Will U.S. Credit Conditions Slowly Apply The Brakes To Economic Growth?

Amidst the excitement about the worldwide growth prospects for 2018, it important to keep in mind what fuels economic expansion - namely, a steady increase in bank credit to the private sector. Despite optimism on economic growth among forecasters, there are signs of tighter monetary conditions appearing everywhere. The U.S. monetary authorities are applying brakes, ever so subtly, to future growth.

In its latest report, Hoisington Investment Management[1] argues that the real impediment to economic expansion in 2018 is the slowdown in money supply growth and the accompanying decline in velocity. Citing the monetary identity:

MV=PQ, where,

M = the growth in the money supply, M2

V = velocity of money, and

PQ = the nominal increase in national total output, (price x output).

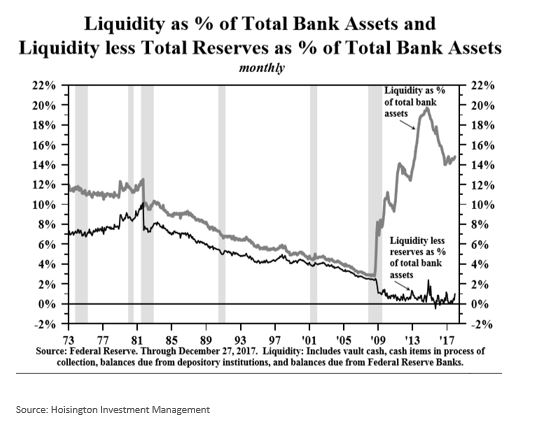

Hoisington demonstrates that a combination of slowing M2 and declining V are holding back economic growth. The firm stresses that Fed reduces liquidity in the banking system which, ultimately, causes a reduction in the supply of credit. At the same time as the Fed expands the monetary base and injects liquidity into the banking system, it encourages the commercial banks to deposit reserves with the Fed such that overall liquidity available for loans has actually been declining (Figure 1).

Figure 1 U.S. Bank Liquidity.

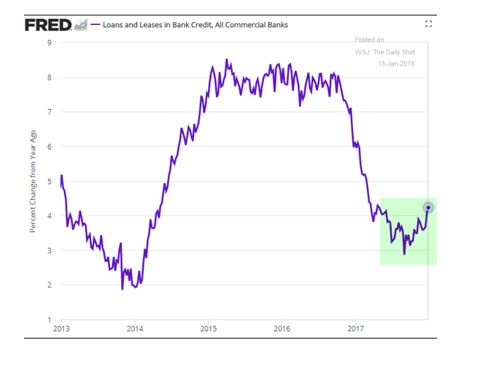

Another way to view this issue is to track the decline in bank credit available from the commercial banks. (Figure 2). Starting over a year ago, the loan growth began a steady decline and currently hovers around the 4 % annual rate of expansion, a rate that clearly is not supportive of nominal growth that is required to continue the recent economic expansion.

Figure 2 US Commercial Bank Credit

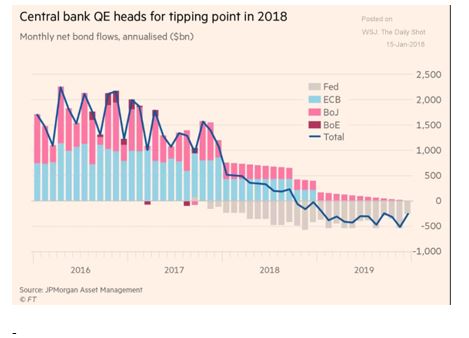

Finally, the Federal Reserve has given notice that it will wind down its bond-buying program. While Chairperson Yellen has stated that the wind-down will be like “watching paint dry”, implying that it will not have any meaningful impact on market liquidity. Nonetheless, it is a further sign that monetary conditions are going to tighten. Along with the Fed QE wind down, we can expect other major central banks to follow suit (Figure 3). The upshot will be a further contraction of market liquidity and credit availability in the advanced economies.

Figure 3 Winding Down of QEs

Given the meaningful slow down in bank credit, possible further deterioration in money velocity and the anticipated wind down of QE, it will be a struggle to achieve nominal economic growth necessary for the continuation of the recent expansion.

[1] The Quarterly Review and Outlook Fourth Quarter 2017, Van R. Hoisington Lacy H. Hunt, Ph.D

Disclosure: None.