4 Companies To Watch That Report Earnings Tomorrow (September 29, 2016)

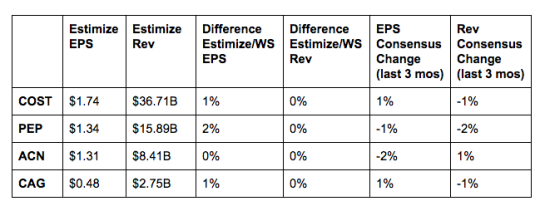

Costco Wholesale (COST): Costco is one of the few remaining companies that release earnings on a monthly basis. This leaves very little to the imagination when they actually report quarterly results. In its fiscal fourth quarter, the company reported net sales of $35.7 billion, a 2% increase from the same period earlier. The fiscal year ended in similar fashion with a 2% increase in net sales to $116.1 billion. Total company comparable sales were essentially flat in the quarter and year despite declines in Canada and other international markets. While the actual numbers won’t matter as much tomorrow, investors will be listening for 2 big things: how the credit card switch going and is a membership hike on the horizon. The wholesaler recently moved from American Express to Visa as the provider of its in-store credit card which was believed to rattle customers. So far there is no indication that it is having a material impact but if it does, customers can expect to pay higher fees.

PepsiCo (PEP): The carbonated beverage industry has come under pressure as consumer preferences shift towards healthy alternatives. This shift hasn’t had a major impact on PepsiCo. The soda and snack provider has positioned itself in a multitude of food and beverage markets, therefore a slight downturn in one business could be offset by a boom in another. Its brands include household names like Frito-Lay, Gatorade, Quaker, Tropicana and of course its namesake, PepsiCo. A slight downturn in US salty snacks and soda consumption has been balanced by its health and wellness-oriented products. Lately, Pepsi has done a good job of topping earnings expectations and printing in-line revenue.

Accenture (ACN): Accenture has been seeing modest upside over the past year. Earnings and revenue have topped expectations in each of the past 4 quarters with steadily improving growth. As a result, shares are up 11% year to date and nearly 20% in the past 12 months. Accenture’s current strategy of expanding through acquisitions remains encouraging in the near term. These takeovers enable entry into newer markets while also broadening and diversifying its product portfolio. Regular acquisitions will have a positive impact on the revenue stream but also an adverse one on profitability. Some other near-term headwinds include Brexit given Accenture’s large exposure to Europe.

ConAgra Foods (CAG): Conagra is undergoing structural changes whereby it is selling profitable businesses and acquiring new brands in order to expand revenue and margins. In July the company received almost $500 million after selling two of its struggling spice and ingredient companies. Meanwhile, Conagra’s processed food brands are being hammered by the ongoing health revolution. This has been seen in recent quarterly reports. In the last 3 reports, both earnings and revenue have delivered negative growth despite already low expectations. As a result, shares are down 8% in the past 3 months.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more