The Mystery Of Low U.S. Inflation

“As I will discuss, this low inflation likely reflects factors whose influence should fade over time. But as I will also discuss, many uncertainties attend this assessment, and downward pressures on inflation could prove to be unexpectedly persistent. My colleagues and I may have misjudged the strength of the labor market, the degree to which longer-run inflation expectations are consistent with our inflation objective, or even the fundamental forces driving inflation.” (Janet Yellen, Chair Federal Reserve System, Inflation, Uncertainty, and Monetary Policy, September 26, 2017).

Janet Yellen is the Chair of the U.S. Federal Reserve System. In a recent speech (September 26, 2017) she frankly admitted that this year’s slowdown in inflation is very much a mystery.

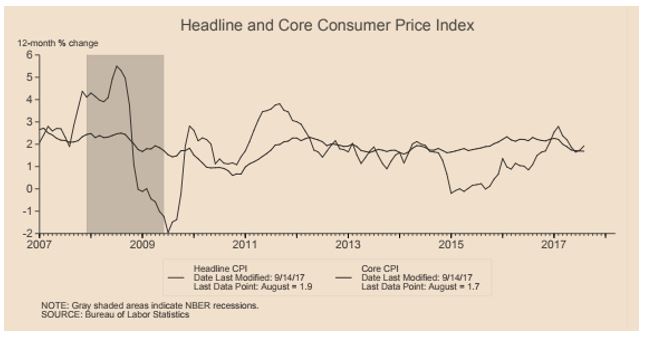

Indeed, for more than five years the Fed has projected that core inflation, as represented by the price index for personal consumption expenditures (PCE), would reach the 2% target over the medium term. However, the forecast of higher inflation never materialized.

The Fed initially argued that the fall off in the inflation rate was due to “transitory” factors, i.e. special one-off situations that result in some prices temporarily falling.

But in her September 26th speech Yellen frankly acknowledged that their research which emphasized low unemployment may have misjudged the strength of the job market and its weak inflationary implications.

Or, as Yellen observes, they may have misjudged the fundamental forces holding inflation down.

Among the fundamental forces, I would include globalization in its widest sense, job displacing technology, and the shift in market power away from labor to employers. The latter impact is reflected in the weakening of the union movement in virtually all advanced countries.

Disclosure: None.