Managing VIX-Leveraged ETPs Through Earnings Season, Political Strife And A Frothy Market

In 2015, I penned my first article on the subject matter surrounding VIX-leveraged ETF/ETNs. Back then, as if it were that long ago, there really weren’t too many well-articulated articles and practical insights for utilizing these instruments to help one boost their portfolio’s performance. Since I had some writing experience, understanding and grammar skills I decided to see if I could generate some articles for investors/traders to connect. And so it was the genesis of my ongoing series of articles that would hopefully inform even the most novice of investor/trader as to how to best utilize VIX-leveraged ETF/ETNs. The first of these articles was published in December of 2015 and titled Year-End Positioning With UVXY Opportunity Highlighted. The article allowed me to dip my toe in the water and introduce myself to a new audience of investors/traders. Below is an excerpt from the article:

On top of these trades, I've been amassing trading positions in what I refer to as a portfolio piggy bank known as the ProShares Ultra VIX Short-Term Futures ETF (NYSEARCA:UVXY). While I would love nothing more than to explain to readers/traders/investors how the UVXY works in great detail, it's more poignantly described by stating that the trading instrument is "designed to fall in price".

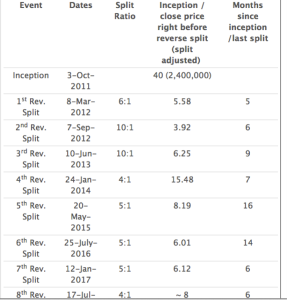

Designed to fall in price, decay in price, erode in price. There was a variety of choices that I can critique my verbiage for with hindsight, but if we fast forward to the present that is exactly what has continued to occur, a constant decay in share price. And since 2015 I’ve written at least two dozen more articles on this subject matter, all the while maintaining a core, short position in shares of UVXY. Naturally, since UVXY is designed to decay in price, ProShares must enact a reverse split in the instrument otherwise it would have gone to zero a long time ago. So for those just tuning in and seeing Friday’s closing price of $8.56 per share, don’t be alarmed when it begins trading at $34ish a share on Monday July 17, 2017. Several weeks ago, ProShares announced a scheduled reverse split for UVXY and other instruments. This will be the eighth reverse split since it commenced trading in 2011. If we add them up that averages to just over one reverse split annually. So if you like sure things, this instrument has definitively delivered. OK, that sound a bit salacious I’m sure, but you get the picture: It’s designed to decay in price and that’s exactly what it has done. Here’s a visual aid regarding the past and pending reverse split:

The reverse split for UVXY should place the share price right around $34.25 come Monday. Why is this relevant? Well, it’s relevant because the instrument will now have more beta than in recent months due to the share price. Below $10 a share UVXY had far less beta, which equates to smaller, dollar moves in the share price be it up or down. For an instrument that is correlated to VIX Futures, UVXY couldn’t touch $12 a share from the $9 level recently and in the face of Spot VIX jumping from the 9s to nearly 13 only a month ago. But now, with a reverse split taking UVXY’s share price into the $30s, well, trust there will be more outsized moves in the near-term.

It has taken ProShares only 6 months to enact yet another reverse split for shares of UVXY, in part due to the rally in the stock market since the November 2016 election that has served to also suppress volatility. Coupled with the element of contango that is ever present in UVXY, shorting shares of the instrument has been a treasure trove for investors/traders. I’ve described the “short instrument” as the investment of the decade given its unique construction paired with a bull market cycle. This is not to suggest that in a bear market, UVXY could not deliver outsized returns for short participants, but rather not to the degree as they do during a bull market cycle. Since 2011 and during this bull market cycle, shares of UVXY have offered a greater than 90% ROIC short. Not too shabby and if you have the stomach to withstand some unpleasantries that come with shorting a VIX-leveraged ETF.

“Fits and starts” in the market can spur great moves in volatility/VIX, moving shares of UVXY against short positions to a great degree. As such, if one doesn’t manage these moves with a sound trading strategy, they can become disenfranchised with the instrument and miss out on strong returns for the sake of fear and loathing. If I were to offer a word of caution and/or limited advice I’d have to say to novice and even intermediate investors, “When choosing to engage VIX-leveraged ETF/ETNs for the first time, do so with a guide, resources and a proven strategy or person to facilitate your experience and learning”. If this sounds like a warning more so than advice, trust me when I suggest that most every conversation surrounding VIX-leverage ETF/ETNs do sound that way. It’s something one comes to accept and understand over time. Time, there’s another word or variable that investors/traders will want to use to its greatest advantage when it comes to VIX-leveraged ETF/ETNs participation and as such one of the reasons I participate with shares as opposed to options. Soapbox, jumping off now! And we’re only half way through, so pay attention.

I’ve been through it all since establishing an understanding of UVXY and since 2012 folks. I’ve experienced the lows of investing in the instrument from the short side and I’ve experienced the highs. Along the way, I’ve read “literally” hundreds of VIX/volatility-related articles. There are at least a dozen published daily and well distributed. A vast majority of these volatility-related articles imprint fear on the reader and/or why they should be fearful of low-levels of volatility, otherwise known as complacency in the market. For the love of Pete, it’s a wonder why we can’t simply enjoy a modestly growing economy that helps to improve the employment picture of the nation and earnings growth in the corporate sector. But maybe I’m just an optimist and innately view the world through rose-colored glasses, right? Well, for those of my readers and followers who read my works in the consumer packaged goods and retail sectors, you know this to be a farce.

Remember back in October of 2016, I was that guy who sent out one of the most widely distributed retail sector reports of the year, warning of a pending crisis in the retail sector. The report focused in on department store brands such as J.C. Penney (JCP), Kohl’s (KSS), Target (TGT), Bed Bath & Beyond (BBBY), Dillard’s (DDS) and Macy’s (M). With over 35 pages of content, it was quite an in depth report with facts, figures and forecasting to boot. Nearly 400 funds and portfolio managers purchased this report and I’m sure another 400+ were wrongly given the report. Yea, I know how ya’ll operate wink, wink! Anyway, the sentiment within the report was publically reviewed by famed asset manager Alan Valdez and published on Yahoo Finance on October 6, 2016.

What the team at focusedstocktrader.com and I are concerned about is the downward trend in retail sales. My colleague Seth Golden notes in his institutional report that, besides the April 1.2% outlier, sales have been anything but inspiring.

September retail sales came in at a lackluster -0.3% month-to-month. And look no further than today’s guidance from Wal-Mart (WMT), projecting a lackluster profit outlook into 2018. Even more troubling is the amount of big box stores closing hundreds of locations: Macy’s (M), Kmart, Sears (SHLD), and Wal-Mart. Yes, people are using online shopping more and more, but the closing of so many stores tells us the consumer is starting to have a more difficult time—and maybe the jobs number Wall Street looks at is not showing us the real picture of Main Street.

OK, so I got us a little off-track there for a moment, but my point in reviewing the latter information was to identify that I’m a facts and figures analyst and investor. The facts are what they are or were and if there was a greater warning produced for investors regarding the retail sector back in 2016, I wasn’t aware of it. My desire with my institutional reporting was to warn asset managers that the retail sector was deteriorating in light of the seismic shift from brick & mortar sales to online retail sales. The effects of this shift in sales channels were forecast to impair both top and bottom line performances of traditional brick & mortar retailers. And if one has been paying attention to the media and retail reporting in 2017, that forecast unfortunately came to fruition.

Facts and figures mixed with a little forecasting or projecting out and into the future. Say that five times fast. But seriously that is how I’ve managed a successful 18-year investing and asset management career. And with that there is one fact that never seems to change: Earnings drive markets long-term. It’s proven accurate 100% of the time. When earnings fall, markets follow. When earnings rise, markets follow. And when central banks intervene, markets rise. In this day and age we have a two thirds opportunity for our investing capital to appreciate, especially with index funds. But even so, it has proven difficult to outperform the benchmark returns of the S&P 500. That is unless you’ve maintained a VIX-leveraged ETF/ETN investing strategy.

So it is with the multitude of warnings circulating the media world and suggesting a normalization of volatility that is ever pending that I suggest relying on the facts and figures. So let’s list some simple facts:

- Interest rates remain at historically low levels

- Unemployment levels remain at historically low levels

- Wages & Income levels are rising, albeit at a slow pace

- Asset prices are rising creating a wealth effect

- Corporate earnings are expected to grow roughly 7% in Q2 2017 after growing double-digits in Q1 2017

- GDP has sustained modest growth YOY and for the last several years

- Consumer sentiment is near record levels

- Monthly retail sales and consumer spending has risen since 2009

- The political environment stinks something fierce

That number 9 has me concerned as we have entered the second half of 2017 and with a great deal of expectations on the docket for the year. The fact is that the major averages have largely baked in the anticipated and/or forecast gains for the year already. The Dow and S&P 500 are trading at record levels as earnings are expected to grow. But there is a problem with the pace of market gains juxtaposed with S&P 500 expected earnings growth. As stated, the earnings growth is already baked in…and then some.

Back in early 2014, the S&P 500 consensus earnings forecast for 2015 was $133. Fast forward to 2017, and earnings per share are still roughly $10 below that level. And yet, the market continues to not only outpace the forecast earnings growth, but most any correlated metric historically measured for S&P 500 earnings that aligns with a reasonable market multiple. The reality is that it concerns me today, these facts and figures. It concerns me today because Golden Capital Portfolio has already captured a 111% ROIC with the political environment being what it is.

Let’s face facts even if just for the moment. Has it been a strong year for the market up till now? Certainly it has. Have we had any meaningful pullback in the markets in the last 6 months or so? Certainly we have not. So would it be healthy to have such a pullback on the magnitude of say 5-7 percent? I would suggest that it would be a sign of a healthy market to have such a reversion. This is not to suggest that a 5-7% pullback would or should lead to a 7-15% correction. Again, the facts are that corporate earnings are growing, algorithmic trading is now the norm and ETF investing is a more predominant choice that facilitates a “buy the dip” mentality in the market place with each and every 1% pullback. So if you have been fighting those variables and insisting the market is overvalued, well that is a great deal to be fighting against.

Having said that…one can reasonably forecast that a delay or failure on the part of the Senate to pass any improved healthcare legislation would be detrimental to many of the previously noted facts and figures. The uncertainty alone that surrounds healthcare costs for the average citizen is likely enough to impact two thirds of the economy, consumer spending. And then there is tax reform. I’m not of the opinion that anybody can state with certainty that a percentage of 2017’s market rally is or isn’t due to the belief that tax reform will occur in the fiscal year. As such and with the captured gains from the market rally already in hand, would it not be prudent to exercise a level of caution with regards to one's portfolio management? This is a must for me at this point. Since 2012, I’ve managed to achieve outsized gains for my clients. I’ve done so by making smart decisions with regards to capital deployment as well as risk management. Below is the brokerage standing for Golden Capital Portfolio fund showing our steady improvement throughout the year…so far.

So here is how I’m managing risk in Golden Capital’s Portfolio through the onset of Q3 2017 and until further notice. On July 14 and 15 I adjusted the portfolio to reflect the already discussed variables investors may contend with in the back half of the year. This past Thursday I shorted a large lot of iPath S&P 500 VIX Short-Term Futures ETN (VXX) shares. On Friday I covered roughly 200,000 UVXY shares. The net result of these two trades reflects my notion of risk management, as I will explain.

With the majority of these covered UVXY shares expressing 95% or greater returns on capital, this was an optimal time to solidify the ROIC. Now, VXX has nearly double the market cap of UVXY. Additionally, it trades nearly double the daily volume of UVXY and as such it carries less beta i.e. lesser dollar/percentage moves. At this stage in the market and volatility cycle, I like this strategy as it will prove less stressful should volatility elevate for any reasonable period of time. In total, Golden Capital Portfolio fund will still carry forward a reasonable size short in shares of UVXY with a larger VXX short position. Taking this action prior to a reverse split in VXX was an optimal strategy, as I believe Barclays Bank PLC will announce another reverse split in its ETNs in the near future. Last but not least, I’m taking Golden Capital Portfolio’s VIX strategic positioning from its typical 20% of total investable capital to 13 percent.

To reiterate, Golden Capital Portfolio has substantially outperformed the S&P 500 benchmark ROIC year-to-date. As such I’m managing capital to reflect long-term belief in corporate earnings growth while de-risking to potential political strife in a somewhat frothy market. The Portfolio is well positioned to take advantage of both a continued complacency in the overall market with respect to volatility as well as any increases in volatility. Through the Q3 2017 period and with ample cash to trade, that is exactly what I will be doing. Trading both volatility and retail as this is what I know best. For those of you who follow me on Twitter, you can review my trades in real-time. In the years since employing my VIX-leveraged instruments trading and investing strategy, most every year I’ve garnered 15-25% of total returns from periodic trading.

I don’t admonish those forecasting, fear mongering and calling for an end to low volatility and the demise of short volatility traders. I really don’t. What I do is to inform or report on what these folks don’t explain or offer to any great degree. Volatility is low, there is no denying that fact, but it’s low for very reasonable and fact-driven reasons. And yes, higher levels of volatility will come; they may even persist for several months if markets become unhinged. It’s happened before so obviously it will happen again. All well known and all well accepted.

So what does a short volatility investor have to do to avoid the “pending doom” that has been prescribed for us? One word, liquidity. Make sure you’re not swinging for the fences with your capital and leave yourself ample liquidity in the event that volatility/VIX should increase and maintain an average above 15 for months. It’s the initial spike that can cause damage if liquidity isn’t managed well. But once volatility settles into a range, be it higher or lower, that range can once again be shorted in perpetuity. The spike/gap in the VIX is where one needs preparedness or risk management. If that spike/gap can be managed well as I’ve had to do many a time since 2012, game on. And trust that I’ll inform as to when I’m swinging a heavy bat.

Disclosure: I am short UVXY and VXX. I intend to trade shares of TGT and JCP over the next 6-12 month period.

Love the content you share! Thank you Seth.