Thursday, January 19, 2017 4:07 AM EDT

The Australian dollar took a break from gains but remains on the high ground. What’s next?

Here is their view, courtesy of eFXnews:

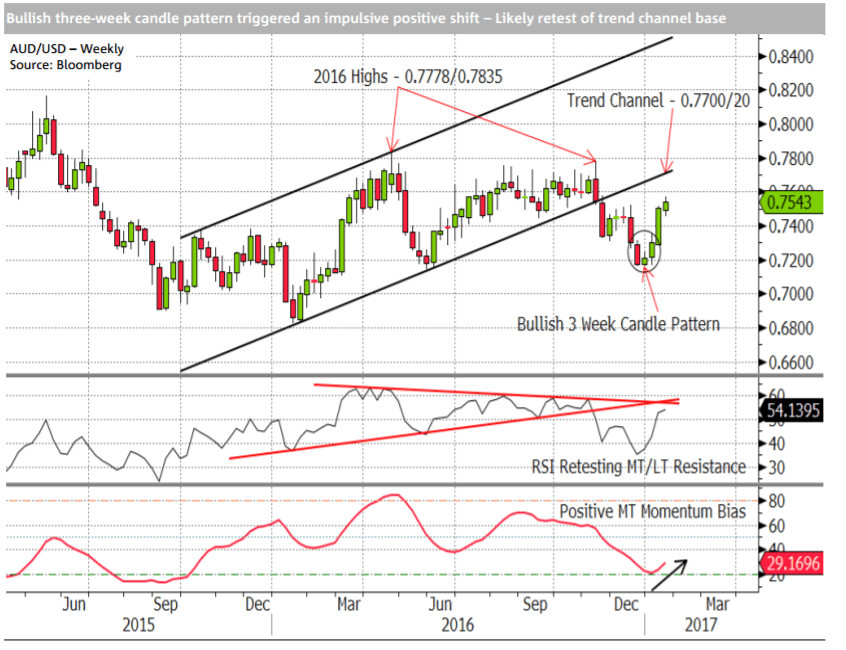

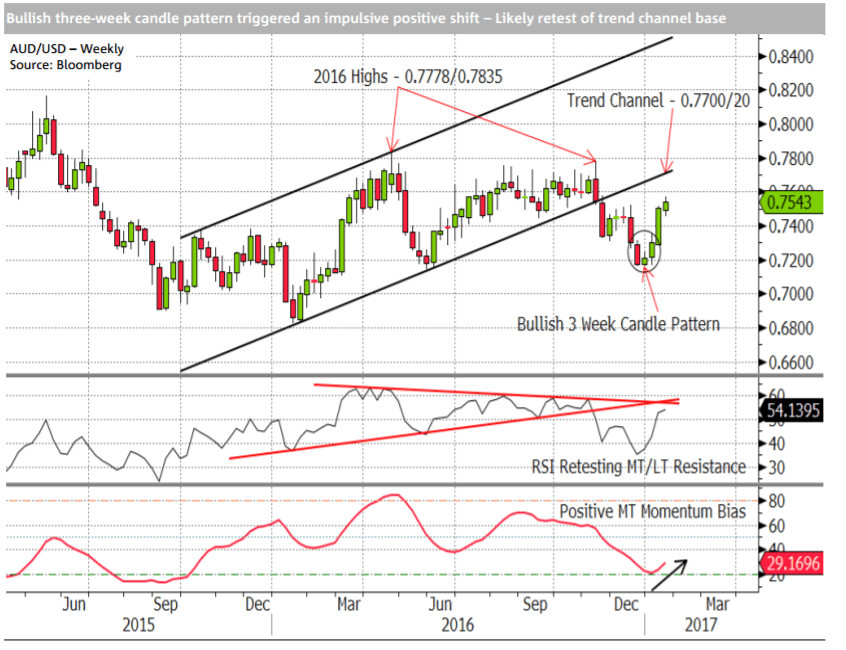

Trend: Price broke down from its broad 2016 triangle in Q4 2016 and challenged the bottom of the nine-month range and our downside target at 0.7150/00 in December. The response to nine-month lows at 0.7150/00 has been positive, however, completing a bullish three-week candle pattern in early January that triggered an aggressive, positive extension last week. The break of late 2016 highs at 0.7525 this week confirms the sustainability of the interim upswing.

At a minimum, we anticipate that this confirmation justifies a retest of the base of the broken uptrend channel at 0.7700/20 in the coming weeks. Beyond this, we note 2016 highs at 0.7778/0.7835 as a difficult hurdle that would need to be overcome to establish a more sustainable MT uptrend.

Outlook: Price achieved our downside target at 0.7150/00 in late December. Bullish three-week candle pattern completed in early January confirms the hold of nine-month lows at 0.7150/00 and implies that range lows will hang on a multi-week basis.

Upward correction targets a retest of trend channel base at 0.7700/20. A more sustainable uptrend would require a break of 0.7835, confirmed by a weekly RSI breakout.

Disclosure: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and the trader's level of experience should be carefully weighed before entering the Forex market. There is always a possibility of losing some or all of your initial investment / deposit, so you should not invest money which you cannot afford to lose. The high risk that is involved with currency trading must be known to you. Please ask for advice from an independent financial advisor before entering this market. Any comments made on Forex Crunch or on other sites that have received permission to republish the content originating on Forex Crunch reflect the opinions of the individual authors and do not necessarily represent the opinions of any of Forex Crunch's authorized authors. Forex Crunch has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: Omissions and errors may occur. Any news, analysis, opinion, price quote or any other information contained on Forex Crunch and permitted re-published content should be taken as general market commentary. This is by no means investment advice. Forex Crunch will not accept liability for any damage, loss, including without limitation to, any profit or loss, which may either arise directly or indirectly from use of such information.

less

How did you like this article? Let us know so we can better customize your reading experience.