What The GOP Pols Have Wrought - A Fiscal, Economic And Political Monster

The GOP tax bill is not "at least something". It's not "better than nothing". And, no, we are not letting the perfect become the enemy of the good.

In truth, this thing is a fiscal, economic and political monster. It is hands down the worst tax bill enacted in the last half-century----maybe even since FDR's 1937 soak-the-rich scheme, which re-ignited the Great Depression.

True, rather than soak them, the GOP's bill will pleasure America's wealthy with a bountiful harvest of tax relief. Owners of public equities, for example, will garner a trillion dollar shower of extra dividends and stock buybacks from the corporate rate cut.

Likewise, 4 million top bracket ATM (alternative minimum tax) payers will be relieved of about $80 billion per year of Uncle Sam's extractions; around 5,000 dead people per year with estates above $20 million will get to leave more behind; owners of real estate will be able to deduct another 20% of property income that isn't already sheltered by depreciation and interest deductions; and tax accountants and lawyers will become stinking rich helping America's proprietorships (24 million), S-corporations (4 million), partnerships (3.5 million) and farms (1.8 million) convert their "ordinary income" into newly deductible "qualified business income".

Notwithstanding these facts, the commonality between the FDR's tax bill disaster and this one is that both represent exactly the wrong policy at a time which could not be worse.

In the New Deal case, business and investor confidence had finally begun to recover after the trauma of the Crash and subsequent withering depression, but FDR's excess profits tax and punitive marginal rates on high incomes sent the economy tumbling until it was rescued by war mobilization after 1940.

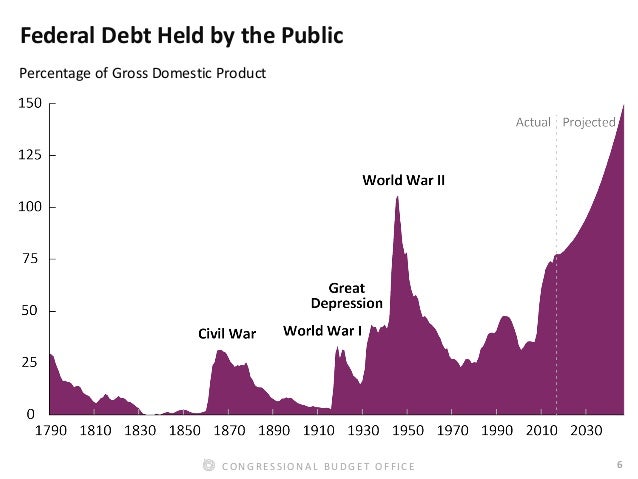

In the current situation, the absolute worse thing you could do is draw on Uncle Sam's credit card to fund temporary cuts for the middle class and a permanent windfall to the top 10 percent of households which own 80% of the stock. And the reason, of course, is that America is marching straight into a 20-year fiscal and demographic trap that has the potential spiral out of control and smoother any semblance of economic prosperity as we have known it.

Indeed, the signal event of 2017 is not the gimmick-ridden dog's breakfast of K-street favors being enacted today, but the GOP's utter failure to repeal and reform ObamaCare.

As we have long insisted, America's health care system consists of the worst of both worlds. It amounts to socialism for the beneficiaries, which generates uncontainable demand via third-party paid, cost-averaged pricing; and crony capitalism for the providers, where delivery system cartels of doctors, hospitals, nursing homes, pharma suppliers, medical device makers etc. have implanted themselves deep on K-street and have thereby rigged reimbursement systems for maximum private revenue gain (and minimum system efficiency and competitive discipline).

That's why the US spends 18% of GDP on health care compared to 10-12% in the rest of the (socialistic) developed world, on the one hand; and why the GOP couldn't lay a glove on ObamaCare, which embodies in spades this "worst of both worlds" paradigm.

Indeed, there is no hope to slowdown the health care monster without restoration of consumer sovereignty and responsibility, risk-based pricing and free market supplier arrangements. Yet only Rand Paul got close to presenting a mild semblance of these necessary cures from the far stage-right periphery of the debate, where he was completely ignored by his GOP colleagues.

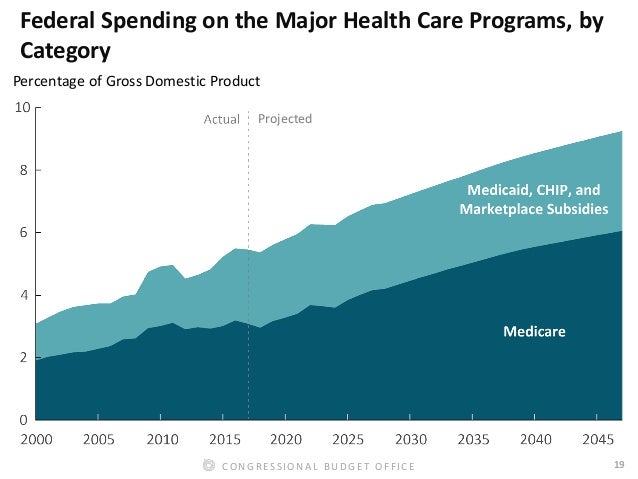

Not surprisingly, there is now no prospect of stopping the relentless rise of current law health care spending. Over the next two decades Uncle Sam's cost burden will double as a share of GDP.

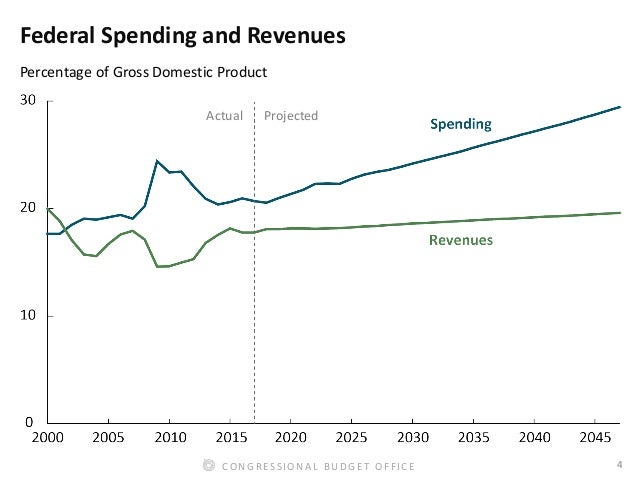

Toss two other factors on top of the above chart----the Washington War Party and the aging out of the Baby Boom---and you have an impossible fiscal equation. That is, a tax system under current law that is impaled on the 18% of GDP marker in terms of revenue collections versus a spending machine that is inexorably climbing toward 30% of GDP.

That's right. The Donald has already succumbed fully to the neocons and the insatiable fiscal demands of the War Party. Thus, the enacted defense budget now stands at $700 billion and on top of that comes the $250 billion annual tab for past unnecessary wars (Veterans and debt service) and $50 billion more for Imperial Washington's walking around money to fund military assistance, foreign aid and political skullduggery all around the planet.

In short, the Warfare State alone consumes $1.0 trillion per year or 5% of GDP and there is not a corporal's guard in the Imperial City of a mind to challenge it.

And especially not now after the so-called "progressive left" has gone full bore McCarthyite on the Russkies and their purported threat to national security. That is, the danger posed by a midget $60 billion military and a pipsqueak economy, which sports a GDP ($1.3 trillion) roughly equal to that of the NYC metro area. (For our money, the latter is actually more the threat to national well-being)

Then you have 60 million social security recipients at $1.1 trillion in FY 2019 that will balloon to 80 million enrollees by the end of the 2020s; and eventually to 95 million recipients after the full measure of the Baby Boom demographic bubble cashes in its social insurance chips.

Finally, there is the compounding feedback loop of net interest: $350 billion today at a drastically suppressed weighted average yield of less than 2.o%; $820 billion by 2027 under more normalized yields and the CBO debt "baseline" before you count the massive interim deficit add-ons of the Trumpian-GOP borrowers; and into the trillions per year and rising in the following decade as spending escalates toward 30% of GDP. And even that's assuming interest rates don't get unruly but remain "normal "(weighted average of 3.4%) as far as the eye can see.

In a pattern which is discernible and inexorable, therefore, the nation's fiscal accounts are being drawn-and-quartered by the embedded policies and gross financial irresponsibility of today's Imperial City politicians.

As it stands, the Federal revenue baseline currently weighs in at 17.7% of GDP, which is as low as it's been aside from recession years since 1980; and about exactly where the great tax-cutter, Ronald Reagan, left it to his successor in 1989 (17.5% of GDP). So the fact that real final sales ( GDP without the inventory fluctuations) growth of 3.5% per year during the 1980s has dwindled to a pathetically low 1.2% per annum over 2007-2016 is not due to some nefarious tax grab.

Stated differently, Imperial Washington loves to borrow, not tax. It's operative fiscal model is Big Government and Small Taxes-----notwithstanding 10,000 Lincoln Day dinner speeches per year in which GOP orators tilt at the windmill of high taxes.

To be sure, lower taxes earned by first effecting a drastic shrinkage of government is always a worthy aspiration, and not entirely unrealistic. After all, President Dwight Eisenhower did just that---shrank the Pentagon side of the swamp by 40% in real terms in order to balance the budget and pave the way, ironically, for the ballyhooed "Kennedy Tax Cut" a few years later.

But this week Ike's Republican heirs and assigns have surely caused the great man to rollover in his grave. Without lifting a finger to cut spending, and actually adding upwards of $200 billion in FY 2019 alone, as we documented yesterday, the Trumpian GOP is crowing loudly about what amounts to a sheer fiscal folly.

As we also previously explained, the tax bill is drastically front-loaded in order to scam the 10-year reconciliation rules (more below). Accordingly, the "static" revenue loss in FY 2019 is $280 billion,according to the Joint Committee on Taxation.

That not amounts to borrowed goodness equal to 1.4% of GDP. Yet, apparently, there is not even a single supply-sider---outside of an institutionalized domicile----who would argue that just 10 months hence there will be a tsunami of jobs and growth and therefore revenue reflows owing to this giant hole in Uncle Sam's cash box.

In fact, what is actually happening here is that the American public is being lied to by the GOP Pinocchio Brigade in a manner that is egregious even by Washington standards.

That is, it is being offered a giant (but disappearing) election year tax cut which brings Federal receipts down to 16.4% of GDP in what would be the 10th year of a business expansion and the longest in recorded US history; and which would also be well below the 17.3% of GDP revenue average during the Gipper's celebrated anti-tax tenure in office.

But being on the very low side of history is no virtue for a K-street and PAC-owned political party that has no plan or stomach whatsoever for taking on the spending machine that is cranking inexorably toward 30% of GDP. And, also, a party which should spare us the cant about next year's aspiration to reform welfare.

The fact, is 75% of the Federal government's $600 billion per year for mean-tested welfare is accounted for by Medicaid, and the GOP has already punted big time on that one during the "repeal and replace" debacle. So perhaps they can find $5 billion to extract from maligners on the $100 billion food stamp and family assistance program. Of course, that would amount to 0.02% of GDP for all the trouble.

In short, the GOP pols have paddled around the fetid waters of the Imperial Swamp so long that they apparently think the American public does spend its time riding around on a hay wagon. There is surely no other way to explain how they plan to sell to the American public a dopey theory that you can have spending policies which rise toward 30% of GDP and a tax burden at 16%.

When all is said and done, the picture below dramatizes the giant fiscal trap that is now built-in, and which the GOP's tax folly would only make far worse because, at best, the now enacted tax bill boils down to the mother-of-all-riverboat gambles.

We are speaking, of course, of the growth dividend fantasy, and the risible idea that driving next year's deficit to $1.275 trillion (see Part 1)won't compound the debt problem in the long run because the outyear revenue loss will all be made up for with incremental growth, jobs, incomes and tax revenues.

Not a chance. Doubling the child credit and lowering the marginal rate schedule by a few points with borrowed funds, for example, will put money in the pockets of the household sector and extract it from capital spending---now that the Fed is out of the debt monetization business.

Likewise, the GOP revilers have gifted ATM payers with a $637 billion tax break over the next eight years, and for that the "donor class" will surely be grateful. But thankful as they may be, we are also quite sure that the 4 million beneficiaries of this tax cut will not any hours to their work schedules or invest any more productively than the have been doing in the US economy---even if the do bid up charter rates on luxury yachts and net jets.

When all the sunsets and temporary middle class breaks are set aside, the heart of the bill is a $1.76 trillion revenue loss over 10 years for the 21% corporate rate and the 20% pass-thru deduction for "qualified business income". Yet as we will demonstrate in Part 2, there is every reason to believe that upwards of 90% of that massive increase to the Federal debt will be recirculated back to Wall Street and the top 1% and 10% of households in the form of increased stock-buybacks, dividends and other forms of capital return.

Just consider the case of Microsoft which employed upwards of 130,000 worldwide---including about 200 in Puerto Rico, 700 in Singapore and1100 in Ireland. So if headcounts in a high tech firm are a reasonable proxy for output, Mr. Softie's production in these three tax havens amounts to just 1.5% of its worldwide total.

By contrast, its books upwards of two-thirds of its taxable income in these jurisdictions thank to state of the art tax planning and the off-shoring of billions of "intangible assets" to havens where the tax rates are 2.0%, 7.3% and 7.2%, respectively.

What we mean is that Microsoft off-shored its tax books, not its production and jobs. The rate reduction to 20%, therefore, will not bring back jobs and investment but only rearrange its tax books---even as it deploys the higher after tax cash flows to shareholder returns.

At the end of the day, the GOP has set up a scheme of massive borrowing and tax sunsets and deferrals that will knock the stuffings out of what remains of Washington's capacity to manage the nation's fiscal disaster in the years ahead. Heading for the scenario below, it chose to embrace K-street

Disclosure: None.

No life without problems no problems without solutions...