The Impact Of The U.S.- China Trade War On Their Trade To Date

According to the U.S. Census Bureau, the United States' trade deficit with China hit a record high in July 2018, with U.S. imports of Chinese goods rising year over year and Chinese imports of U.S. goods falling over the same period.

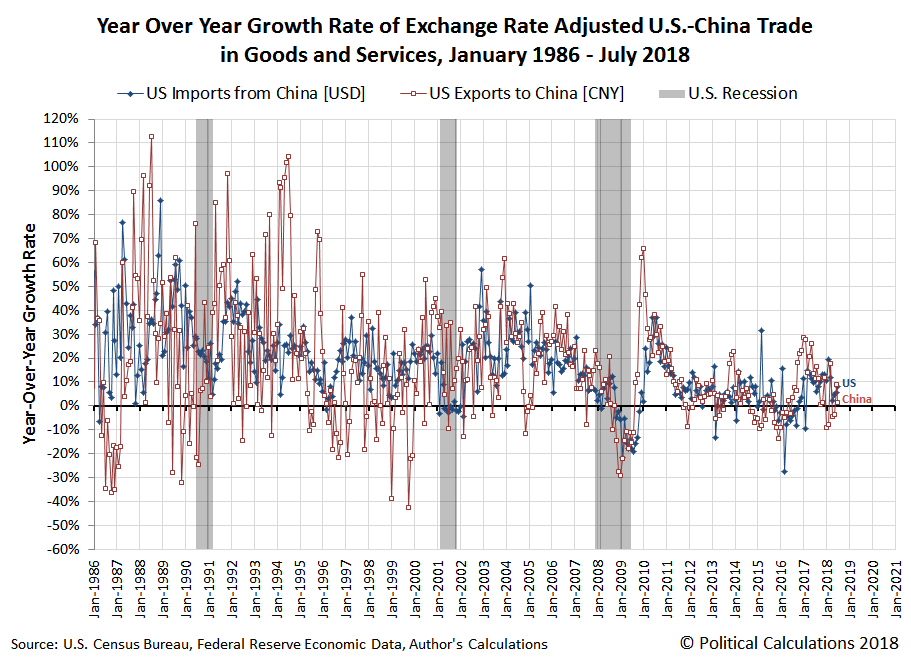

The following chart shows what the year over year growth rate of trade in goods and services between the two nations looks like after adjusting for the relative value of the exchange rate between the U.S. dollar and Chinese yuan.

(Click on image to enlarge)

In the absence of its strategy to minimize its economy's intake of U.S. goods and services, the near-zero growth rate of China's imports of U.S. goods in July 2018 would be consistent with recessionary conditions being present in that country, which was certainly suggested in early 2018 prior to the implementation of any new tariffs being imposed by either nation on the other's goods.

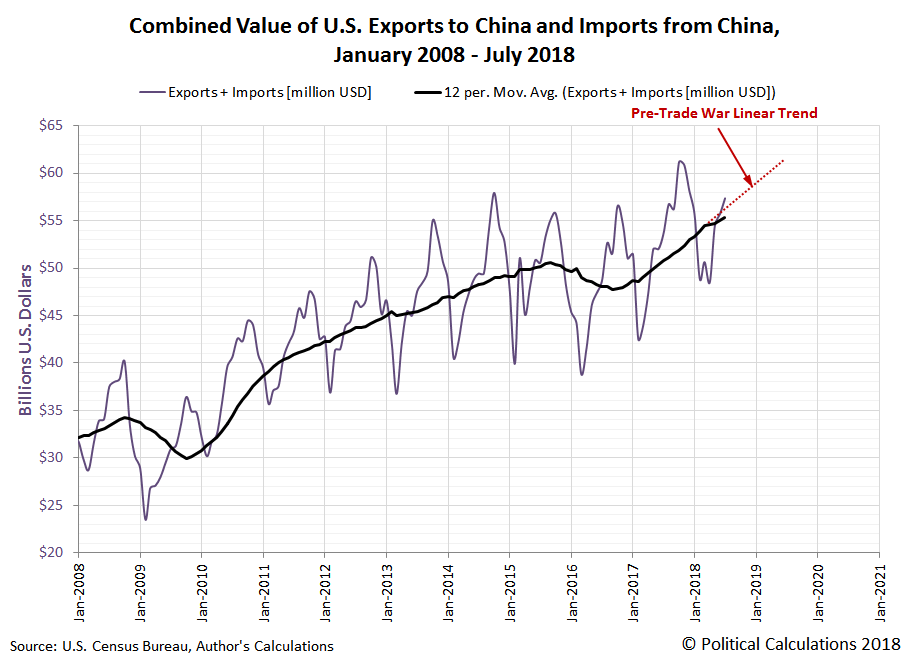

However, since China's political leaders have adopted that strategy, it is contributing to the appearance of slow growth in China's economy from this particular data series. We can however use that data to get a sense of the extent to which the tit-for-tat tariffs that both nations have imposed on each other since the trade war between them began after mid-March 2018 by looking at the combined value of the U.S.' imports to and exports from China, where we can use a the linear trend established in the months before any tariffs were first imposed as a counterfactual for what the value of trade would be in the absence of their budding trade war with each other.

The following chart shows the combined value of that trade from January 2008 through July 2018, with the counterfactual shown as a projection of the linear trend that was established in the trailing twelve month average of the monthly data over the period from March 2017 through March 2018.

(Click on image to enlarge)

Based on this very simple counterfactual, we think that in the absence of the U.S.-China trade war, the combined monthly value of goods and services traded between the two nations would be roughly $1 billion, or 2%, higher through July 2018 that what actually has been recorded.

Assuming that China's organic economic growth hasn't itself also slowed, which is a real possibility.

References

Board of Governors of the Federal Reserve System. China / U.S. Foreign Exchange Rate. G.5 Foreign Exchange Rates. Accessed 5 September 2018.

U.S. Census Bureau. Trade in Goods with China. Accessed 5 September 2018.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more

Sadly this is just a politicized tax on consumption imposed on US citizens. Worse it creates a very bad impression on countries tariffs are imposed which is now cutting into US goods consumption. One can not blame China or others for the US creating a bad name for itself.

The other issue is although China has been trying to support its currency, its currency is being driven down by the trade war which negates much of the tariff's effect. This is not a result of currency wars, but the predictable result of creating a trade war with a country going through economically stressful times already. Sadly, the low priced leaders today are not Chinese manufacturers but Southeast Asian nations which even China can't compete with.

Very good points - thank you for your comments! We should also recognize that China's retaliatory tariffs are having a similar effect on Chinese consumers where U.S. goods are involved. Where the interests of regular people are involved, tariffs are not a positive development, no matter why they're applied.

Clearly, we hadn't yet have enough coffee when we wrote:

"where we can use a the linear trend established in the months before any tariffs were first imposed as a counterfactual for what the value of trade would be in the absence of their budding trade war with each other."

If we had more caffeine, and a do-over, we would make that:

"where we can use the trend established in the months before any tariffs were first imposed as a counterfactual to tell us what the value of trade would be in the absence of their budding trade war with each other."

Small differences, but much clearer!...