US Q4 GDP Growth Remains On Track For Moderate Slowdown

Early futures trading points to another rocky session for the US stock market today, in part due to rising concern over trade relations with China. Judging by the current outlook for US economic output in the fourth quarter, however, the macro trend still looks set to post moderate growth in GDP for 2018’s final three months, based on a set of nowcasts compiled by The Capital Spectator.

The median nowcast for Q4 is currently 2.6% (seasonally adjusted annual rate), which marks a fractional downtick vs. the outlook published on Nov. 27. Once again, the estimate reaffirms that US growth peaked earlier this year. If today’s median nowcast is correct, real GDP is headed for a second round of softer quarterly growth following the strong 4.2% rise in Q2 and Q3’s 3.5% gain.

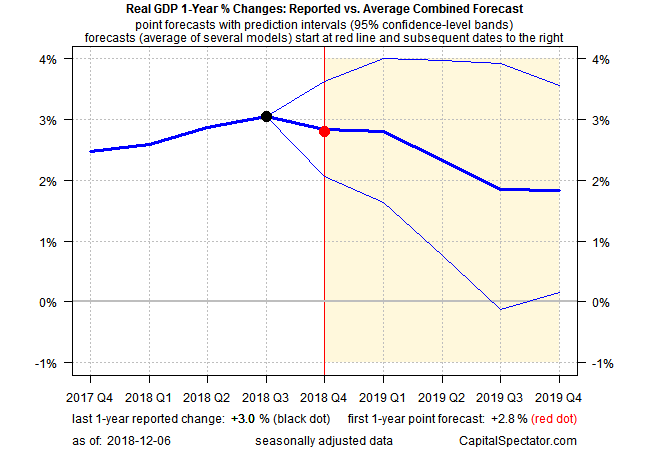

Projecting GDP in terms of year-over-year changes also indicates that growth has peaked. The chart below shows estimates for one-year GDP comparisons, based on the average forecast of eight models (including ARIMA, VAR and neural net applications) calculated by The Capital Spectator. The outlook anticipates that the 3.0% annual increase in real GDP in the third quarter will edge down to 2.8% in Q4 and slip further in 2019.

From the perspective of the Federal Reserve’s vice chairman, the economy remains on sturdy footing. “Right now I think the US economy is in good shape, and we can talk about risky scenarios, but I think the baseline outlook is very solid,” Richard Clarida said earlier this week.

Nonetheless, the stock market appears to be discounting higher odds of softer growth, perhaps well below current expectations.

“There are so many forces weighing against markets right now, whether it’s the China slowdown, weak European data, Fed hikes, uncertainty around trade and now Brexit as well,” notes Bilal Hafeez, head of fixed-income research for EMEA at Nomura. “We really need to see some stabilization in any of those factors to see markets stabilize now.”

Disclosure: None.