Bubble Watch: The Fed Has Burst The Everything Bubble, Pt. 2

Yesterday’s piece generated a lot of interest, so we’re going to develop this theme some more.

The key item of note is that while US stocks are holding up, the Fed’s hawkishness has already blown up much of the global financial system. In particular, Emerging Market Stocks have already entered full-blown bear markets.

That’s the GOOD news.

The bad news is that the global debt bubble is in the process of bursting.

Quietly, and with few noticing it, sovereign bond yields have broken out of their long-term downtrends.

Here’s Germany’s 10-Year Government Bond yield:

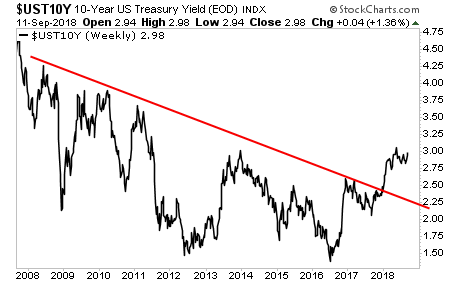

Here’s the US’s 10-year Treasury yield:

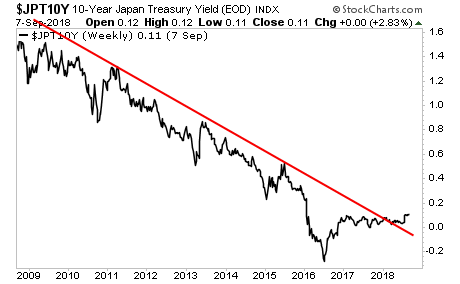

Even Japan’s 10-Year Government Bond, which is actively managed by the Bank of Japan, has begun to breakout.

This is a massive deal… because it is BOND markets, NOT stocks that determine true systemic risk.

When a stock market breaks down, investors lose money.

When the bond market breaks down… entire countries go broke.

We are already seeing this happen on the periphery of the bond market with countries like Argentina and Turkey… but eventually this mess will spread to developed nations.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

We are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our ...

more

Bond yields are above trends but it could be looked at as more of a counterparty stress test than as a bear market in bonds