Post-CPI Analysis - Friday, August 10

Below is a summary of my post-CPI tweets:

- half hour to CPI. Welcome again to the private channel. Tell your friends!

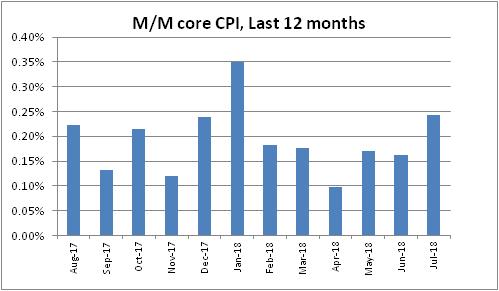

- Another easy comp (0.143%) versus year ago. August 2017 was +0.222%, Sep was 0.132%, Oct was 0.214%, and Nov was 0.121%. So we still have some easy comps ahead although not easy as they were. That means core should keep rising, although slower than over the last 6 mo.

- Pretty safe economist estimate for 0.2% on core and for y/y to stay 2.3% rounded. As long as m/m core is 0.162%-0.259%, y/y will stay in that range.

- Rents have been leveling out recently, and not providing as much upward oomph. That passes the baton to core goods and more generally to core ex-shelter.

- Ironically, even though core goods started to accelerate before any sign of tariffs, investors I think might “look through” inflation like that, which they can explain away by saying “ha ha tariffs trump ha ha.”

- One other item – I will be especially attentive to Median CPI this month, which jumped to 2.80% y/y last month. That looks a little like an acceleration past the prior trend (meaning 2013-2015), well past merely erasing the 2016-17 dip.

- I should note that this month’s CPI report is being brought to you from sunny Curacao! Only 20 minutes to the number.

- Well, 0.23% on core CPI was a bit higher than expected, but oddly got a tick higher in the y/y to 2.354%, rounding up to 2.4%. The SA y/y is still 2.3%, but NSA is 2.4%. This happens from time to time because seasonal factors change year to year.

- Last 12 Rorschach test.

- CPI – Used Cars and Trucks +1.31% m/m, pushing y/y to 0.84% y/y FINALLY. Private surveys have been saying this for a while.

- Owners’ Equivalent Rent +0.29% (3.395% y/y), up from 3.37%, and primary rents +0.32% to 3.628%, up from 3.58% last month. Lodging away from home +0.4% m/m after -3.7% last month, so some give-back.

- Core goods back to 0% y/y, first time in 5 years it has been out of deflation!

- A fair amount of that is cars.

- But not all is upbeat. Interestingly core services was steady at 3.1% even though Medical Care was weak across the board. Overall Med Care -0.2% m/m, making y/y 1.91% vs 2.45% last month. Pharma -0.96% m/m, 0.92% y/y vs 3.19% last month. Doctors svcs -0.17%/0.64% vs 0.86%

- …and hospital services 0.36% m/m, 4.59% y/y, vs 4.74% last month.

- used car chart update.

- Not much market reaction. It is after all August. 10y breakevens up about 0.5bps from just before the figure. I think for the “look through the number” people the jump in cars is going to scream “steel tariffs” even though I think it’s more.

- New cars y/y.

- core ex-shelter now at 1.50%, the highest in 2 years. Inflation isn’t just in housing any more.

- Biggest m/m declines were two apparel categories (which move around a lot) and Medical Care Commodities. Biggest gainers Public Transport, Car/Truck Rental, Jewelry/Watches, Fresh Fruits/Veggies, and Used Cars & Trucks.

- My estimate of Median CPI is 0.224%, pushing y/y to 2.84%. Getting perilously close to 3%!

- Four pieces: food & energy

- Core goods – it has been a long time since core goods was meaningfully above 0%. It will happen.

- Core services less Rent of Shelter. This is interesting because Medical Care Services is a big part of this and it was weak. But Core Services didn’t soften.

- Piece 4: Rent of Shelter. Stable, high. No real chance for this to substantially slow in the near-term.

- I think we’ll stop there for today. All in all an interesting report as core goods is starting to show some worrying strength and core inflation outside of shelter is now getting perky too.

Really, the only important softness in this report was medical care. A lot of that was pharmaceuticals (which is in core goods), and yet core goods still accelerated to flat for the last year. But the core services part of medical care also decelerated, and core services overall didn’t drop. The weakness in medical care matters because PCE – which the Fed uses as its benchmark – exaggerates the importance of medical care so this trend will tend to keep core PCE lower relative to core CPI, and help the Fed believe they are not “behind the curve.” Yet, there are some signs that even dovish FRB members are not wholly on board with that any longer; nor should they be. For a long time, shelter has been the driving force pushing core inflation higher but that is no longer the case. The rise in core-ex-shelter to 1.5%, and the fact that core goods is about to lurch into positive territory, are both contributing to the broadening inflation trend. We see this in median inflation, which should rise again to a further post-crisis high when it is reported in a few hours.

We alternate between modest comps and easy comps for the next few months – but no really difficult comps. Measured inflation should continue to accelerate for the balance of 2018 and make the Fed’s obsession with core PCE increasingly indefensible.