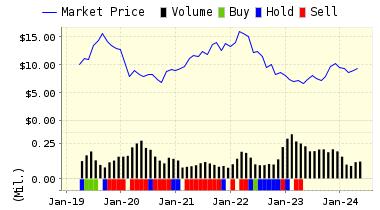

Brazilian Food Company JBS SA Leads Strong Buy Stocks

JBS S.A. (JBSAY) is a Brazilian multinational food company, producing chilled and fresh beef, processed beef, and fresh and chilled pork, as well as beef and pork by-products. Its Fresh beef includes chilled and frozen cuts, rump cover, ribs, tenderloin, forequarter cuts, and offal. JBS fresh beef brands includes Maturatta, which sells chilled, cleaned, and boneless cuts, rump cover, rump brain, tenderloin, hump, sliced rump cover, brisket, thin skirt, rump tail and short ribs; Organic beef; Friboi; Cabaa Las Lilas and Swift Angus Select. Its Processed Beef products are derived from beef, such as cooked, frozen, and canned beef, beef extracts, processed beef like hamburger, beef croquettes, sausages and cured sausages and ready-to-eat meals. JBS processed beef brands includes Swift, Anglo, Sola and Exeter. JBS S.A. is based in Sao Paulo, Brazil.

JBS SA is one of the world's largest beef and chicken producers and is the second-largest food packager behind Nestle SA. This food giant garners the bulk of its revenues from beef, and with high beef prices the bottom line looks strong. In addition, more than 80% of their sales take place in US dollars, which largely eliminates issues related to Brazilian currency devaluations and other BRIC-related problems. They also own 75% of Pilgrim's Pride (PPC) which has been a perennial favorite of our models lately.

Below is today's more extensive data on JBSAY:

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on JBS SA-ADR for 2015-06-16. Based on the information we have gathered and our resulting research, we feel that JBS SA-ADR has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Company Size.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

10.74 | 1.36% |

|

3-Month |

10.76 | 1.54% |

|

6-Month |

11.03 | 4.04% |

|

1-Year |

12.34 | 16.38% |

|

2-Year |

11.37 | 7.25% |

|

3-Year |

6.82 | -35.62% |

|

Valuation & Rankings |

|||

|

Valuation |

n/a |

Valuation Rank |

|

|

1-M Forecast Return |

1.36% |

1-M Forecast Return Rank |

|

|

12-M Return |

57.97% |

Momentum Rank |

|

|

Sharpe Ratio |

0.12 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

5.12% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

43.13% |

Volatility Rank |

|

|

Expected EPS Growth |

8.75% |

EPS Growth Rank |

|

|

Market Cap (billions) |

15.60 |

Size Rank |

|

|

Trailing P/E Ratio |

11.24 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

10.33 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

1.28 |

PEG Ratio Rank |

|

|

Price/Sales |

0.33 |

Price/Sales Rank |

|

|

Market/Book |

3.56 |

Market/Book Rank |

|

|

Beta |

2.44 |

Beta Rank |

|

|

Alpha |

0.16 |

Alpha Rank |

|

Disclosure: None.

ValuEngine subscribers can easily check out all of our top-rated STRONG BUY stocks with our "5-Engine ...

more