As The Chinese Economic Cycle Turns, So Do The Fortunes Of The Australian Dollar

In the past few weeks, economic data releases from China have fallen below expectations. Earlier this month, non-manufacturing and manufacturing surveys from the China Federation of Logistics and Purchasing came in below previous figures, suggesting a weaker outlook for future growth. Earlier this week, fixed asset investment, industrial production and retail sales (from the National Bureau of Statistics) have all missed estimates.

House prices lead the way for the Chinese economy

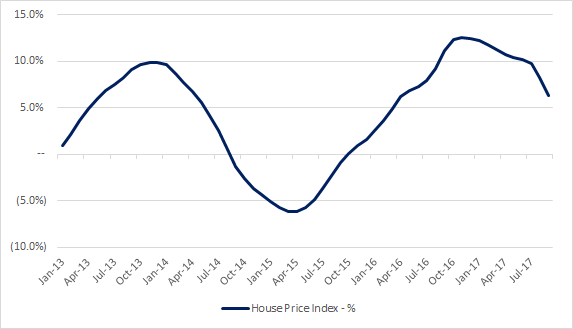

Historically, changes in house prices have served as a good leading indicator for the Chinese economic cycle. This is because property and its associated sectors makes up a significant portion of the Chinese economy. According to Moody’s, 25% to 30% of Chinese GDP is ultimately linked to property and construction. Recent data increasingly suggests that a cyclical downturn is coming following the conclusion of the 19th Party Congress earlier in October. A visual overview of recent House Price Index values is shown below for reference:

Here comes the down cycle: house prices decelerate in rate-of-change terms

Investment and consumption growth fail to excite

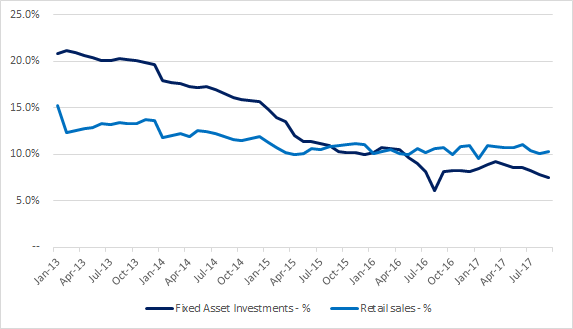

Given the significant size of investments as a proportion of the Chinese economy, data relating to investment activity is also watched closely. In particular, investors focus on fixed asset investment growth rates given China’s large appetite for natural resources. According to CEIC data, investment as a portion of Chinese GDP reached 44.2% in 2016.

As the country has been seeking to transition from an economy dominated by state-led investments to one based on private consumption, measures of private consumption also bear watching. In particular, retail sales growth is a good measure of China’s ‘new’ economy. Based on CEIC data, private consumption made up 39.2% of China’s GDP in 2016.

Looking at both sets of figures, growth has been decelerating or moving sideways in recent history. While investment activity briefly accelerated in the fourth quarter of 2016, fixed asset investments have been slowing in 2017. Retail sales, on the other hand, have flattened around 10% growth for many quarters. Unlike house prices, there are no obvious cycles prevalent in the figures. A recent overview is shown visually for reference:

Slowing or flat: both investment and consumption indicators remain lackluster

Implications for the Australian dollar

For Australian dollar speculators, the specter of a new down cycle in the Chinese economy suggests difficult times ahead. Given Australia’s position as a leading exporter of industrial metals such as iron ore and copper, the fortunes of its currency are ultimately intertwined with China’s real estate and construction sectors. Beyond the problem of a coming slowdown in the Chinese economy, Australia faces the much bigger issue of permanently lower demand for industrial metals. Given the sheer scale of Chinese infrastructure investment in the past ten years, a repeat of such a feat is highly unlikely in the near future. Bill Gates famously tweeted the fact that China used more cement in three years relative to the US in the entire 20th century. Thus the long-term outlook for industrial commodity demand is weak.

Based on the House Price Index chart, the Australian dollar has been tracking Chinese house prices with a 6-9 month time lag. The currency fell sharply from its peak in late 2013 to its trough in the third quarter of 2016. Since then, the Aussie has rallied alongside accelerating house prices in China. It achieved its most recent peak earlier this summer. As the House Price Index suggests that China is about to go into a new downturn, the long-term outlook for the Aussie is looking bearish.

Any opinions, news, research, analyses, prices or other information is provided as general market commentary and does not constitute investment advice. MarketsNow will not accept liability for any ...

more