Warnings Of A New Credit Crisis And The Potential For System Wide Bail-In Push

Alternative analysts are often shunned in their views that the 'world is ending' when it comes to the financial system, and this despite the fact that those who correctly forecast the bursting of the housing bubble and subsequent credit crisis were dead on in their assertions.

But while many of these same prognosticators have so far been wrong in their timing of how long the Fed and other central banks could keep both the markets and monetary system going through the incessant use of continuous credit and money printing, just like in 2007-08, it is only a matter of time before these individuals once again are proven right.

Yet with that being said, alternative financial analysts rarely have a big audience or 'choir' to listen to their message, and this in part is because most people in the West (U.S. and Europe) have not had to go through a severe financial crisis in over 80 years (Great Depression). But unlike their grandparents who had to live through that era, when there have been economic crises during the past eight decades the government has put in place many programs to protect their people from outright starvation and homelessness.

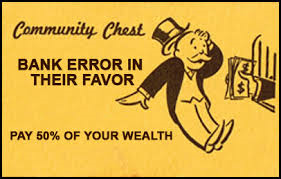

One of these programs of course is that of insurance on your bank accounts (FDIC). But something happened in 2010 which has made even this safety net no longer valid as the Dodd-Frank Banking Reform Act changed your depositor status to that of an unsecured creditor, and where the banks can institute what is commonly known as a bail-in of your money that will negate the FDIC from paying you back most of the money you will lose.

We have already seen bail-ins take place here in this decade in the West with the 'test case' example in Cyprus. And with central banks suddenly shifting course from eight years of propping up the banks and the markets with zero percent interest rates and tens of trillions in cheap money to that of Quantitative Tightening (QT), is it a coincidence that the new Federal Reserve Chairman happens to be one of the original architects of the bail-in program?

The new Fed Chair Jerome Powell is rapidly changing the focus of the Fed in terms of monetary policy.

A large component of this stems from Powell’s experience prior to join the Fed. Indeed, Powell is the first Fed Chair with any kind of banking experience (albeit investment banking) since Alan Greenspan: former Fed Chairs Janet Yellen and Ben Bernanke were both career academics.

However, to say that Jerome Powell is strictly a private sector banker would be to overlook the most critical role of his career… namely, that… Jerome Powell was head of oversight for the Fed’s “too big to fail” banks.

In that capacity, Powell gave a speech titled Ending “Too Big to Fail” at the Institute of International Bankers 2013 Washington Conference in Washington, D.C.

During this speech, Powell emphasized that the Federal Reserve no longer has the authority to directly bail out a failing bank, stating, “Dodd-Frank eliminated the authority used by the Federal Reserve and other regulators to bail out individual institutions during the crisis, including Bear Stearns, Citicorp, Bank of America and AIG.”

So if the Powell Fed is not in the bail out business anymore… who is?

Shareholders and bondholders.

And guess who developed the plan through which this would happen?

Jerome Powell… the man Trump just picked for Fed Chair.

Powell was a central figure in the development of the “bail-in” strategy in the US, having been involved in “simulations” of a large bank failure as far back as 2011, as well as the development of the strategies put forth in Dodd Frank bill, namely:

1) That banks develop “living wills” or plans for “rapid and orderly resolution in the event of material financial distress or failure of the company, and include both public and confidential sections.”

2) Bail-Ins: programs through which the FDIC would seize a failing bank systemic importance and wipe out all of its shareholders’ capital as well as much of bondholders’ in order to prop the bank up. - Silver Doctors

So what does this mean for you as a depositor?

It is fortunate that over the past 10 years, technology has advanced to the point where one no longer needs a traditional bank to be able to conduct most of their daily transactions. And when you couple this in with the movement to return to sound money following the four decade's long fiat currency system the the world functions under today, not only does one have the capability to store your money in a private business model that is not regulated as a banking institution, but also have it backed 100% by gold which is insured not for the deposit itself, but for the value of the commodities you own.

Additionally the advent of the Blockchain has also led to alternative forms of securities such as cryptocurrencies, which are outside the authority of the financial system, but for now are still much too volatile in their price determinations.

The bottom line is that the financial and monetary systems are once again coming to a nexus, where the amount of credit and debt created has surpassed the global GDP by nearly 300%. And with central banks now being forced to have to cut off the spigot because inflation is signalling that everything is reaching a tipping point of overheating, how long can the banks sustain themselves when the credit and liquidity they have used to remain solvent these past 10 years suddenly is shut off?

What he said about not bailing out banks through the government is a fantasy that I am sure he would like to do. But now that he is Fed chairman, it is unlikely that he will jettison the 250k insurance. Could he bail in above that amount? Sure. And we do remember Cyprus. But having the populace hiding cash under the mattress or going to bitcoin can't surely be the goal of the Fed which wants to keep track, best they can, of the money supply. That is why I wrote this about Ron Feldman: www.talkmarkets.com/.../ron-feldmans-fed-secret-and-treasury-bond-behavior

Gary -

I believe the 'secret' to being able to ditch the FDIC insurance for most depositors is through this scheme.

Banks announce they need to recapitalize and issue a bail-in, taking unsecured creditor monies first. In return they will issue those depositors 'equity swaps'.

Then the FDIC will tell the depositor that they have received 'in kind' recompense for their rehypothicated moneies. That's how I believe they will get away with not having to cover any upcoming claims on insurance.

Well, that may work one time. I don't see the US concept of bank safety being undone as viable in our society. But you could be right, one time.

In that you are most probably correct. But all it took was 'one time' for a massive bailout on that fateful day back in 2008 and with the fear of God put into Congressmen to vote for it.

I personally don't believe when bail-ins come it will be piecemeal. It will come on a holiday similar to 1933 when they shut down the banks.