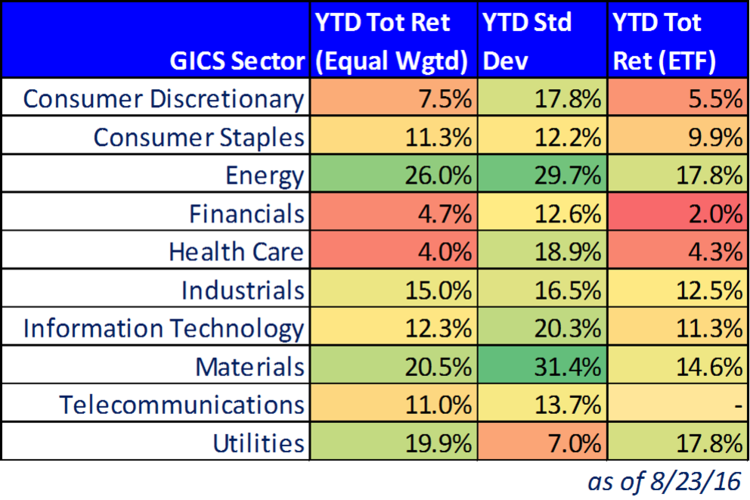

Energy & Utilities: Best Performers, Highest & Lowest Volatiltiy

Not surprisingly, Utilities stocks are the least volatile this year, and Energy stocks are the most. However, the Utilities ETF (XLU) and the Energy ETF (XLE) are the two top performing sector ETFs, both providing 17.8% total returns so far this year.

With regards to Utilities, it's been a case of dividend chasing, whereby artificially low interest rates have left income investors clamoring for anything with a decent yield that seems low risk. However, in the cast of Energy, it's been a wild stock-pickers market as low energy prices have impacted different energy stocks differently.

Also interesting to note, on an equal-weighted basis, S&P 500 Energy stocks delivered a whopping 26% YTD total return versus only 17.8% for the market cap weighted Energy ETF. Some of the largest Energy companies (e.g. Tesoro TSO, Valero VLO, Transocean RIG, and Marathon MRO) all have delivered less than NEGATIVE 15% total returns so far this year, dragging down the sector ETF because of their larger market capitalization. (Largest Cap Exxon Mobile XOM is up 15.5% YTD, total return).

We believe it continues to be a stock-pickers market within the energy sector. We also believe the two Energy stocks we own, (one of them is up 32% since we purchased it 3-months ago, and that's not including it's big 9% dividend) are poised to continue delivering big returns going forward because of their unique businesses. Additionally, several of the non-energy-sector companies we own have still have significant exposure to the Energy sector, and we believe they too are poised for strong performance ahead.

Disclosure: None.