UK Wages Rise Less Than Expected Amid Rising Inflation

The latest labor market data in the UK showed that while the employment situation was relatively stable, wages have started to fall as the data indicated the squeeze on the UK household situation.

Last week, the labor market report showed that the unemployment rate in the UK remained steady in the February through April period at 4.6%. This is the lowest level since mid-1975.

The number of people in work, however increased 109k, reaching 32 million. This was the highest level on record, according to the Office for National Statistics. Wages, rose just 2.1%. When adjusted for inflation, average earnings during the three months through April fell 0.6%. This was the second month of decline.

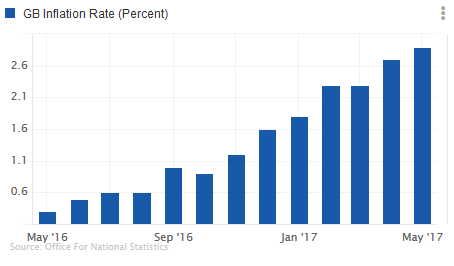

UK Consumer Prices Rise Sharply in May

UK Consumer Prices YoY (2.9%)

Earlier last week, data showed that inflation continued to accelerate in May. Consumer prices rose 2.9% in May, up from 2.7% in the month before. The gains in consumer prices came amid a broad increase in prices across the board. This was the fastest pace of increase in prices in nearly four years.

The decline in wages continues to remain a major concern for the UK's economy. The Bank of England had repeatedly warned about the risks of a squeeze on wages.

Bank of England sends mixed signals

On Thursday, the Bank of England left the benchmark interest rates unchanged at 0.25% and also the asset purchase program at £435 billion. While the monetary policy committee (MPC) left interest rates steady, there were three dissenters. This left the vote count on interest rates at 5 – 3.

The vote on interest rates briefly sent the sterling surging on the day. Policy makers were clearly divided on whether interest rates should rise or fall. Despite the doubts, it is clear that policymakers are no longer willing to tolerate a continued overshoot of inflation.

The MPC estimates inflation to reach 3% by autumn this year.

Brexit negotiations start this week

The Brexit talks are expected to kick off on Monday, 19 June. This is likely to bring more uncertainty to the British pound. The BoE had previously cited the exchange rate's weakness as one of the reasons for inflation overshoot.

This is expected to continue even more once the Brexit process starts. The EU-27 has invited the UK to the table. But for the most part, the UK is largely unprepared with no strategy.

This confusion was further deepened by the fact that there is still no clear leadership for the UK to walk the process. The Conservative party has a majority in the parliament with 317 seats, just short of the 325 needed to form a majority government.

The Tories are still in talks with parties but there is still no clear outcome on the political side of things.

Unless there is some firm leadership change, it is quite likely that the British pound will suffer even more. This could lead to inflation continuing to accelerate more than expected.

BoE: Policy dilemma?

For the Bank of England, this could spell a dilemma. Should they raise rates purely because of inflation and overlook the wage growth?

Wages have failed to keep up and it is anyone’s guess that wages will continue to slide as business investment slows on account of the uncertainty. Raising interest rates is most likely to hurt the UK consumers as it could potentially slow down the gross domestic product as well, which could spiral into a recession.

Thus, the BoE is likely to bide time without making any hasty decisions. In the near term, unless there is significant progress as far as the EU – UK talks are concerned, the British pound is likely to remain subdued.

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission (CySEC) (License Number 124/10). ...

more