ETF Stats For April 2016: Smart Beta ETFs Surpass 600

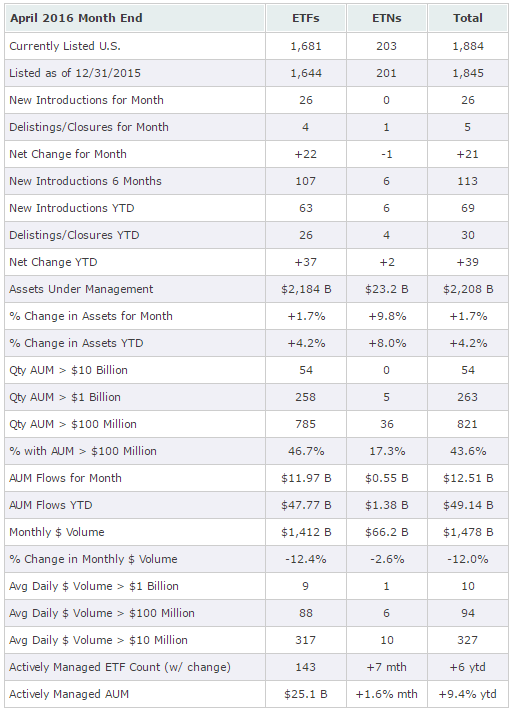

Twenty-six new ETFs came to market in April, producing the briskest pace of the past six months. Only five delistings occurred during the month, and the net increase of 21 results in a tie for the largest increase of the past nine months. April ended with 1,884 listed products, consisting of 1,681 exchange-traded funds (“ETFs”) and 203 exchange-traded notes (“ETNs”). Assets rose by $37.6 billion to a new high of $2.2 trillion. Inflows accounted for $12.5 billion of the increase, while the other $25.1 billion were the result of market gains. The year-to-date percentage increase in assets is relatively modest at 4.2%, and the year-over-year gain is just 3.7%. Asset gains are not keeping pace with the 10.6% increase in product count the past 12 months. Smart-beta, or alternative-beta, funds were once again prevalent among the new ETFs in April, numbering 16 in all. Three of the closures fit the alternative-beta category, pushing the overall count 13 higher to 607. Of the 69 new ETFs introduced so far this year, 47 (68%) are smart-beta funds, 10 are actively managed, and 12 track traditional cap-weighted indexes. However, the dozen traditional ETFs aren’t all vanilla, as six are either leveraged or inverse funds, and three use adaptive currency-hedging techniques. Actively managed ETFs took a big jump in April, increasing their ranks by seven to 143. Two of the new actively managed ETFs are “gold hedged” from new sponsor REX. They are both fund-of-funds ETFs that use an overlay of gold futures to effectively hedge away exposure to the U.S. dollar. Although REX claims to be the “first” to offer gold-hedged ETFs, UBS has been offering the ETRACS S&P 500 Gold Hedged ETN (SPGH) for more than six years. However, investors will likely prefer the ETF structure of REX Gold Hedged S&P 500 (GHS) over the ETN structure of SPGH. The most notable closure during April was the forced delisting of the DB Commodity Long ETN (DPU). It is notable because DB has no plans to liquidate the product and return the money to owners of the notes. The NYSE suspended trading and delisted the product because DPU was not meeting the minimum market value of $400,000 required for continued listing. The good news is that this ETN is so small that very few investors will be affected. The bad news is the notes do not mature for another 22 years. If owners are not willing to wait that long, then they will have to pursue a sale in the over-the-counter markets. Additionally, if owners happen to hold 100 ETNs, or multiples thereof, then they can possibly partake in Deutsche Bank’s monthly small-lot redemption. Good luck with that. Trading activity declined 12.0% for the month, marking the third consecutive month of double-digit drops. These three months combined to produce a 31.9% plunge in trading activity to $1.28 trillion from January’s $2.2 trillion in ETF dollar volume. April’s activity saw just 10 products averaging more than $1 billion a day, although these 10 represented an impressive 48.7% market share. The quantity of products averaging more than $100 million a day in trading activity dropped from 97 to 94 and accounted for 86.4% of trading activity.

Data sources: Daily prices and volume of individual ETPs from Norgate Premium Data. Fund counts and all other information compiled by Invest With An Edge.

New products launched in April (sorted by launch date):

- Dhando Junoon ETF (JUNE), launched 4/4/16, seeks to track a rules-based index of approximately 100 U.S. securities selected from three event-driven categories: Share buybacks will receive a 75% allocation, select value manager holdings via 13F filings will get a 20% weighting, and spin-offs get the remaining 5%. The ETF has an expense ratio of 0.75% (JUNE overview).

- JPMorgan Diversified Return Europe Currency Hedged ETF (JPEH), launched 4/4/16, seeks to track the performance of the FTSE Developed Europe Diversified Factor 100% Hedged to USD Index. Its top-down risk allocation framework equally distributes portfolio risk across 10 sectors. The bottom-up multi-factor stock-ranking process combines value, quality, and momentum factors. The fund hedges out the currency exposure and has an expense ratio capped at 0.49% (JPEH overview).

- JPMorgan Diversified Return International Currency Hedged ETF (JPIH), launched 4/4/16, seeks to track the performance of the FTSE Developed ex North America Diversified Factor 100% Hedged to USD Index. Its top-down risk allocation framework equally distributes portfolio risk across 40 regional sectors. The bottom-up multi-factor stock-ranking process combines value, size, momentum, and low volatility factors. The fund hedges out the currency exposure and has an expense ratio capped at 0.49% (JPIH overview).

- REX Gold Hedged FTSE Emerging Markets ETF (GHE), launched 4/5/16, is an actively managed fund-of-funds ETF that holds Vanguard Emerging Markets (VWO) and overlays the portfolio with gold futures contracts via a Cayman subsidiary. The ETF will issue 1099 tax forms and caps its expense ratio at 0.65% (GHE overview).

- REX Gold Hedged S&P 500 ETF (GHS), launched 4/5/16, is an actively managed fund-of-funds ETF holding Vanguard S&P 500 (VOO) and overlays the portfolio with gold futures contracts via a Cayman subsidiary. The ETF will issue 1099 tax forms and caps its expense ratio at 0.48% (GHS overview).

- Direxion Daily Energy Bear 1x Shares (ERYY), launched 4/7/16, seeks investment results that are 100% inverse the daily performance of the Energy Select Sector Index. The new ETF caps its expense ratio at 0.45% (ERYY overview).

- Direxion Daily Financial Bear 1x Shares (FAZZ), launched 4/7/16, seeks investment results that are 100% inverse the daily performance of the Financial Select Sector Index. FAZZ will cap its expense ratio at 0.45% (FAZZ overview).

- Direxion Daily Technology Bear 1x Shares (TECZ), launched 4/7/16, seeks investment results that are 100% inverse the daily performance of the Technology Select Sector Index. The fund caps its expense ratio at 0.45% (TECZ overview).

- WisdomTree Emerging Markets Dividend Fund (DVEM), launched 4/7/16, tracks a fundamentally weighted index that measures the performance of dividend-paying stocks selected from 17 emerging-market nations. It weights companies by annual cash dividends paid. The fund has an estimated yield of 3.8% and an expense ratio of 0.32% (DVEM overview).

- WisdomTree International Quality Dividend Growth Fund (IQDG), launched 4/7/16, tracks a fundamentally weighted index that provides exposure to dividend-paying developed-market companies. It is composed of the top 300 companies from the WisdomTree International Equity Index with the best-combined rank of growth and quality factors. The growth factor ranking focuses on long-term earnings growth expectations. The quality factor ranking is based on three-year return on equity and return on assets. It then weights companies by annual cash dividends paid. The new ETF has an estimated yield of 2.4%, and its expense ratio is capped at 0.38% (IQDG overview).

- First Trust RiverFront Dynamic Asia Pacific ETF (RFAP), launched 4/14/16, is an actively managed ETF holding equity securities of developed-market Asian Pacific companies while utilizing a dynamic (0-100%) currency-hedging strategy. The manager quantitatively scores geographies on fundamental and technical momentum, and combines this with a qualitative assessment. A geographic and thematic rotation strategy is established, and a proprietary valuation model gauges markets for relative and absolute value. The portfolio manager combines the outputs of the quantitative and qualitative processes to select the most attractive regions and securities. The fund has an expense ratio of 0.83% (RFAP overview).

- First Trust RiverFront Dynamic Developed International ETF (RFDI), launched 4/14/16, is an actively managed ETF holding equity securities from developed markets outside of North America while utilizing a dynamic (0-100%) currency-hedging strategy. The manager quantitatively scores geographies on fundamental and technical momentum, and combines this with a qualitative assessment. A geographic and thematic rotation strategy is established, and a proprietary valuation model gauges markets for relative and absolute value. The portfolio manager combines the outputs of the quantitative and qualitative processes to select the most attractive regions and securities. RFDI currently holds more than 400 stocks and has an expense ratio of 0.83% (RFDI overview).

- First Trust RiverFront Dynamic Europe ETF (RFEU), launched 4/14/16, is an actively managed ETF holding equity securities of developed-market European companies while utilizing a dynamic (0-100%) currency-hedging strategy. The manager quantitatively scores geographies on fundamental and technical momentum, and combines this with a qualitative assessment. A geographic and thematic rotation strategy is established, and a proprietary valuation model gauges markets for relative and absolute value. The portfolio manager combines the outputs of the quantitative and qualitative processes to select the most attractive regions and securities. The ETF has an expense ratio of 0.83% (RFEU overview).

- SPDR DoubleLine Emerging Markets Fixed Income ETF (EMTL), launched 4/14/16, is an actively managed ETF that seeks to provide high total return from current income and capital appreciation. The five-step investment process combines bottom-up research with sovereign macro overlays. The fund’s manager, DoubleLine, links credit fundamentals with market valuation to guide portfolio construction and investment decisions. It uses a research-driven process with a focus on countries, sectors, and companies believed to have improving fundamentals and ratings. EMTL has a current yield of 5.3%, an effective duration of 5.4 years, and an expense ratio capped at 0.65% (EMTL overview).

- SPDR DoubleLine Short Duration Total Return Tactical ETF (STOT), launched 4/14/16, is an actively managed ETF that seeks to maximize current income with an effective duration between one and three years. The fund’s manager, DoubleLine, believes that active asset allocation is of paramount importance in its efforts to mitigate risk and achieve better risk-adjusted returns. DoubleLine also believes an active approach is best suited to navigate the divergence and uncertainty in global interest rates and economic activity. The lower duration (one to three years) seeks to limit drawdowns relative to a global broad market fixed income portfolio. STOT has a current yield of 3.4%, an effective duration of 2.4 years, and an expense ratio capped at 0.45% (STOT overview).

- Deutsche X-trackers FTSE Emerging Comprehensive Factor ETF (DEMG), launched 4/19/16, tracks an index designed to provide core exposure to emerging-market equities based on five factors: quality, value, momentum, low volatility, and size. The value score is calculated on a company’s valuation ratios, including cash-flow yield, earnings yield, and country relative sales to price. The momentum score is calculated on each company’s cumulative 11-month return. The quality score is calculated from a company’s leverage and profitability. The low volatility score is calculated from the standard deviation of five years of weekly local total returns. DEMG has an expense ratio of 0.50% (DEMG overview).

- Global X S&P 500 Catholic Values ETF (CATH), launched 4/19/16, tracks an index that excludes companies involved in activities perceived to be inconsistent with Catholic values as set out by the U.S. Conference of Catholic Bishops, including screens for weaponry and child labor. It seeks to minimize tracking error by matching the sector weightings of the broader S&P 500 Index, and its expense ratio is capped at 0.29% (CATH overview).

- Guggenheim Large Cap Optimized Diversification ETF (OPD), launched 4/19/16, will track the Wilshire Large Cap Optimized Diversification Index, which combines differentiated return streams from low-correlated stocks. The benchmark index is methodically constructed via a proprietary algorithm where individual stocks are added only up to the point that they contribute to diversification. The fund seeks to manage risk by constraining stock and sector levels relative to the parent index. OPD has an expense ratio of 0.40% (OPD overview).

- Sprott BUZZ Social Media Insights ETF (BUZ), launched 4/19/16, tracks the BUZZ Social Media Insights Index, which identifies the 25 most bullish U.S. stocks based on investment insights derived from social media. It processes more than 50 million unique stock-specific data points from social media comments, news articles, and blog posts on a monthly basis. The data is filtered through an analytics model composed of patented natural-language processing algorithms and artificial-intelligence frameworks. BUZ has an expense ratio of 0.75% (BUZ overview).

- Amplify Online Retail ETF (IBUY), launched 4/20/16, is a portfolio of companies generating significant (70%) revenue from online and virtual sales. The underlying EQM Online Retail Index segregates holdings into three categories: traditional retail, marketplace, and travel. The index is equal-weighted with a maximum of 25% exposure to non-U.S. stocks and ADRs. Any excess weight will be allocated equally to all U.S.-domiciled index members. The expense ratio is 0.65% (IBUY overview).

- iShares Sustainable MSCI Global Impact ETF (MPCT), launched 4/22/16, seeks to track the investment results of an index composed of positive-impact companies that derive a majority of their revenue from products and services that address at least one of the world’s major social and environmental challenges as identified by the United Nations Sustainable Development Goals. The ETF currently has 93 holdings and an expense ratio of 0.49% (MPCT overview).

- CrowdInvest Wisdom ETF (WIZE), launched 4/26/16, seeks to track the CrowdInvest Wisdom Index, which is composed of U.S.-listed equities weighted by sentiment built by an independent, diverse crowd. It will attempt to harness “the wisdom of the crowd” from user votes on the CrowdInvest mobile app. The users’ bullish or bearish opinions on any U.S.-traded stock determine which equities will be included. The ETF has an expense ratio of 0.95% (WIZE overview).

- WisdomTree Fundamental U.S. Corporate Bond Fund (WFIG), launched 4/27/16, tracks a rules-based alternatively weighted index designed to capture the performance of selected issuers in the U.S. investment-grade corporate bond market that are deemed to have attractive fundamental and income characteristics. The methodology employs a multi-step process that screens on fundamentals and then tilts to those with attractive income characteristics. The new ETF has an estimated yield of 2.7%, an effective duration of 6.8 years, and an expense ratio capped at 0.18% (WFIG overview).

- WisdomTree Fundamental U.S. High Yield Corporate Bond Fund (WFHY), launched 4/27/16, tracks a rules-based alternatively weighted index designed to capture the performance of selected issuers in the U.S. high-yield corporate bond market that are deemed to have attractive fundamental and income characteristics. The methodology employs a multi-step process that screens on fundamentals and then tilts to those with attractive income characteristics. WFHY has an estimated yield of 6.2%, an effective duration of 4.5 years, and an expense ratio capped at 0.38% (WFHY overview).

- WisdomTree Fundamental U.S. Short-Term Corporate Bond Fund (SFIG), launched 4/27/16, tracks a rules-based alternatively weighted index designed to capture the performance of selected issuers in the U.S. investment-grade corporate bond market that are deemed to have attractive fundamental and income characteristics. The methodology employs a multi-step process that screens on fundamentals and then tilts to those with attractive income characteristics. Selected debt securities must have fixed coupons and a remaining maturity of at least one year but not more than five years. SFIG has an estimated yield of 1.6%, an effective duration of 2.3 years, and an expense ratio capped at 0.18% (SFIG overview).

- WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Fund (SFHY), launched 4/27/16, tracks a rules-based alternatively weighted index designed to capture the performance of selected issuers in the U.S. high-yield corporate bond market that are deemed to have attractive fundamental and income characteristics.The methodology employs a multi-step process that screens on fundamentals and then tilts to those with attractive income characteristics. Selected debt securities must have fixed coupons and a remaining maturity of at least one year but not more than five years. SFHY has an estimated yield of 6.6%, an effective duration of 2.5 years, and an expense ratio capped at 0.38% (SFHY overview).

Product closures in April and last day of listing:

- Highland HFR Equity Hedge (HHDG) 4/11/16

- Highland HFR Event-Driven (DRVN) 4/11/16

- Highland HFR Global (HHFR) 4/11/16

- DB Commodity Long ETN (DPU) 4/15/16 – delisted but not liquidated

- Global X GF China Bond (CHNB) 4/18/16

Product changes in April:

- ProShares 30 Year TIPS/TSY Spread (RINF) became ProShares Inflation Expectations ETF (RINF) with a new underlying index effective April 15.

Announced product changes for coming months:

- Van Eck Global will unite all of its investment products under the VanEck brand with the Market Vector ETFs becoming VanEck Vectors ETFs effective May 1.

- First Trust Indxx Global Agriculture ETF (FTAG) and First Trust ISE-Revere Natural Gas (FCG) will undergo 1-for-5 reverse splits effective May 2.

Disclosure: Author has no positions in any of the securities, companies, or ...

more