ETF Product Development: Past, Present And Future

On October 1st, 1908 Henry Ford introduced the Model T to the world. The power of the Model T was that it democratized the automobile so the average working-class person could afford a car for the first time. The design was simple and efficient. For much of its early production, the Model T was only produced in black. Future advances came from offering differentiation to meet the needs of different consumers. Eventually, competition entered the market, segmentation went wild, and now we have an automobile industry that delivers a wide variety of vehicle solutions.

Enjoying your Model-T? Or Would you like some alternative options?

Competition in the ETF industry has democratized investing in a similar way. Early production was focused on being simple and efficient. Similar to the black Model T, early ETFs were mainly produced in one style: Market Cap Weighted. As ETFs have become a more widely used tool for investors, more differentiated and advanced strategies have been brought to market in response to a combination of investor demand and ETF issuer innovation. And the 80/20 rule is alive and well in the ETF industry as well–80% of the market is controlled by iShares, Vanguard, and State Street — but 20% is controlled by boutiques that deliver value propositions that target a specific niche.

In a previous post, we looked at the history of the product development of ETFs from a high level; there have been two definitive waves: Market cap weighted ETFs and smart beta ETFs. In this post, we’ll focus on how we moved beyond the Model T of the ETF industry. I’ve broken the ETF universe into smaller categories to answer the following:

- Which product types have resonated with investor dollars to cause the growth of ETF product development; also, when did this occur?

- Ascertain the “why” behind the growth of ETF product development.

- What this tells about the future growth of ETF Product Development.

To simplify the process of analyzing the ETF landscape, I have chosen to focus only on large-cap equities. We’ll look at the top 100 equity ETFs by assets under management (AUM) starting with 12/31/2005. At that time, ETFs were still almost exclusively market cap weighted, so it’s a good period to start with to show the shifts over the following decade-plus window.

We’ll use the end dates of every three-year period, starting with 12/31/2005, then 12/31/2008, 12/31/2011, 12/31/2014, and then year-to-date, 7/31/2017. The idea is to pick up on how the trends in ETFs have shifted and see what that tells us about the future.

Rules for categorizing ETFs:

ETFs are categorized as follows:

- Market Cap Weighted

- Leveraged and Inverse

- Multifactor

- Low volatility

- Value

- Growth

- Quality

- Equal-weight

- Dividend

- Currency-Hedged

- Momentum

The images below represent two items:

- The Pie Chart (on the left) represents the breakdown of the percentage (%) of AUM by product type.

- The Bar Chart (on the right) represents the breakdown of the number (N) of ETFs by product type.

Onward to the analysis!

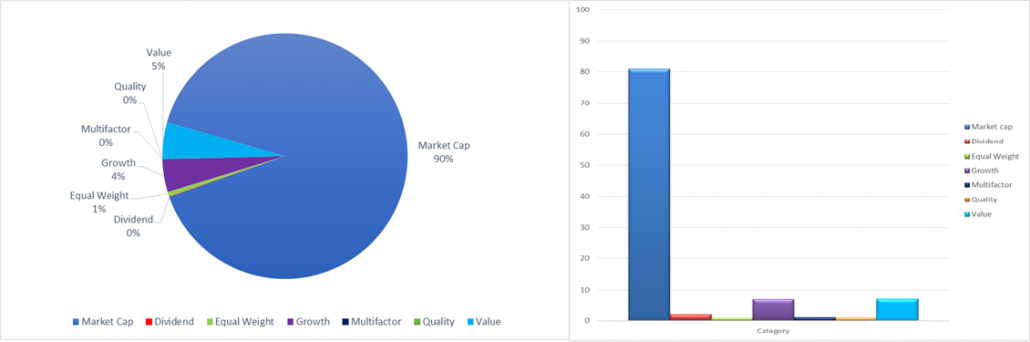

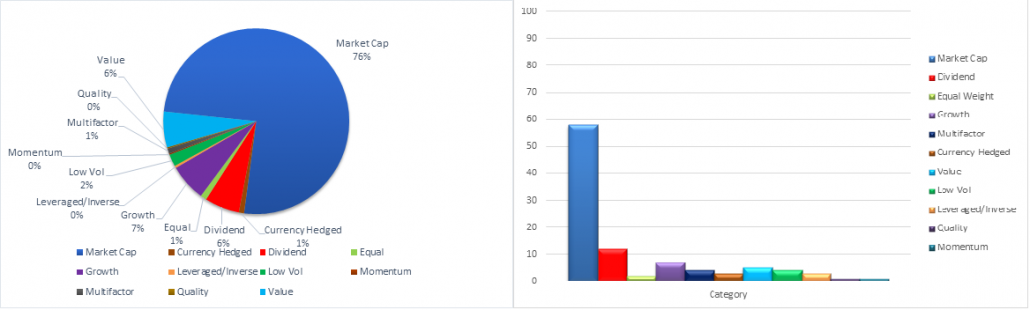

2005: Beta to the World

(Click on image to enlarge)

AUM within Top 100 Equity ETFs by Product Category – 2005 (left) and Number of Product Category within Top 100 Equity ETFs – 2005 (right)

In 2005, from both a percentage of AUM and the number of products in the top 100, it was the same story: market cap weighted products dominated. 81 of the top 100 names were broad-based market cap weighted funds (countries or regions) or sector funds that were market cap weighted. It’s not until you reach Guggenheim’s Equal Weighted S&P 500 fund (RSP) at number 26 on the AUM rankings, that anything but a market cap weighted fund comes up. That fund had just over $1.3 billion in AUM at the time.

Growth and value ETFs also had a significant amount of the percentages, at a combined 9% of AUM and 14% of product type. Alternative product types made up a combined 2% of AUM and 5% of product type.

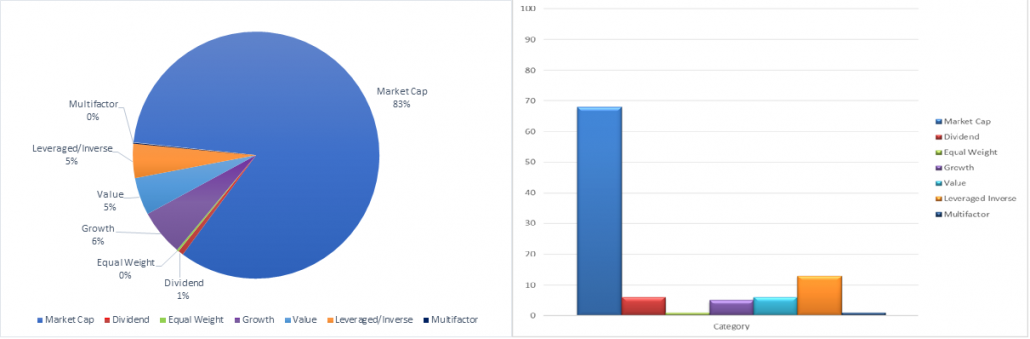

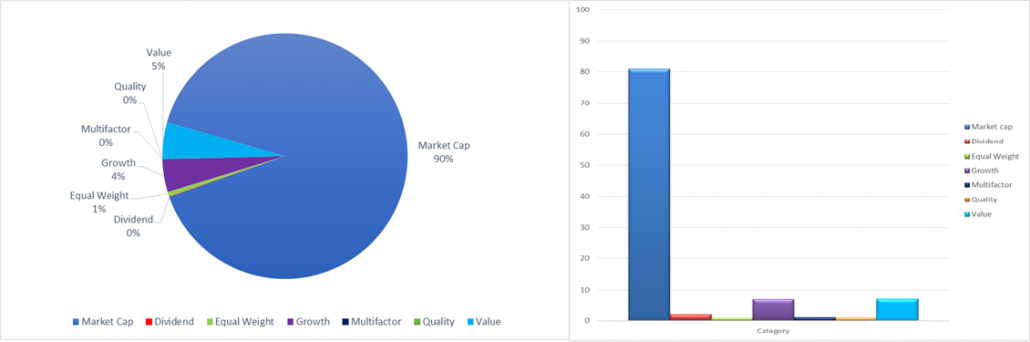

2008: A Second Tool Levers Up

(Click on image to enlarge)

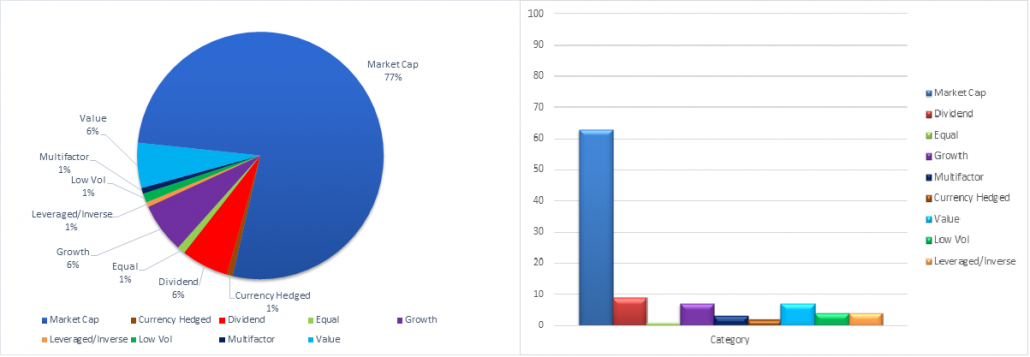

AUM within Top 100 Equity ETFs by Product Category – 2008 (left) Number of Product Category within Top 100 Equity ETFs – 2008 (right)

By 2008, broad-based market cap weighted ETFs lost ground to other types of ETFs, dropping from 90% of ETF AUM in 2005, to 83% in 2008. Leverage ETFs came into the ETF world and again gave a new tool to investors. In 2005, investors of any type were able to achieve quick, easy, exposure to beta from around the world. With the market crashing and volatility up, investors were hungry for anything that could assist them in hedging that risk. Leveraged and inverse ETFs provided regular (and advanced) investors just that.

In 2005, no leverage ETFs made it into the top 100 (as none were created yet!). At the end of December 2008, leveraged and inverse ETFs made up 5% of the top 100 equity ETF AUM and 13% of the product type.

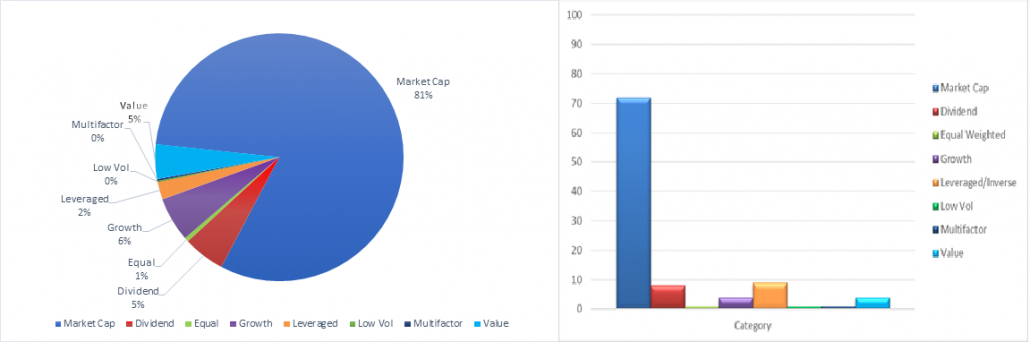

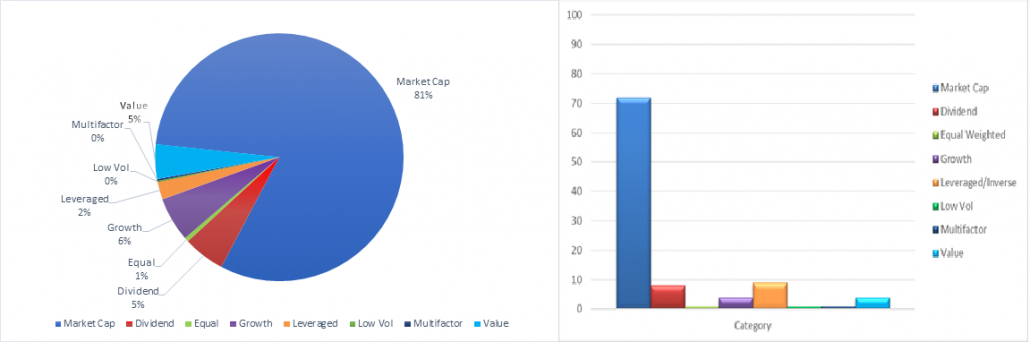

2011: The Hunt for Yield and Low Volatility

(Click on image to enlarge)

AUM within Top 100 Equity ETFs by Product Category – 2011 (left) Number of Product Category within Top 100 Equity ETFs – 2011 (right)

In 2008, dividend ETFs made up only 1% of the AUM, but 6% of the product type within the top 100 equity ETFs. In 2011, the total AUM of dividend ETFs began to catch up with the total number of dividend ETFs in top 100, as they now made up for 5% of the AUM. Investors needed income in the low-interest rate environment, and ETF issuers were happy to step in and provide them just that.

With the two epic stock market collapses of 1999 and 2008/’09 still fresh in their minds (and stock market prognosticators consistently calling for more crashes to come), investors were also in search of something to calm their fears on that.For ETFs, one key to growing the AUM in a fund is an ability to explain the benefit in one sentence. A one-sentence explanation of the benefits make it simple for the financial advisor to explain to their end client, and that gives the potential of a rapid adoption.

SPY? You own the 500 largest companies in America. VIG? It gives you a consistently growing income. IShares Russell 1000 Growth (IWF)? It gives you access to the fastest growing companies in America.

In 2011, we saw the addition of a new one-sentence product type that resonated with investors at that time (and continues to do so today). On May 5 of that year, PowerShares launched the PowerShares S&P 500 Low Volatility ETF (SPLV). By December 31st of that year, the fund had already amassed an impressive $865 million in assets under management. For investors, “you get the S&P 500, with less volatility” was (and is!) a very attractive selling point.

Now we had eight major product types (up from seven in 2005).

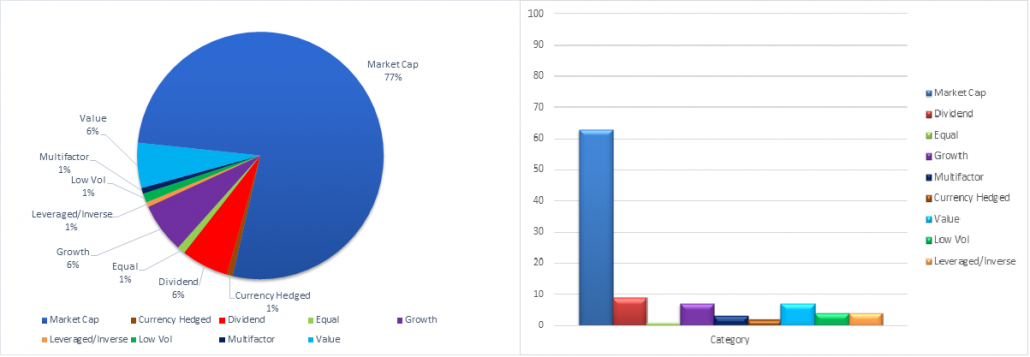

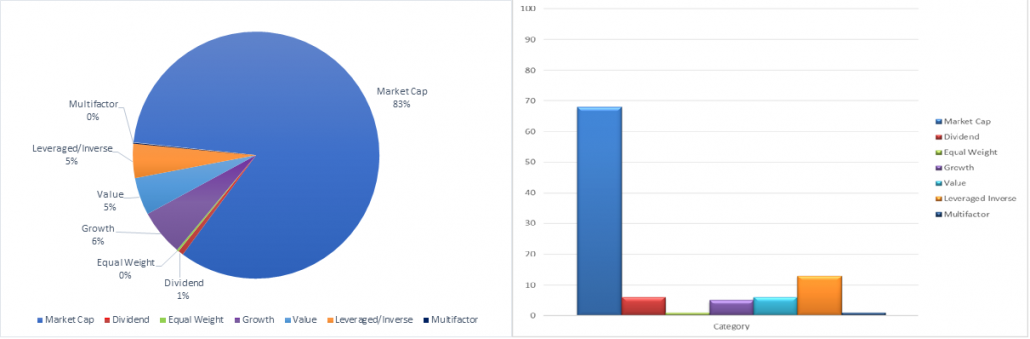

2014: Dollar Strength Flexes on ETFs

(Click on image to enlarge)

AUM within Top 100 Equity ETFs by Product Category – 2014 (left) Number of Product Category within Top 100 Equity ETFs – 2014 (right)

2014 was the year of the dollar. It marked the first time since the turn of the century that the dollar rose against all major currencies. Simultaneously, international markets in Europe and Japan were rising. Investors started asking the following question:

If only there was a way I could own the international markets, and short their currencies.

Enter WisdomTree.

By the end of 2014, the Wisdomtree Europe Hedged Equity Fund (HEDJ) amassed $5.6 billion in AUM, putting it at number 37 on the top 100 list of large-cap equity ETFs. HEDJ went on to become the largest European Equity ETF in the U.S. in 2015. The trend faded somewhat, but the ETF industry once again gave investors of all types simple access to an advanced strategy. This brought the total to nine types of product types in the top 100 large cap equity ETFs.

2017: Fine-Tuning Factors

(Click on image to enlarge)

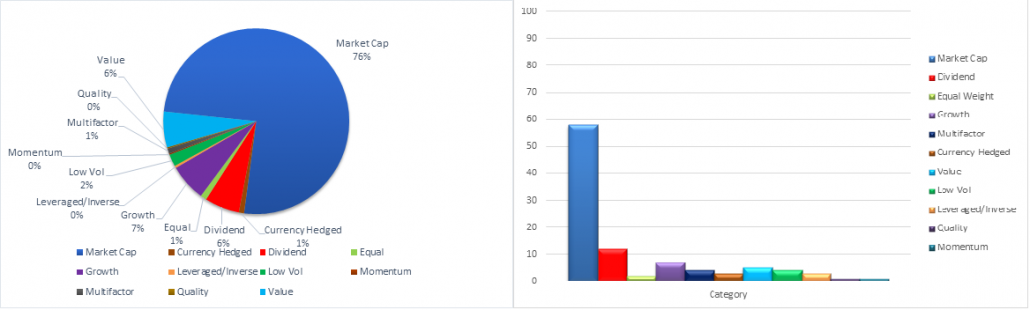

AUM within Top 100 Equity ETFs by Product Category – 2017 (left) Number of Product Category within Top 100 Equity ETFs – 2017 (right)

In 2005, 90% of the top 100 large cap ETF AUM was market cap weighted. At the end of July 2017, pure market cap weighted ETFs made up “only” 76% of AUM. Market cap weighting is far from dead (and never will be as they provide a necessary amount of scale for investors). But the growing size of the ETF pie has made room for additional ETF strategies to flourish, and more ETF firms to build sustainable businesses around differentiated product types.

There are now 11 product types which have gained a place in the top 100. Every single one of the top 100 equity ETFs has over $1 billion in assets under management. At the end of 2005, only 29 large cap equity ETFs crossed the billion-dollar threshold. What was the size of the 100th ranked large cap ETF in 2005? It was the SPDR Euro Stoxx 50 ETF (FEZ) with $12 million in market cap. Today that ETF has over $4.5 Billion in AUM! That would be a great ETF business on its own and would make State Street the 23rd largest ETF issuer.

It certainly pays to be early in any industry, and the ETF industry is no different. However, going from 7 major product types in 2005 (being generous, as it was three that dominated the AUM and provided for sustainable businesses), to 11 major equity ETF types in 2017 shows that innovation in product development continues to provide solutions to investors in meaningful ways (or maybe ETF issuers are good at convincing investors they need new ways to invest!).

What Product Type is Next?

What will be the next equity product type to lead the growth of ETF product development? It’s tough to say. What drove the product categories above to become major categories was mainly due to large macro events pushing demand to a new product type. Predicting the next major macro event would be the best lens to attempt to predict the future of ETF product development with. Good luck, right?

The large drawdown and volatility of 2008/’09 drove AUM into leveraged and inverse products. The fear of that was the likely cause driving investors into low volatility ETFs. Currency-hedged ETFs took off with the strong dollar in 2014 and 2015, causing unhedged international ETFs to significantly lag their hedged competitors.

In 2017 we’re seeing assets go to factor ETFs, as shown in the 2017 chart by the introduction of the momentum factor to the top 100, along with low volatility, quality and multifactor, and value ETFs becoming a larger part of the pie. Representing the standalone momentum ETF in the top 100, Ishares Large Cap Momentum ETF ($MTUM) had $482 million in AUM on 12/31/2014 and was ranked number 165 for Large Cap Equity ETFs in the U.S. As of 2017, it had almost $3.5 billion in AUM and ranked at number 71 of Large Cap Equity ETFs (Wes had an article looking at that performance here). Combine the momentum factor with the AUM of the other factors in the top 100 equity ETFs (low vol, quality, multifactor, and value), and factor investing now makes up about 9.7% of the pie. At the end of 2014, factor investing made up only ~7.9% of the ETF top 100 equity pie.

As opposed to the major ETF product additions in 2008, 2011, and 2014, there’s no specific macro event we can point to for the factor growth, so my theory doesn’t completely hold true, but it is directionally correct.

What could be significant macro triggers to drive future product demand? It’s impossible to say. History doesn’t repeat itself, but it does often rhyme (as they say). The most likely macro events to jump-start a new major category in ETF product development are an unexpected sharp increase in rates causing investors to scramble for interest rate hedged ETFs, a sharp pullback (20% plus) that drives investors towards products that protect against the downside, or an unexpected increase in inflation. All three of these product types exist already in the ETF space, as ETF issuers are prepared for just these types of scenarios and want to be the first to provide the needed solution as being the largest ETF in space has compounding benefits.

A word of caution though: Generals often fight the last war. U.S. investors often do the same. If you’re going to follow a new trend, be sure you’re not getting in after that battle’s already been fought.

Appendix

Here’s all of the charts in a row, to help readers visualize the shifts a little easier.

2005

(Click on image to enlarge)

2008

(Click on image to enlarge)

2011

(Click on image to enlarge)

2014

(Click on image to enlarge)

2017

(Click on image to enlarge)

Join thousands of other readers and subscribe to our blog.

Disclaimer: Please remember that past performance is not an indicator of ...

more