A Bitcoin/Blockchain Deal Worth Looking Into

All around the world, millions of people are working jobs far from their homes. They spend little and send most of their cash back home.

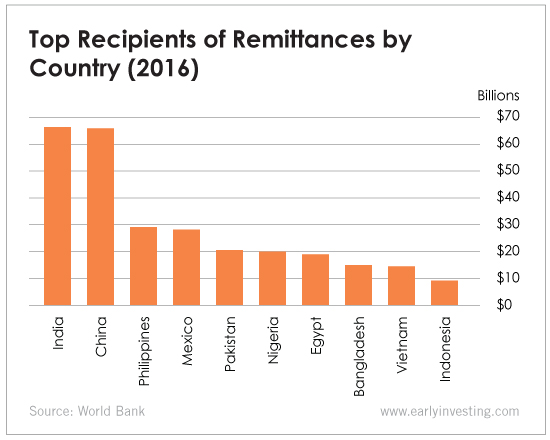

This transnational river of money is known as the remittance market. And it’s very, very large.

Here are some of the top countries for inbound remittance in 2016 (estimated):

- China: $65 billion

- India: $65 billion

- Philippines: $29 billion.

The whole market is estimated to be worth around $500 billion per year. The dollar amounts range from small chunks to thousands of dollars.

Currently, this market is dominated by firms like Western Union, MoneyGram and a few other large players.

Each of these transfer companies must have cash agents all over the world. Local retail stores, for example, hand out cash to recipients in exchange for a cut of fees.

A majority of this cash is transferred through the U.S.-controlled SWIFT banking system today.

Fees are high, especially for small transfers. For example, to send $20 from the U.S. to the Philippines costs $5, plus around 6% in currency exchange loss.

Fees vary widely and are generally cheaper with bank-to-bank transfers. However, many people in developing countries don’t have bank accounts, so they wind up paying extreme amounts to send cash back home.

Remittance: A Perfect Fit for Blockchain/Bitcoin Technology

By now you’ve probably heard about bitcoin. But if you’ve never understood what a real life application of this new tech might look like, now is the perfect time.

With bitcoin and other “cryptocurrencies,” international borders aren’t much of a barrier at all.

It’s simple, quick and cheap to transfer money with bitcoin. Millions of dollars can be “wired” for almost nothing. And legal frameworks are being developed around the world to handle these types of transactions.

As you can probably guess, bitcoin’s decentralized and digital nature makes it a natural fit for the remittance market.

ZipZap – Now Raising on Wefunder.com

ZipZap is a remittance startup based in Canada. It’s raised money from some sophisticated Silicon Valley bitcoin investors, including well-known angel investor Scott Banister in 2014 and Blumberg Capital in 2010. (See ZipZap’s AngelList profile for more.)

The company uses a unique mix of both traditional and bitcoin-enabled SWIFT payments. It has what it calls a proprietary “currency router” that compares cost and speed options, then uses whatever’s cheapest at the moment.

The bitcoin is changed locally at bitcoin exchanges, which operate nearly everywhere today. These businesses guarantee the exchange rate long enough to allow companies like ZipZap to do the same for their customers.

It’s a brilliant idea. You can see why the company attracted some sophisticated money.

However, there are caveats. This company’s been around since 2010 and appears to have not yet found “product-market fit.” ZipZap doesn’t really disclose any traction numbers, which usually means they’re not trending well. And indeed, its Regulation Crowdfunding Form C shows a startup that could be in trouble. (Although it’s hard to say without knowing a lot more details.)

Perhaps the technology seems too strange to the target market. I can barely explain bitcoin to my own mother, so imagine how hard it must be in another language…

However, this market is too large and the solutions are too disruptive to ignore.

Just a Hint

What’s happening in cryptocurrency and fintech has the potential to revolutionize international finance, in many more ways than just remittance.

Faster. Cheaper. Safer in some ways. More dangerous in others. Difficult to regulate. Threatening to the monetary status quo. It seems like something out of a sci-fi book at times.

With cryptocurrency markets on fire again and the emergence of a potential “bitcoin killer” (Ethereum), this is a sector we’ll be covering more frequently going forward.

Disclosures: We have no position in ZipZap. Also, I realize that since we have a lot of new readers, I should reiterate our policies here.

Our research and writing is 100% ...

more