was widely expected, nonetheless the latest underlying components of growth paint a rather gloomy picture. Ironically, Canada’s growth in the third quarter is almost identical to the projected 2% trend rate expected over the medium term.

Canada’s Q3 economic slowdown reflected a moderation in the annualized growth of real consumer spending to 1.2% as well as a huge 9.8% annual drop in business fixed investment. Uncertainties related to whether a new trade agreement with the US and Mexico would be signed was clearly a negative factor causing some of the cutbacks in investment spending in the third quarter.

Net exports expanded 1% in the third quarter after declining by 14% in Q2 and 24% in Q1. The latest slight improvement on the net export side was primarily due to a sharp 7.8% annualized drop imports, while exports rose less than 1%.

Defying the slowing economy, pre-tax corporate profits have been growing strongly this year and expanded at a 33.2% annual rate in the third quarter.

Ironically in terms of contribution to total economic growth in Q3, the largest boost came from net exports, which contributed to 3.1% to total GDP growth. Virtually all other expenditure components were either very weak or negative for the economy.

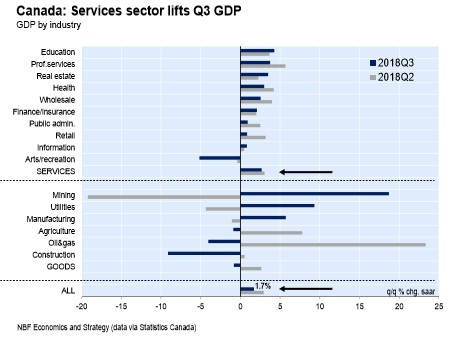

As one of the following charts illustrate, monthly GDP growth in September was supported primarily by the service industries. Indeed, over the entire third quarter, monthly GDP output increased at a 1.7% annual rate.

Looking ahead, the outlook for the Canadian economy has suddenly become much gloomier. The number of worrisome indicators on the horizon are numerous.

There is little doubt that the world economy is cooling, as is Canada’s largest export market, the US economy. Moreover, recent data highlight an unintended build-up of business inventories this year and a weakness in business investment and housing construction. Moreover, it is hardly an endorsement of confidence in the Canadian economy that the largest contributor to growth in the third quarter was a hefty contraction in imports.

Consumer spending is also expected to remain soft due to higher interest rates, the softening in the housing market, and a low personal savings rate.

While some of the trade uncertainty with the US has been resolved with the signing of the US, Mexico, Canada trade agreement, nonetheless the American tariffs of steel and aluminum are still hurting the Canadian economy. The continuing threat from tariffs and trade war concerns are curbing Canadian investment, and of course, hurting export sales.

Moreover, the major slump in oil prices and the huge disparity between Alberta oil prices and world prices has created a virtual recession in that important province. Cutbacks in output and investment in the oil & gas sector are coming as Alberta producers and its government grapples with record high oil inventories and sinking prices.

Additionally, the announced closing of the GM plant in Oshawa Ontario has also dampened prospects dramatically.

Thus, the latest Canadian GDP figures as well as these two relatively new negative pieces of information (Alberta’s oil woes and the closing of the GM plant in Oshawa), have dampened prospects and are indicative of a further slowing of Canada’s economy in the fourth quarter, to perhaps as low as 1% annual growth.

One of the important implications from this array of bad news is that it is somewhat less likely that the Bank of Canada will increase its benchmark interest rate once again in January.

Disclosure: None.