Commercial Bank RBB Bancorp Prepares For IPO

LA-based commercial bank, Royal Business Bank (RBB) will make its market debut on Wednesday (7.26) and expects to raise 82.8 million pricing its shares between $22 and $24. The bank is offering 2.1 million shares with 892,000 shares being offered by selling shareholder. The company intends to contribute approximately $25 million of its net proceeds to Royal Business Bank, its wholly-owned banking subsidiary, and to use the rest for general corporate purposes such as growth initiatives like future acquisitions.

Assuming shares price at the mid-point range, RBB Bancorp will have a market cap value of $373 million.

Underwriters for the IPO include: Sandler O'Neill, Keefe Bruyette Woods, Stephens Inc., FIG Partners.

We previewed the deal on our IPO Insights Platform.

Company Background

RBB Bancorp was founded in 2008 with the mission of providing commercial banking services to first generation immigrants, initially concentrating on Chinese immigrants, and now, marketing to other Asian ethnicities as well. The bank’s management team has utilized its strong local community ties as well as relationships and credibility with federal and California bank regulatory agencies to build up its client base and operations.

RBB Bancorp serves all ethnicities. However, its marketing focus was initially on first generation Chinese-Americans who favored working with banks which conducted business in their native languages.

The bank completed two acquisitions. In May 2013, it acquired Los Angeles National Bank, adding $190.7 million in total assets and $162.0 million in total deposits, and in February 2016, it acquired TFC Holding Company, adding $469.9 million in total assets and $405.3 million in total deposits.

The company’s services include a full range of depository accounts, trade finance, 1-4 single family residential loans, SBA7A and 504 loans, industrial and commercial loans, business lines of credit and loans, investor and commercial real estate loans, mobile banking, electronic banking, and remote deposit.

The Bank operates 13 branches across three regions: Los Angeles; Ventura County; and Clark County, Nevada.

Executive Management Overview

Mr. Yee Phong (Alan) Thian serves as president and CEO, positions he has held since the banks founding in 2008. He also now serves as chairman of the board. Mr. Thian was appointed twice to the FDIC community bank advisory committee and is also on the CFPB community bank advisory committee. He previously served as the president and chief executive officer of First Continental Bank beginning in July 2000 until its acquisition by United Commercial Bank. Following the acquisition, Mr. Thian then served as the executive vice president and regional director of United Commercial Bank until April 2007. Mr. Thian earned his bachelor’s degree from Nan Yang University and a Master of Business Administration degree from the University of Southern California.

David R. Morris serves as executive vice president and chief financial officer, positions he has held since 2010. Previously, Mr. Morris served as president and chief executive officer of MetroPacific Bank (2007- 2009) and as executive vice president and chief financial officer (2006 to 2007). Mr. Morris received a B.S. from University of Maryland and an M.B.A. from University of Southern California.

Financials and Competition

RBB Bancorp generated net interest income of $56.5 million in 2016, up from $35.6 million in 2015. Provision for loan losses represented 4% and 8% of net interest income in 2015 and 2016, respectively. Net income was $19.1 million in 2016, up from 13.0 million in 2015.

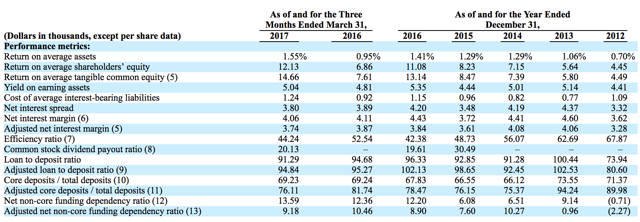

The bank showed improving performance metrics, for return on average assets and return on average shareholders' equity. In 2016, the company generated a yield on earning assets of 5.35%.

(Click on image to enlarge)

(Source: S-1/A)

The Chinese-American banking market, consists of 37 banks of which RBB Bancorp is currently the sixth-largest bank. Some of its competitors include: East West Bancorp, Inc. (Nasdaq:EWBC), Cathay General Bancorp (CATY), First Choice Bank (OTCQX:FCBK), First General Bank (OTCPK:FGEB), and First American International Bank (OTCQB:FAIT).

Conclusion

RBB Bancorp shows improving financials and has a standing with its local communities as well as credibility with the federal and California bank regulatory agencies.

We are hearing there is solid demand for this IPO.

We recommend investors take their allocations and buy into this unique bank.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in RBB over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more