Although Monetary Policy Is Still Quite Easy, Central Banks Are Tightening

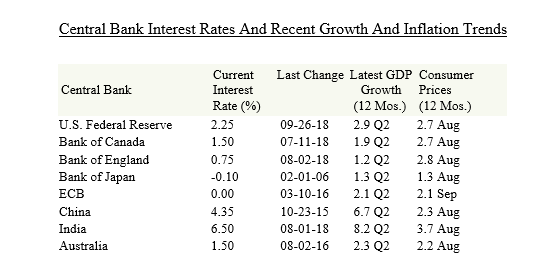

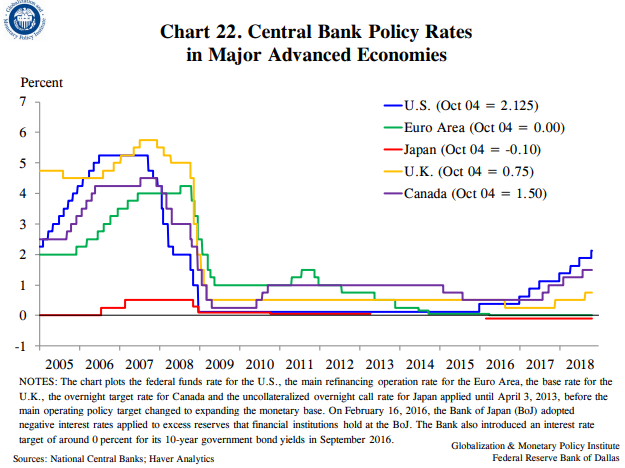

The two largest central banks (The Federal Reserve and the ECB) are easing back on their monetary stimulus which was so necessary to battle the multiple crises which emerged after the 2008 financial meltdown.

Of course, the combined tightening impact is presenting a significant challenge to the global economic outlook as higher interest rates start to spread around the world to other economies.

Indeed, the emerging market countries that marketed their debt in an era of cheap money are facing a turning point, as global capital is more attracted to the higher returns and lower risk available in the US and Europe.

The ECB has been scaling back its longstanding asset purchase program and will end it this December, which will likely coincide with the US Fed’s eighth interest rate increase since 2015.

The Fed has also been gradually reducing its $4 trillion portfolio of bonds, which also imposes further pressure on interest rates.

At the same time, the ECB has pledged not to raise its target interest rate for more than a year. Accordingly, the first ECB rate hike will likely come after summer 2019.

Disclosure: None.