Dodd Frank Amended

Leading Indicators

The economic data is important to my thesis which states you should be buying stocks at these prices. It may not seem like the economy moves stocks, but fundamental investors might not react within the minute a report is released like the algorithms do after a geopolitical event occurs. The chart below shows the year over year change in the leading indicators which I discussed last week on a month over month basis. As you can see, the indicators aren’t close to falling to the negatives which would be forecast a recession. One interesting factor which isn’t seen by looking at this chart is the adjustments in the data after the fact don’t make the indicator look like it did at the time the results came out. That being said, we aren’t in 2012 or 2016 when the index was close to the flat-line, so a recession is clearly not going to occur this year.

(Click on image to enlarge)

Chicago Fed Activity Index

On Monday, the Chicago Fed National Activity Index for April was released showing more positive results as the report of 0.34 beat the consensus for 0.25. The March number was revised up from 0.10 to 0.32 and the 3 month moving average went from 0.23 to 0.46 which is the highest point since January 2015. The index was led by manufacturing and employment. Only 51 of 85 indicators are included in this report which is why there are sharp revisions like we saw with March. The index reading is set up that 1.00 means the economy is overheating and throwing off excess inflation, meaning we’re not near that level yet.

Strong Richmond Fed Reports

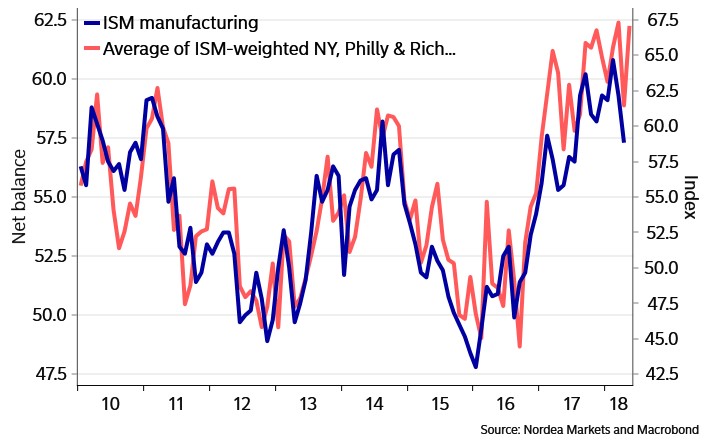

The May Richmond Fed Manufacturing report was great just like the NY and Philly Fed manufacturing reports. The index was 16 which was above the consensus for 10. The highest estimate was 16. Last month was -3, showing how much this month improved. The chart below combines each regional Fed index to show how the economy improved back to the levels seen earlier in the year. Early in the year when manufacturing was strong, I was worried that we were near the peak of the cycle. At first my worries were verified, but now they are being alleviated. I think Trump’s plans are specifically targeting the manufacturing sector, which explains the improvement.

Almost every index within the report improved from April to May. Shipments were up from -8 to 15 and new orders were up from -9 to 16. The chart indicates that the ISM report, which comes out next Friday, should be great. The prior report was 57.3 which certainly wasn’t horrible. Personally, I don’t care much about predicting a soft data report. I care about what these reports all mean for industrial production in May. The implication is another strong month of results. The April report was good even though the Richmond Fed index was -3. Like the other regional Fed reports, the indexes indicate inflation picked up. The prices paid index was up from 2.43 to 2.63. The prices received index was up from 1.46 to 1.75. The wages and prices indexes are the highest since at least May 2013.

The Richmond Fed also came out with a great services business activity index signaling the district had a strong May. The revenues index was up from 2 to 11. The demand index was up from 11 to 17. The local business conditions index was up from 10 to 16. The employment section of the report wasn’t as strong as the manufacturing counterpart as there was general improvement since April, but the indexes were mostly down from March. For example, the wages index was up from 16 to 17, but down from 32 in March. The prices index was stable because the prices paid index was up from 1.76 to 2.14, but the prices received index was down from 1.59 to 1.32.

Dodd Frank Upheaval

In a bipartisan vote of 258-159, the House sent a bill which reforms Dodd-Frank to the President’s desk on Tuesday. The bill lowers the threshold to be a too big to fail bank from $250 billion in assets to $50 billion. Technically, there can be any exotic contract at a small bank which can be the first domino to push the financial system to the brink. However, cost benefit analysis needs to be done to decide the proper policy. The problem with Dodd Frank is it limited the profitability of community banks, putting some out of business.

Another part of the bill is community banks with less than $10 billion in assets won’t need to follow the Volcker Rule which makes it illegal to make risky bets with the money insured by taxpayers. Specifically, deposits are FDIC insured. The small banks can make riskier bets with the capital which can grant them higher returns.

Quickly, the government went from penalizing regional and community banks to supporting them. I wouldn’t be surprised if this limits the mergers of regional banks as small banks will prefer to stay small. I think that’s a great thing for the financial system as relying on just a few banks is systemically risky. There’s even a chance some of the bigger banks break up so small pieces benefit from the rule changes. The KBWR regional bank ETF was up 0.31% on Tuesday which isn’t much because this legislation has been priced in over the past few weeks. In the past month, the index is up 4.82% which is better than the S&P 500’s 2.35% return.

Conclusion

We’ve seen mostly great economic reports coming in which means May was a great month for the economy. We are well on our way to seeing above 3% GDP growth. Speaking of GDP, the first Q1 GDP revision will be released on Wednesday May 30th. I’m expecting an improvement to the report. Generally, backwards looking reports like revisions don’t impact stocks, but it should, along with the great Q2 results, make investors more confident in the economy. I’m already confident in my bullishness, but more data to support my thesis is always helpful.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more