My ETF Trio

I’m feeling pretty good this morning since (a) I’m back home with my dogs (b) I’m feeling healthy again (c), in spite of the public buying up equities (d) I was able to hot glue gun my keyboard at EXACTLY the right angle to my desk. It was about two degrees off earlier, which was bugging the hell out of me. Now it is locked in a glorious position.

I suspect you’re more interested hearing about my ETF picks than my keyboard angle, so I’ll say this: I have three positions, all of them profitable. They are all longs, but they are all ultrashorts, which means I am still thrusting knitting needles into the eyeballs of the bulls. In spite of being near lifetime highs in equities, my positions are doing just dandy, thank you very much. They are as follows…

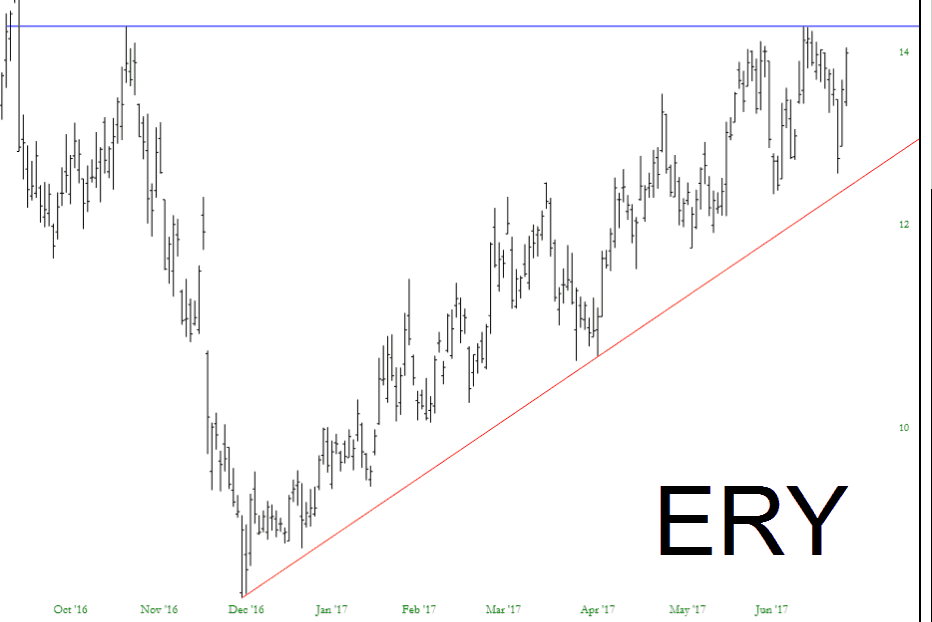

First is ERY, the triple-bearish-on-energy, which is benefitting from crude’s resumed fall; a crucial breakout is represented by the horizontal:

(Click on image to enlarge)

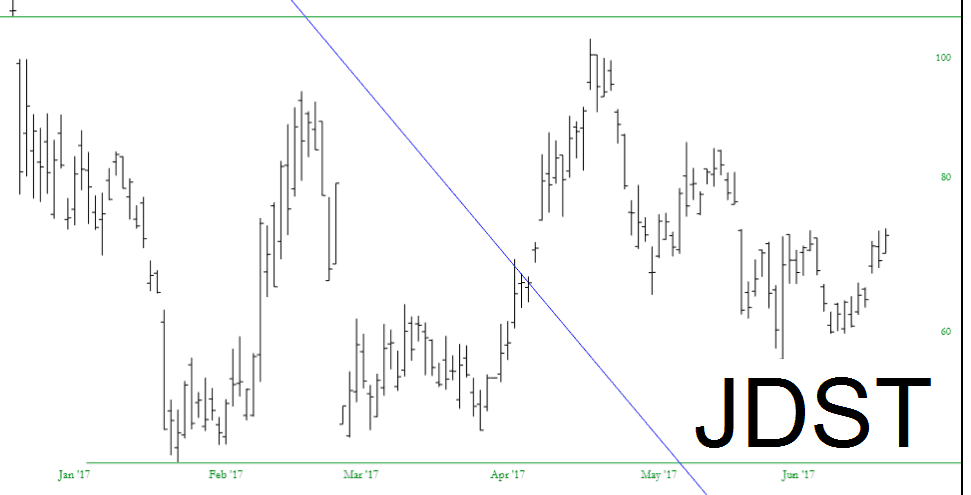

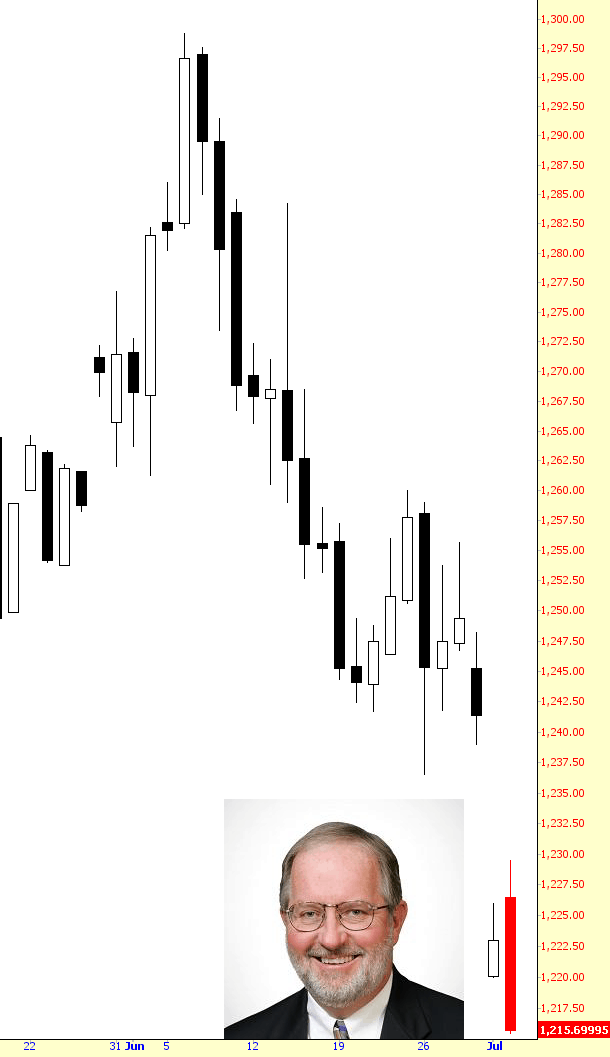

There’s also triple-bearish-on-junior-miners JDST, which I believe has the greatest potential percentage gains of any of these three. This could be just the beginning of something much larger:

(Click on image to enlarge)

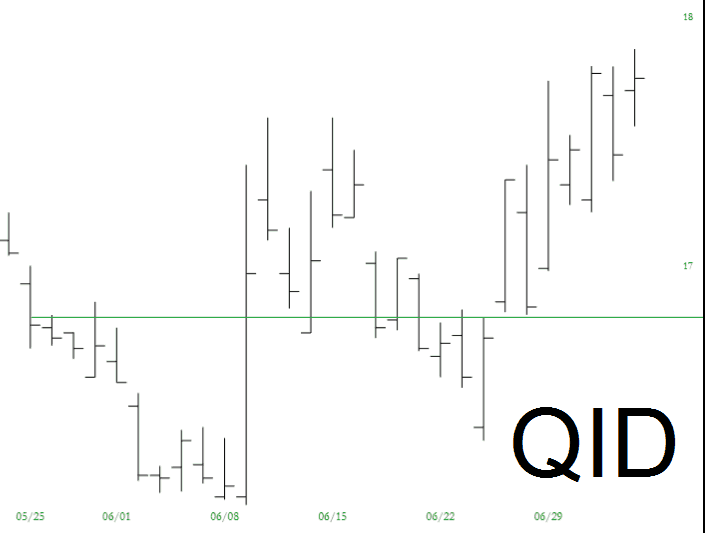

Lastly, there is ultrashort-on-NASDAQ QID, which I feel is most vulnerable right now, but obviously I have tight stops on all three of these positions, so I’ll just take the risk:

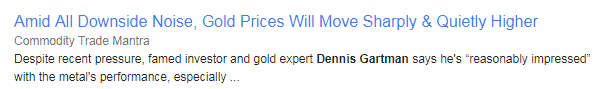

I’m particularly excited about gold (which, in my regular portfolio, is my largest short position). My PLUS subscribers already know about the reasons, but my bearish zeal was augmented yesterday when I read this………..

Which, as we all know, led to the instant and the inevitable.

Disclosure: None.