Ascendas REIT: A Lot To Like For An Income Investor

Ascendas REIT (ACDSF) is a real estate investment trust focused on business space and industrial properties based out of Singapore. It is the largest such trust operating in the small city-state, boasting 102 properties in Singapore, ten properties in Australia, and two properties in China. This scale, breadth of operations, and the natural characteristics of real estate make Ascendas REIT an excellent opportunity for income-focused investors.

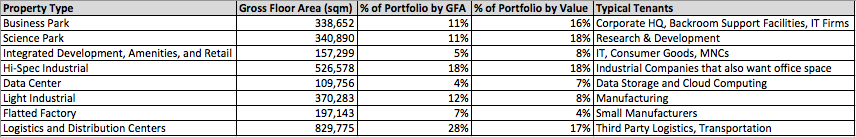

Ascendas REIT’s portfolio is quite well diversified among a variety of industrial property types, as shown here:

(Click on image to enlarge)

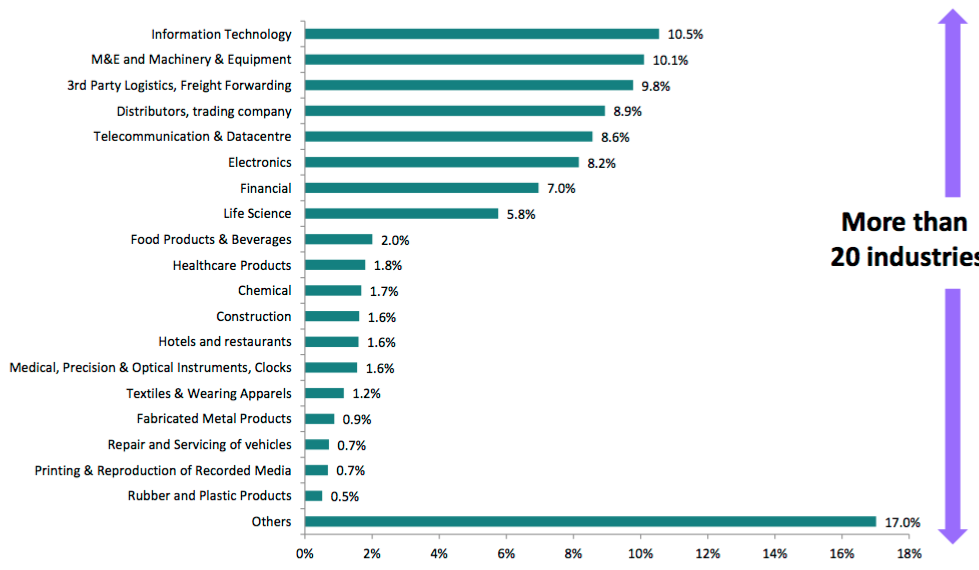

There are a number of advantages to having such variety among its properties. The most important of these is that the trust is able to both attract and accommodate tenants from a wide variety of industries. This insulates the trust somewhat from economic fluctuations as it ensures that the trust’s rental revenues are not overly dependent on any one industry. As a result, an economic downturn that forces several companies in an industry into a situation where they could not continue to make rent payments is unlikely to have a significant impact on top-line revenues. As this chart shows, no single industry accounts for more than 11.0% of the trust’s revenue.

Source: Ascendas REIT

With that said however, while a variety of industries can use some facilities, such as office space, there is only one industry that makes extensive use of warehouses, which make up 28% of Ascendas REIT’s gross floor area and 17% of its gross asset value in Singapore. In addition, Ascendas REIT is in the process of acquiring 26 warehouse properties in Australia. This will increase the gross lettable area of its warehouses by 76% and naturally result in their proportion of the portfolio increasing (although it will still be balanced). This may be one reason why an outsized proportion of the trust’s new leases are transportation, logistics, and shipping providers.

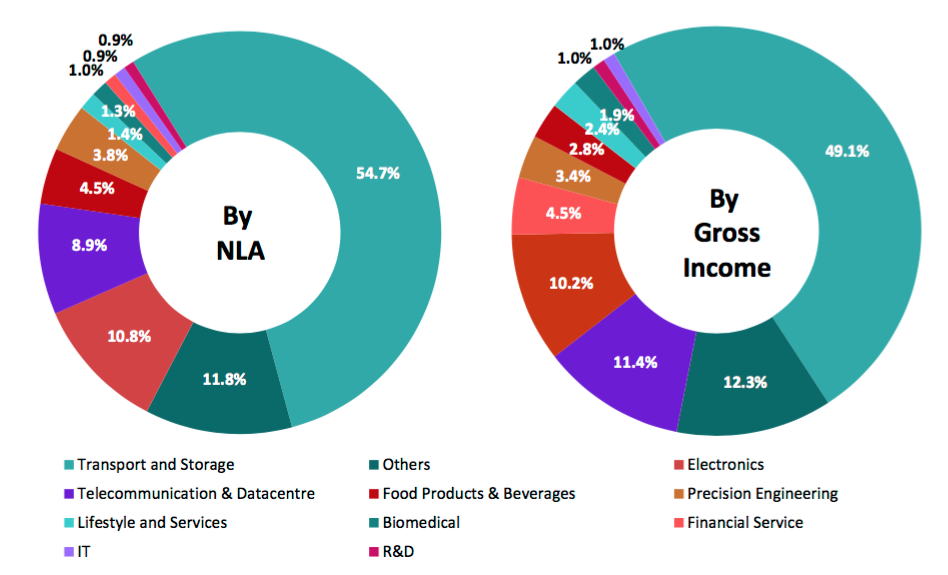

Source: Ascendas REIT

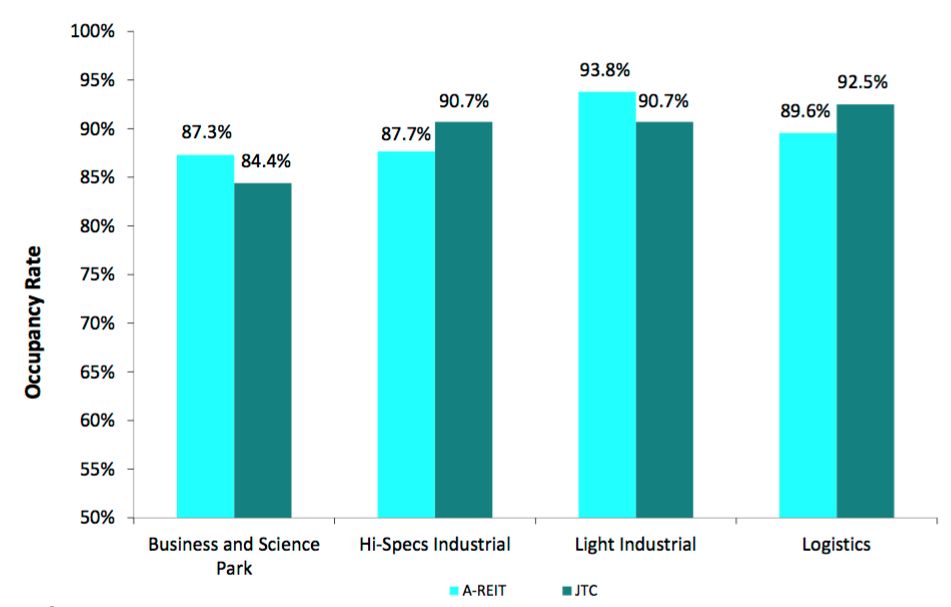

One important metric to use when researching real estate investments is the occupancy rate. This is a figure that represents the proportion of a property owner’s lettable area that is occupied. Ascendas REIT is quite a solid performer here, seeing its portfolio occupancy climb from 88.8% in the year-ago quarter to 89.0% today. This tells us that Ascendas REIT is doing a better job of maximizing the revenue that it generates from its property portfolio compared to the same time last year. Here is how the trust’s occupancy compares to that of other Singaporean property owners:

Source: Ascendas REIT

As this chart shows, Ascendas REIT’s occupancy rates are roughly equal to the industry average. Admittedly, this is not particularly impressive but it is not discouraging either. While I will admit that I ordinarily do prefer to see somewhat higher portfolio occupancy rates in my real estate investments, this does show us that the company is doing as well as its peers in maximizing the income from its properties.

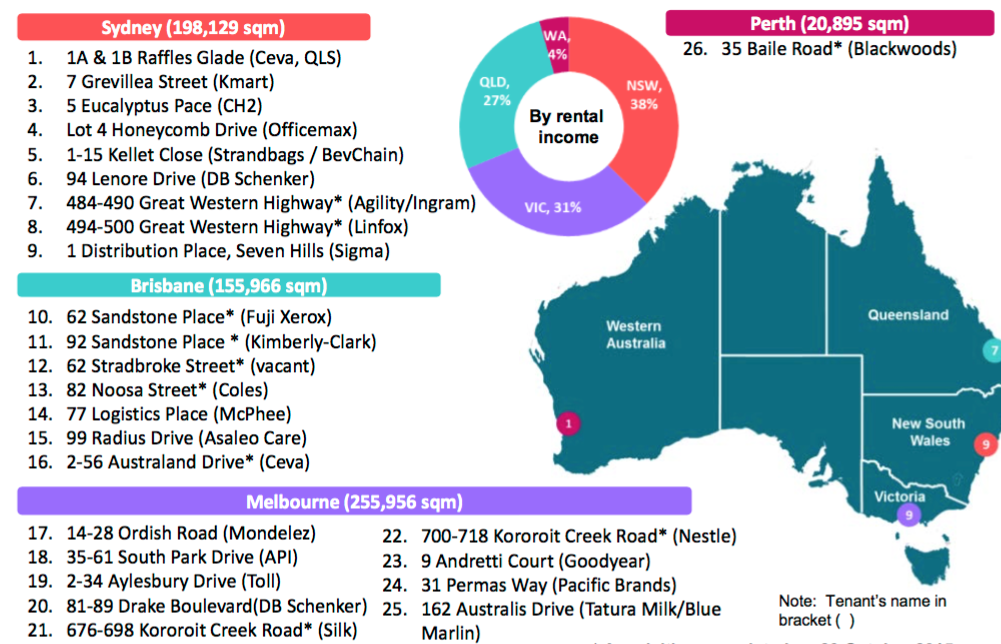

There are two ways for a real estate property owner to increase its revenues. Either the company can raise its rents or it can acquire more properties. Ascendas REIT has been enjoying success at doing both of these things. As already mentioned, Ascendas REIT is in the process of purchasing a portfolio of 26 warehouses in Australia. This portfolio has excellent characteristics, including a very healthy 94.4% occupancy rate. Out of all 26 warehouses, only one does not have a current tenant.

Source: Ascendas REIT

In addition, the warehouse portfolio has a very long weighted average lease expiry of 5.9 years. Unlike residential leases, commercial property leases are for extended periods of time, typically several years. As a result, a commercial property essentially has guaranteed cash flow for several years, but there is a very real risk that these cash flows will terminate at the expiration of the lease. The weighted average lease expiry is a measure used by investors to determine the risk of a group of properties being vacated and it is calculated by taking the remaining term of every tenant’s remaining lease and weighting it by the income provided by that tenant. At a weighted average lease expiry of 5.9 years, we can have confidence that the cash flows from this portfolio will likely remain consistent or increase going forward.

This portfolio of properties is expected to generate net property income of A$64.5 million ($____________). For this, Ascendas REIT is paying a total of A$1.0778 billion. This gives the portfolio a capitalization rate of approximately 6%, which is a much more favorable valuation than what can be obtained in a large American city such as New York, NY or San Francisco, CA.

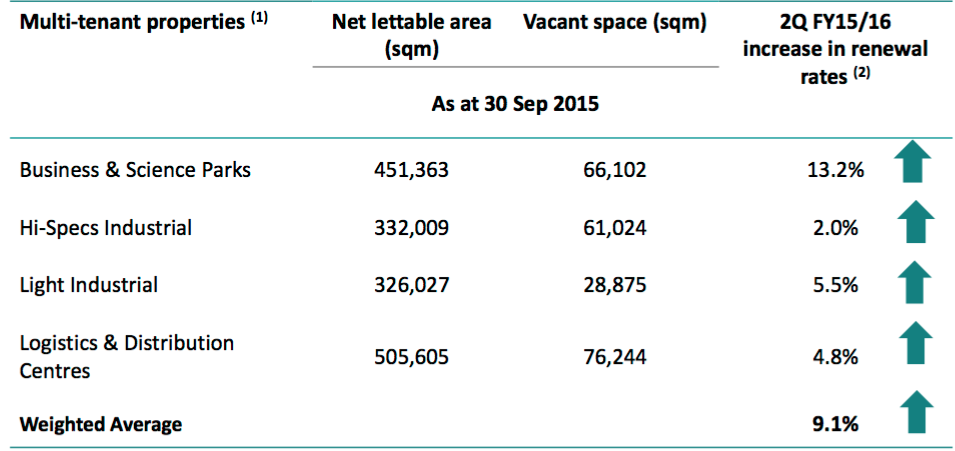

As I already mentioned, the second way that a real estate company can increase its revenue is by increasing the rent that it charges its tenants. The most common way that this is done is through rent reversion. Rent reversion is defined as a property owner adjusting the rent on a property at the time that a lease is renewed. If the market rental rate increases then the property owner can adjust the rent upwards, a situation known as positive rent reversion. Ascendas REIT managed to achieve this in the most recent quarter, increasing tenants’ rent by a weighted average of 9.1% for renewals across all property types.

Source: Ascendas REIT

As can likely be expected, the company’s success at securing rent increases is a good thing for unitholders. This is because it results in higher revenue from an affected tenant and thus increases the cash flow from the property in which the tenant is housed. This both supports the current distribution (which is the primary reason most investors purchase real estate) as well as provides the necessary cash flow to allow for future distribution increases.

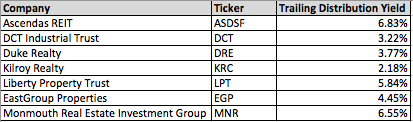

Ascendas REIT boasts a distribution yield that greatly exceeds that of nearly any equity REIT in the United States. At the time of writing, Ascendas REIT pays a trailing distribution of S$0.15301 per trust unit. Given the current unit price of S$2.24, the company has a trailing distribution yield of 6.83%. Here is how that compares to the yields of several American industrial and mixed industrial/office space REITs, which would be the closest domestic equivalent.

(Click on image to enlarge)

Source: Capital IQ

As this chart shows, Ascendas REIT boasts a significantly higher distribution yield than most of its American peers, a situation that should appeal to most income-focused investors. In addition, unlike most dividend paying foreign securities, Singaporean REITs are not subject to withholding taxes for most individual investors and thus are not disadvantaged when held in a tax-advantaged account such as an IRA. Please note that in the past, some readers have commented that certain brokers have withheld taxes on distributions paid by Singapore-based REITs. However, according to this report by Big Four accounting firm Pricewaterhouse Coopers, this is not supposed to be the case.

Thus, Ascendas REIT has a lot to offer an income investor including strong growth prospects, a high dividend yield, and tax advantages. The company also boasts a very diverse and appealing portfolio that should provide some security to the distribution. This investment may be worth further research.

Disclosure: I have no positions in any stocks mentioned nor any plans to enter into a position in any stock mentioned within the next 72 hours.