Australian Dollar Loses Steam From Surprise China Rate Cut

One thing about a trading range is that it gives both bulls and bears a lot of trading opportunities.

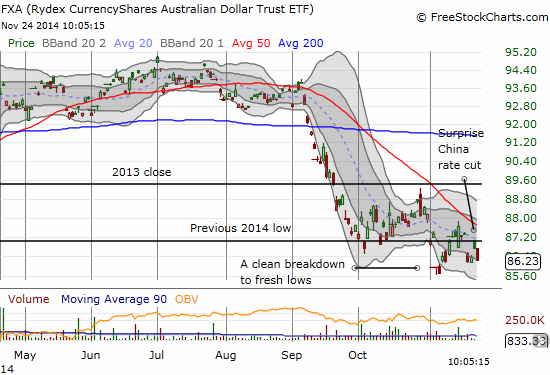

The latest disturbance of equilibrium in the Australian dollar (NYSEARCA:FXA) was the surprise rate cut from China's central bank. At the time, it helped the Australian dollar surge against all major currencies. At the time of writing, the currency has already given up most or all its gains against those same currencies, particularly the U.S. dollar. The chart below shows that FXA continues to pivot around the previous 2014 low as the current trading range extends.

The celebration from the surprise rate cut from China's central bank is already fading for the Australian dollar

Source: FreeStockCharts.com

What DID change of note, albeit marginally, is the market's expectation for a rate cut at the Reserve Bank of Australia's December meeting on monetary policy. Ahead of the Chinese rate cut, odds of a RBA rate cut stood at 4%. Now, those odds are 2%. The odds were as high as 6% earlier this month.

![]()

Odds of a rate cut in December are back to levels just about as low as they can go

Source: RBA Rate Indicator

In a sense, China is doing the work of stimulus that the RBA might look to do with rate cuts. The change in RBA rate expectations seem small, but it is important in that there is no catalyst for further weakness in the Australian dollar coming from market expectations on monetary policy. If the RBA is serious about a weaker currency, it will have to do THAT work on its own.

Be careful out there!

Disclosure: Net long the Australian dollar.