U.S. Corporate Profits Are Very Strong, Particularly Foreign Earnings

The U.S. economy has been in a steady growth pattern for quite a while now, and corporate profits have been improving. Indeed, one of the primary factors behind the robust performance of the U.S. stock market in 2017 was the noticeable improvement in corporate profits.

The improvement in profits was broad-based last year, with every one of the 11 primary S&P 500 sectors posting substantial growth. However, much of the profit growth last year was concentrated in three sectors -- energy, materials, and technology.

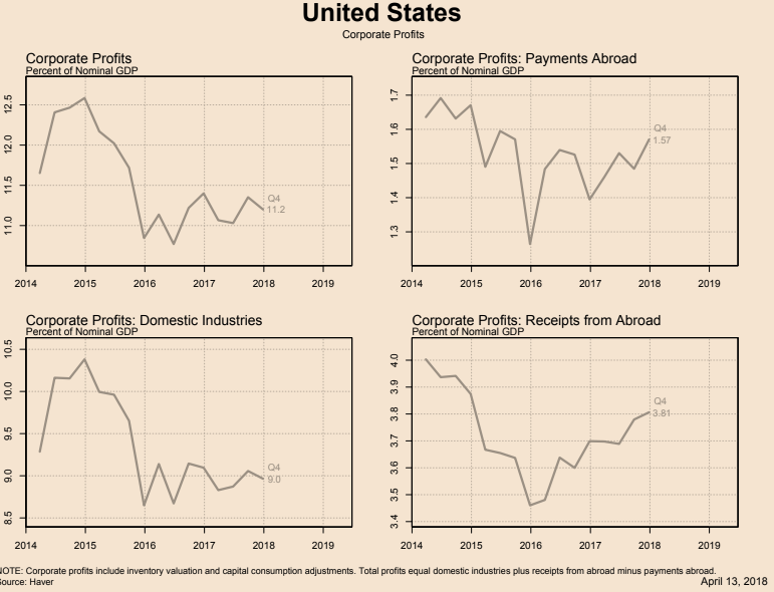

While profit growth has been strong over the past three years, nonetheless corporate profits declined 2.1% in 2016 and the rose 4.4% in 2017. Current-dollar GDP rose 2.8% in 2016 and 4.1% in 2017. So, the spurt in profit growth last year had a lot to do with the pick up in real and nominal GDP.

Of course, it is rather unusual for corporate profits to be exceptionally high for a long time, or to expand faster than the economy. At some point, profits must decline back to their traditional share of nominal GDP.

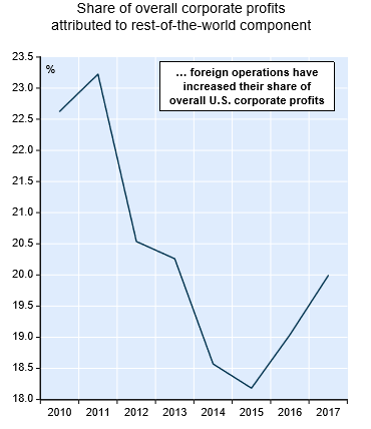

Recently the weakness in the U.S. dollar together with the robust growth of the rest of the world’s economy has helped profits growth, particularly for U.S. multinational firms. What is less than obvious is in the current era is that foreign operations have been delivering a greater share of American corporate profits.

Disclosure: None.