AUD/USD Short Term Outlook Ahead Of RBA Meeting Minutes

The AUD/USD has bounced off a key support level around 0.7450, which also coincides with a key trend line, and the pair reclaimed the 0.75 handle on positive risk sentiment to start the trading week.

The RBA Meeting Minutes is the main event risk in the short term for the pair, but all eyes are on the Fed and BOJ this week.

Against this backdrop we will form our outlook and look to find short term trading opportunities using different tools such as the Grid Sight Index (GSI) indicator.

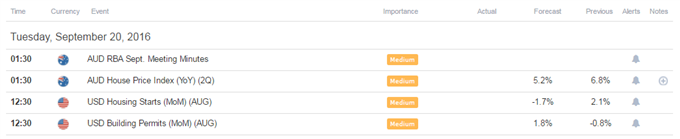

Click Here for the DailyFX Calendar

The RBA September Meeting Minutes are set to hit the wires 01:30 GMT.

In their latest rate decision, the RBA opted for status que, keeping the benchmark interest rate unchanged at 1.5%.

The currency’s strength has been a headwind for the Australian economy, as was stated by the bank, but with the prospects of potential rate hike/s by the Fed by year end, some pressure might have been taken off.

In turn, we suggested any knee-jerk weakness might be seen as a buying opportunity by Aussie bulls, which indeed proved to be the case, until a certain shift took place in the market, and the currency's yield appeal started to ease somewhat after the ECB opted for inaction, and speculation rose that the BOJ might shift its policy to try and push longer term yields higher– potentially inducing a bond market rout.

As a consequence, global yields saw a leg higher and stocks sold off on fears that central banks are running out of ammo.

In comes the other event risk on the docket; the Fed and BOJ monetary policy decisions.

A “hawkish hold” by the Fed and/or a BOJ that misses expectations seem likely to bode ill for risk trends, potentially implying that the RBA minutes might prove to be a “nonevent” this time around, as the market trades in anticipation for Wednesday.

Interestingly, the market started the trading week on a positive risk mood, possibly reflecting moderation in the “hawkish Fed” narrative, which seems to have given the sentiment linked Aussie a boost.

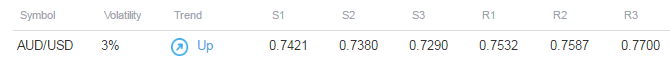

AUD/USD Technical Levels:

We use volatility measures as a way to better fit our strategy to market conditions. The Australian Dollar is expected to be more volatile than most other majors versus the US Dollar, based on a 1-week implied volatility measures (Yen more), potentially implying that the market is looking at the Aussie as a likely candidate for more volatile moves on the aforementioned event risk.

Realized volatility as well has seen a pick up recently based on 20-day ATR readings.

In turn, this may imply that breakout type plays might be generally preferable this week.

AUD/USD 30-Min Chart (With the GSI Indicator): September 19, 2016

(Click to Enlarge)

The AUD/USD is trading around potential resistance at 0.7550, with GSI calculating higher percentages of past movement to the downside in the short term from current levels.

The GSI indicator above calculates the distribution of past event outcomes given certain momentum patterns. By matching events in the past, GSI describes how often the price moved in a certain direction.

Other resistance levels to watch in the short term might be 0.7575, 0.7600 and 0.7624.

Levels of support may be 0.7525, 0.7500 and 0.7475 and the zone above 0.7450.

We generally want to see GSI with the historical patterns significantly shifted in one direction, which alongside a pre-determined bias and other technical tools could provide a solid trading idea that offer a proper way to define risk.

We studied over 43 million real trades and found that traders who successfully define risk were three times more likely to turn a profit.

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing that about 54.1% of FXCM’s traders are long the AUD/USD at the time of writing, implying a short bias on a contrarian basis.

What are the more