Big Yield Roadmap: 8 Attractively Priced +5% Yielders

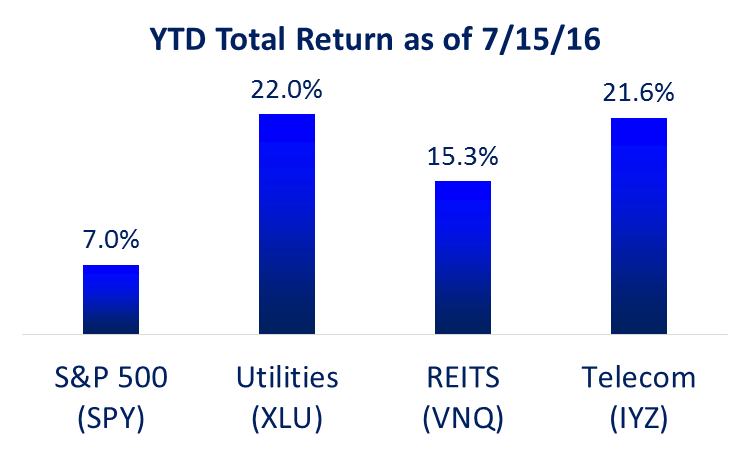

Artificially low interest rates have driven many investors to look to big yield equities to satisfy their income needs. However, as the following chart shows, many of the traditional higher-yield lower-volatility equity categories (such as REITs, utilities and telecom stocks) have recently experienced very strong performance relative to the rest of the market as buyers have bid up their prices.

This strong relative performance doesn’t mean we’re in a bubble, nor does it mean they can’t go even higher, but it does mean investors should use caution. For your consideration, we’ve compiled a list of 219 investments yielding over 5% (we ran a screen requiring 5% yield, $500 million market cap, and $100 million in sales), we’ve broken the list into seven custom big-yield categories, and then we’ve identified eight securities across the categories that we believe represent attractive investment opportunities regardless of the broader market trend.

1. REITS

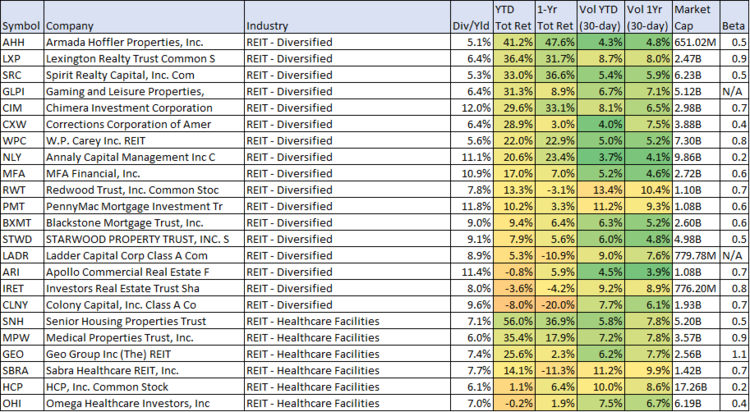

Among the 219 big-yield securities that passed our screen, REITs were the most common. And as the following chart shows, the 50 REITs that passed the screen also tended to exhibit very low volatility.

This combination of big yield and low volatility helps explain REIT popularity and their recent strong performance especially as central banks have kept interest rates so low. For example, an extremely popular REIT among income investor is Realty Income (O). However, given its recent strong performance (it’s up 35% year-to-date) and its high valuation (its price-to-FFO ratio is at a historically high level) we much prefer other REIT opportunities. For example:

HCP Inc. (HCP) is a healthcare REIT that has relatively low volatility, but it has also delivered lower than average returns. HCP has underperformed the market because of difficulties with its largest tenant, HCR ManorCare. However, we believe HCP is prudently working through these challenges by spinning off HCR ManorCare. And once the spin-off is in the rear view mirror, HCP shares will still offer an attractive big yield, low volatility, and the opportunity for big price gains. You can read our recent HCP full report here.

Omega Healthcare Investors (OHI) is another healthcare REIT. It offers an attractive 6.9% dividend yield, and it has NOT delivered the same large price gains as some of its peers (it's down 3.7% YTD). We believe OHI offers attractive price appreciation opportunities considering its leadership position in the Skilled Nursing Facilities (SNF) Industry. Further, a variety of valuation and risk metrics (mainly Price-to-FFO and dividend payout ratio) suggest the dividend is relatively safe and likely to grow. If you are comfortable with the unique risks of an SNF REIT (like we are), Omega currently offers an outstanding opportunity to buy in at a very attractive dividend yield. You can read our earlier full report on Omega here.

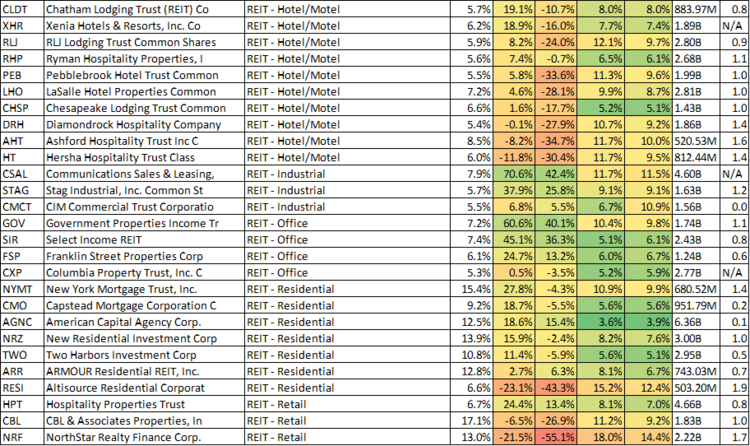

2. Telecom Stocks

Telecom stocks are a classic big-yield low-volatility market sector, and like REITs, many investor have been piling into this sector of the market and driving up the prices. As shown previously, the telecom sector has been a top performer, and we don't expect the entire sector to experience the same level of big returns going forward. However, if you are a brave contrarian, there are still several attractive big-yield telecom opportunities with significant price appreciation potential. For example:

Frontier Communications (FTR) is a big dividend telecom company that is currently trading at an attractive price. Frontier paid out $576 million in dividends last year, and it also received $500 million in government subsidies (Annual Report, p.22). Said differently, Uncle Sam pays 87% of Frontier’s dividend. Frontier has created a niche for itself by operating in regions that are heavily subsidized, and they deepened their foothold in that space with their April 1st $10.5 billion acquisition of assets from Verizon. We believe Frontier’s niche is attractive, the company easily covers its dividend payments, and its current valuation is compelling. You can read our full write-up on Frontier here.

Verizon (VZ) is another potentially attractive telecom investment opportunity. Even though it did not pass our screen (because its yield has fallen below 5% as the shares have gained significantly over the last year), we believe it could have significant price appreciation potential following the results of the upcoming Yahoo (YHOO) sale. Specifically, Verizon is one of several leading potential acquirers of Yahoo’s core business. And if Yahoo sells itsleft to Verizon, we expect Verizon shares to first fall (as stocks often to following a big acquisition), thus creating a more attractive entry point for long-term investors. Verizon is a low volatility investment that offers an attractive 4.1% dividend yield. Warren Buffett is a fan of Verizon, and as we wrote about here whoever acquires Yahoo's assets (potentially Verizon) will be acquiring a diamond in the rough.

3. Utilities

Utilities are another classic big-yield low-volatility market sector, and like REITs, many investor have been piling into this sector of the market and driving up the prices. As shown previously, the utility sector ETF has been a top performer year-to-date. However, we believe there are still opportunities in this sector. In particular, we like profitable smaller cap utilities because of the recent sector trend towards buying them out at a premium. As the larger utilities companies struggle to continue to grow organically, they've been acquiring small and mid-size utilities to fuel continued growth inorganically.

4. Business Development Companies (BDCs)

Perhaps lessor known by many investors, business development companies also offer big yields and low volatility. BDC’s invest in small and mid-sized business, and two of our favorites are Prospect Capital and Main Street Capital. Prospect Capital is the more popular one and its price is already up 26% over the last year, so we’ll focus on Main Street (it' only up 11% over the last year) and it offers very low risk, a big dividend, and an attractive valuation:

Main Street Capital (MAIN) is an internally managed Business Development Company that offers a dividend and low volatility. Additionally, its investment income consistently exceeds its dividend payments, and its net asset value continues to enable additional supplemental dividend payments. We believe it is worth significantly more than its current market price, and if you are a long-term investor, Main Street Capital could be a valuable addition to your diversified income-focused portfolio.

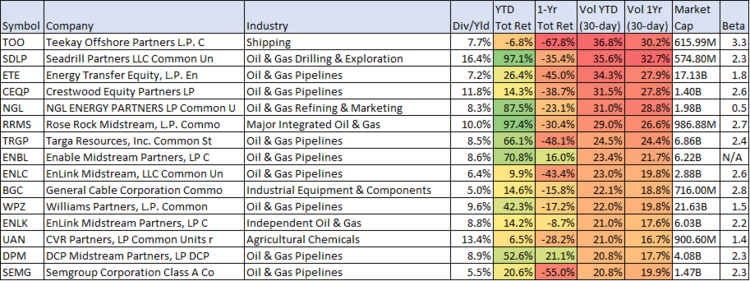

5. Master Limited Partnerships (MLPs)

MLPs are publically traded limited partnerships that generate income from sources such as oil & gas exploration, extraction and refining. Many investors are turned off by this category because of the recent high volatility, but that doesn’t mean there aren’t great big-yield investment opportunities here. For reference, this chart shows many oil and gas companies (some of them MLPs) are among the 15 most volatile that passed our big-yield screen.

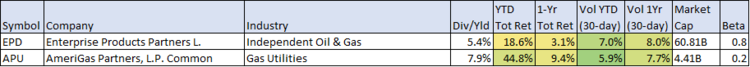

However, some MLPs have experienced lower volatility and moderate 1-year total returns. Enterprise Product Partners and AmeriGas partners are two that we find attractive:

Enterprise Product Partners (EPD) is an MLP we like because it’s been far less volatile than many other MLP’s, its dividend is big, and its one-year return has been only 3.1% (which is an attractive big yield opportunity from a contrarian standpoint). Aside from its consistent growing big dividend, we highlighted a variety of reasons why we like EPD in this report back in April.

AmeriGas Partners (APU) is the largest propane distributor in the US (with about 15% retail market share), it’s organized as a master limited partnership (MLP), and it currently pays a big safe growing distribution yield. It also offers low volatility, a low beta, and an exceptionally attractive return on invested capital. Further, we believe AmeriGas is uniquely positioned to successfully execute on its growth-through-acquisitions strategy, and fears of a declining propane market are largely overblown. For income-focused investors, we believe AmeriGas is a worth considering, and you can view our recent full AmeriGas report here.

6. Shipping Companies

Shipping companies are another big-yield category that scares away investors because of the higher volatility. However, we believe there are still some great big-dividend opportunities in this category that are worth considering.

Teekay Offshore (TOO) is a shipping company we like. Teekay recently shored up its balance sheet last month by successfully issuing $200 million in new equity securities. And if the volatility of the common shares is too much for you to handle, we also like the less volatile preferred shares which happen to still yield over 9.0%. You can read our recent write-up on Teekay’s preferred shares here.

7. Miscellaneous Big Yielders

The categories we’ve described above tend to have a concentration of the big-yield opportunities, but that doesn’t mean there aren’t attractive big-yield opportunities is other corners of the market. For example:

Bank of America series EE preferred (BAC-A) yield 5.9%, trade for just above par, and were down big (-2.25%) on Friday thus creating a more attractive entry point. The shares were just issued in April, and the earliest call date is in April of 2021. As we’ve written in the past, we don’t particularly like Bank of America’s common stock, but these preferred shares are worth considering, especially after Friday’s decline.

Conclusion

Big-yield low-volatility investments (like utilities, REITs and telecom stocks) have been performing extremely well lately, but that doesn’t mean there are not still attractive opportunities as we’ve described above. Additionally, just because certain big-dividend sectors of the market are up big, that doesn’t mean they can’t still go up more. This is why we prefer a diversified portfolio of big-yield investments focusing on attractive opportunities that can perform well regardless of top-down market forces and trends.

Disclosure: None.