How Banks Can Survive In An Increasingly Competitive Financial Landscape

For quite a few years now, financial institutions considered fintech companies as the industry’s biggest potential disruptor, as confirmed by KMPG’s recent survey. As such, many financial institutions have been formulating their fintech strategies, opening innovation hubs and investing in fintech startups to some extent. However, collaboration levels have been limited to specific service acquisitions and initiatives and there is so far limited evidence of a significant enough change taking place in the traditional banking sector.

Being slow to embrace new technologies, highly sophisticated fintech startups have managed to flood the market, offering customers superior user experience as standard and enabling the strongest fintechs to gain significant share of the banking world’s core business. Over the past year we’ve seen a dramatic increase in the complexity of the competitive landscape both from early and later stage fintech startups. To add to this, competition has come from the new economies being created thanks to blockchain technology on the one hand, and the big tech giants strengthening their fintech capabilities on the other.

In this rapidly changing market, financial institutions are feeling the pressure and are tooling themselves up by adopting new technologies, breaking down the barriers between siloed internal systems and creating fintech strategies for adopting a more collaborative working framework with the wider industry. If they are to maintain their relevance moving forward, the banks know change needs to happen now.

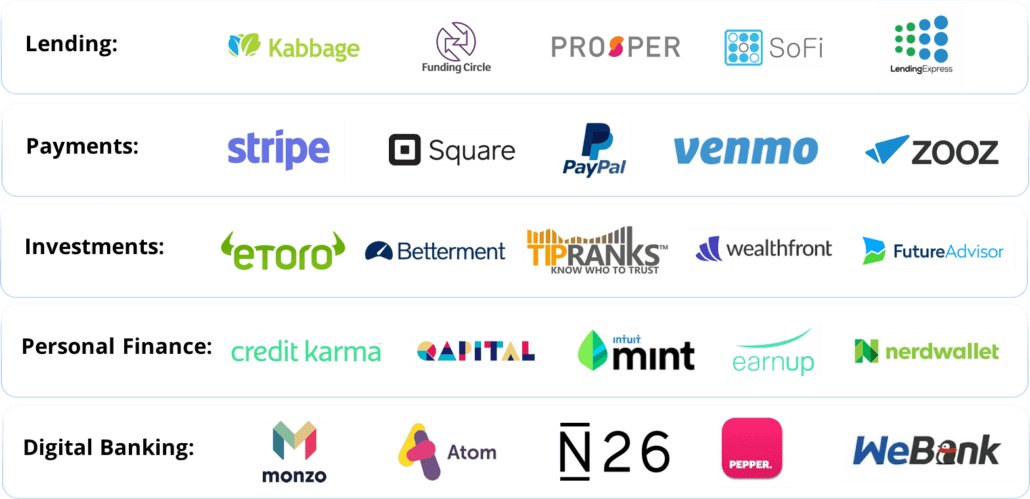

In the past few years we have seen over 30 fintech unicorns and many equally significant companies start to rival the banks at their core activities including lending, investments, payments, personal finance and digital banking.

Top 5 fintech companies by area of focus:

Unburdened by outdated legacy systems and heavy operational costs, the fintechs of tomorrow benefit from having strong artificial intelligence and machine learning capabilities and are able to offer highly personalized, timely, optimally designed financial products that are often perfectly tailored to a consumer’s behaviour.

Supported by regulators trying to level the playing field and open the market up for more competition, rulings such as the PSD2 regulation in Europe allows 3rd parties (mainly fintechs) to access consumer financial data, stripping the banks from one of their most valuable assets.

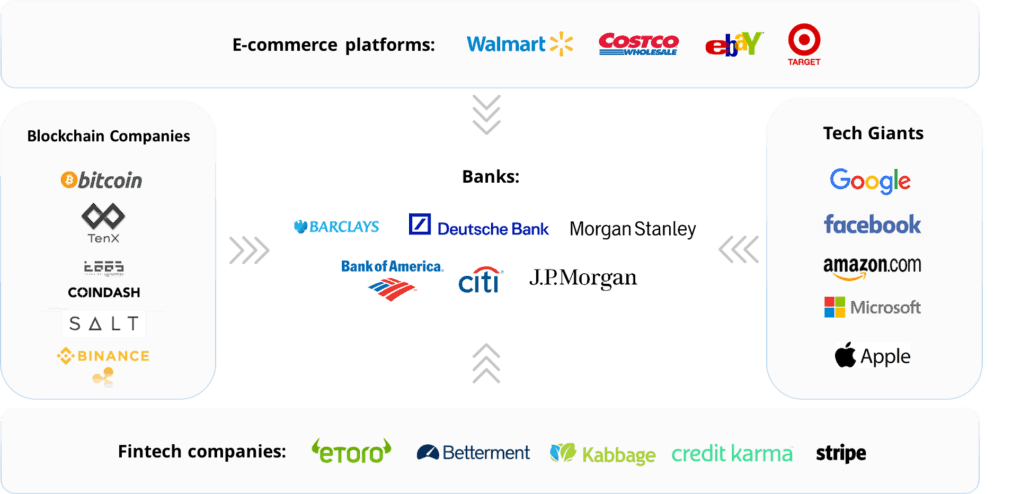

The blur between pure e-commerce and fintech as the worlds of offline and online shopping start to merge is creating a totally new dynamic and threat for traditional banks. An example of this was eBay’s acquisition of PayPal back in 2015. PayPal, a fintech company now valued at $90B, alongside other payment solution providers included in the image above, retailers’ growing credit card business, consumer loans and lending solutions are becoming more deeply rooted in the overall shopping experience.

In Asia, we’re seeing e-commerce platforms expand their remit by providing full stack financial service offerings. The most significant of which is Alibaba’s Ant Financials. Founded in 2014, it’s now the world’s largest online banking platform and is planning to IPO with an estimated valuation of $100B. Pure evidence of the potential power that can be created thanks to an alliance between a fintech and an online retailer.

2017 has also been a transformative year for blockchain technology and the crypto economy. A substantial financial services ecosystem has emerged in creating a $400B plus blockchain based economy in less than a year. Given the size of this new economy and its rate of growth, the threat posed to traditional banking is very real. Consumers and businesses are steadily being offered a totally alternative economic system, that has the potential to replace infrastructures, governance mechanisms and the value distribution between parties. The potential for blockchain to truly disrupt the traditional banking system as the technology continues to mature, is not far off.

Whereas blockchain promotes a decentralised economy, on the other end of the spectrum, highly centralised economies are starting to form within the tech giants: GAFAM – Google (GOOGL), Amazon (AMZN), Facebook (FB), Apple (AAPL) & Microsoft (MSFT), as they start to build up their fintech capabilities. Their increasing global dominance, reach and technical superiority gives them the potential to overshadow the traditional bank’s relationship with consumers. Built on data collected from each interaction powered by the most advanced AI and machine learning technology, they are defining the standards for customer experience and control the most pervasive consumer social channels and experiences (Siri, Alexa, Google’s personal assistant etc).

To add to this, the increasing adoption of cloud based solutions by traditional banks is leading to a growing reliance on tech giants for their cloud based services. Consequently, this has the potential to erode another valuable asset of traditional banks – their legacy systems.

So far, the GAFAM giants have only displayed subtle attempts at competing directly with traditional banking. Amazon’s growing lending business, and the other giants’ initial attempts to enter the payments and transfers environment have been small in general. But nonetheless, these moves could certainly be seen as early signs of their desire to expand by leveraging the significant power stored in their balance sheets.

The Asian fintech ecosystem serves as an example of the potential dominance major platforms can have on the financial industry. Tencent managed to reach a $500B market cap, now offering full stack financial offering thanks to its WeChat payment solution. Together with Ant Financial, Tencent has managed to capture over 50% of the fintech market in Asia.

Competitive landscape of the financial industry:

It is clear that with so many competitive pressures placed on the traditional banking sector coming from multiple directions, banks should be rethinking their objective of trying to control the entire value chain. Instead, they have a huge opportunity to focus on leveraging what they have and working in a more collaborate way with the wider ecosystem.

The number one opportunity and also challenge, is for banks to leverage their consumer data and become powerful data driven organizations. Their ability to harness AI and and machine learning capabilities is critical to their survival. The challenge comes in organising existing data systems that often sit across multiple, siloed platforms where data is inhomogeneous and the appetite for change is often not aligned internally.

Nevertheless, instead of passing on financial data to industry newcomers, they should insteaduse their extensive financial product portfolio and position of trust, to offer their consumers enhanced financial products via GAFAM channels by working in collaboration with tech giants. For example, imagine a time when consumers could openly interact with their e.g eToro account, or apply for a loan from Kabbage via their own bank thanks to a voice activated personal assistant of choice.

In addition, banks should be embracing blockchain technology both for internal system means, as well as for building stronger bridges in order to further strengthen their position of trust.

Despite many weaknesses, the current banking system still remains the backbone of the financial industry. Although outdated, their legacy systems are proven to be the most reliable at scale. They also benefit from having a significant equity cushion and are the ones to carry the inherent risk in every financial transaction. To add to this, their systems and equity position are highly supervised by regulators and government insurance schemes, which over time have given the banks their most valuable asset, trust. Trust, however, can erode quickly if the banking system is to continue to lag behind in terms of customer experience and poor financial product offering.

We have a significant way to go before we see a real transformation of the banking industry but it really is now or never if the banks are to preserve their position of strength. To accelerate this transformation, we’ve seen many interesting investment opportunities in Israeli startups focused on helping the traditional banking system to advance. They include startups focused on advanced data analytics capabilities, more personalised customer journey and interface platforms, process automation, data governance and security solutions. All of which are powerfully trying to close the innovation gap and help build a more collaborative financial ecosystem.

Disclosure: None.