COWZ: Focus On High FCF Yields A Winning Strategy For This New ETF

So many of the new ETFs that were opened in 2016 focused on narrow segments of the market. We saw new funds such as the 3D Printing ETF (PRNT), the Wearable Technologies ETF (WEAR) and the Global X S&P 500 Catholic Values Index ETF (CATH). And that's not even mentioning the myriad of smart beta funds that have also launched recently. I'm not suggesting that any of these are poor funds by any stretch. I actually like a number of them and think they have solid management teams backing them up but how do some of these funds fit into a portfolio? How much portfolio capital really needs to be dedicated to liquor producers and drones?

So I was pleasantly surprised to find a new ETF launch last month that focused on fundamentals instead of niche markets. The Pacer US Cash Cows 100 ETF (COWZ) targets the 100 companies from the Russell 1000 index that deliver the highest free cash flow yields. By focusing on cash rich companies, you've got a portfolio of names that have a great deal of flexibility to both target growth opportunities and return capital to shareholders in the form of dividends and buybacks.

I've always liked free cash flow as an indicator of financial health. It's a measure that's less easily manipulated than traditional measures such as earnings per share so it tends to be a truer measure of corporate performance. Companies that generate billions of dollars in free cash flow annually are able to pay all of their bills, pay down debt if appropriate, reinvest back into the business and reward shareholders. Companies with higher free cash flow yields tend to have the added benefit of being excellent value candidates and having above average dividend yields.

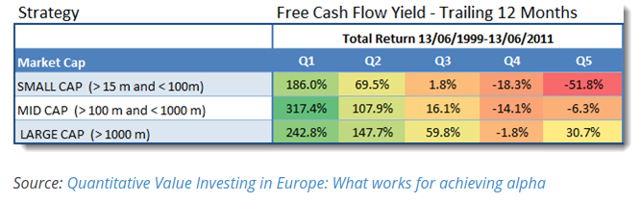

Targeting high free cash flow yields is a strategy that has proven successful in the past. One study examined the returns of companies that were split into buckets by market cap and free cash flow yield over the past 12 months. The returns of the study are as follows.

The results are pretty compelling. Companies in the top quintile of FCF yields significantly outperformed the market across all market caps over the testing period. Even the second quintile did noticeably better than the market as a whole.

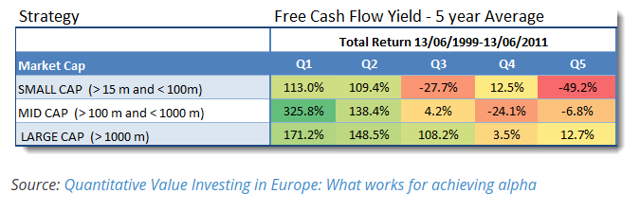

Looking at FCF yields over the past five years yielded similar results.

The results of the five year study are particularly interesting in that you can almost draw a straight between the 2nd and 3rd quintile and figure out pretty quickly which side of the fence shareholders should be on. In short, a strategy focusing on companies with high FCF yields not only makes theoretical sense but also has historically delivered strong returns.

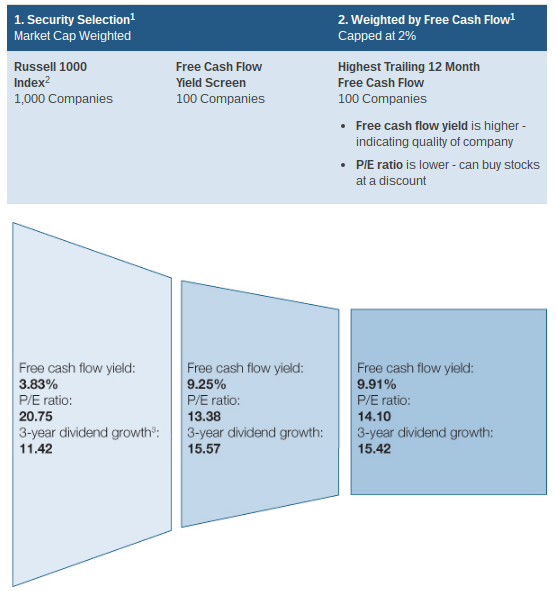

Examining the methodology of creating the portfolio, the Cash Cows 100 ETF identifies the top free cash flow yields from the Russell 1000 over the trailing 12 month period and weights them accordingly with no single holding counting for more than 2% of the total portfolio. Sticking with the top 10% of FCF yields in the large- and mid-cap space should keep shareholders squarely in the sweet spot.

Since FCF yield is a function of both cash flow and stock price, it's not surprising to see the portfolio lean towards low P/E stocks. The fund's P/E as a whole is a full one-third lower than the broader Russell 1000 while sporting a dividend growth rate one-third higher.

Currently, the fund is finding strong free cash flow yields in the Warren Buffett-endorsed airline sector as United Continental (UAL), Delta Airlines (DAL) and Southwest Airlines (LUV) are the fund's top three holdings. Other top holdings include Boeing (BA), Valero Energy (VLO) and Qualcomm (QCOM). Top sector holdings include Tech (25%), Industrials (21%), Consumer Discretionary (19%) and Healthcare (12%). The financial sector doesn't appear anywhere in the portfolio.

The fund is currently yielding around 2.1% according to the fund's fact sheet which puts it right in line with the S&P 500. Its expense ratio of 0.49% will put it at a disadvantage to some of its larger counterparts such as the Vanguard Dividend Appreciation ETF (VIG), the Vanguard High Dividend Yield ETF (VYM) and the Schwab U.S. Dividend Equity ETF (SCHD) - all funds that charge 10 basis points or less. The fund launched with around $2.5 million in seed which is about where it's at right now, but it is starting to get some attention from traders as it's averaged around 18,000 shares traded daily.

Conclusion

It's worth pointing out that another fund focused on free cash flow yields, the TrimTabs International Free Cash Flow ETF (FCFI), closed its doors in October with about $13 million in total assets. I don't think that fund closure is necessarily an indication that this concept has little investor interest. Pacer is a decent sized ETF provider that has nearly $750 million in assets across its six funds so it should be able to generate some interest in the fund over time.

I'm a fan of ETFs that focus on quality dividends and I'd put the Cash Cows 100 ETF right in this category. The FlexShares Quality Dividend ETF (QDF) remains my top choice in this area but as its asset base grows I can see the Cash Cows 100 ETF moving up near the top of that list. Targeting high free cash flow yields is a strategy that has proven successful in the past and should continue delivering solid returns into the future as well.

It's still a bit early for me to jump in here but put this ETF on your watchlists and consider adding shares as the fund becomes a little more efficient.

No positions.