Market Briefing For Tuesday, Nov. 14

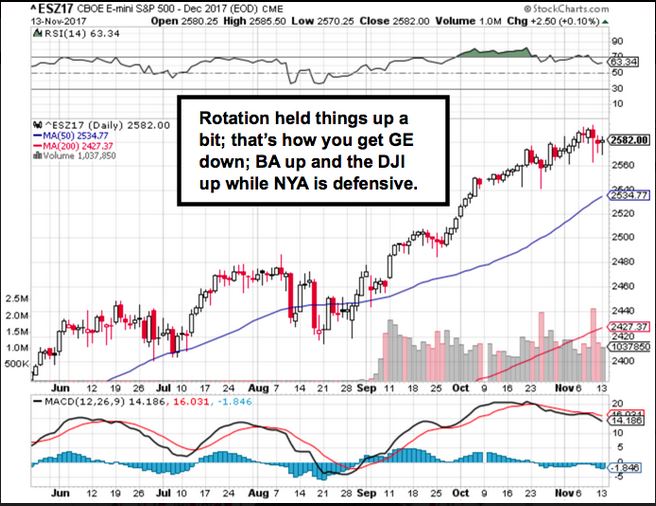

The market on Monday was fairly dull; recovering as outlined for the session; but with breadth and other aspects defensive. It's on-hold just ahead of a decision on taxes mostly; with all the other buzzards sort of out there circling. Risk remains at a high level.

Daily action - primarily saw a few Dow stocks hold up the 'list'; primarily we got strength in Home Depot, McDonald's and Boeing doing the job; as Oils and techs were basically bland on Monday.

Boeing (BA) especially took a bow; snatching a huge 40-plane order for the new Longest Range version of the Dreamliner; the 787-10 as it will be named; a replacement on many routes of Emirates for the earlier 777 or even 380's.

At the same time Emirates did not order the competitive Airbus A350 or any new 380's. The CEO of Emirates said they would not unless Airbus could be able to commit to a 10-15 year continued production and support role. I do understand that as clearly the 380 isn't exactly an albatross, but it's quickly loosing favor with airlines and the first one of Singapore's is being parked at a small airport in the French Pyrenees, stripped of engines, and may either be leased, or believe it or not, scrapped, if no new home is found fairly soon.

What's different here is a clear (frequent passenger) preference for smaller than gargantuan airliners; especially the 787 which I've often championed in light of its pressurization system (keeps it at a lower altitude hence less jet lag at destination) and economics for airlines. Passengers (other than super wealthy in First Class catered too differently on Emirates) disdain the egress aspects of the 380 most; airports and border control have more challenges when a plan arrives with 500 passengers or more; not to mention multiple flights typically departing and arriving nearly simultaneously internationally.

Basically the market Indexes have managed to stay disconnected from the economic reality; which is slow growth evolving. UBS noted a fact strongly supporting my view of the disconnect, by observing that outside of 'energy', we have only had about a 1% growth rate over the last year or so. Hence I am not so sure this is all 'late cycle' as far as the economy (maybe markets) and that's where I depart from the economists talking about this being really a 'mature' economy. Not necessarily. And not one that make the Fed heavily willing to hike rates, because they know what I'm referring to: slow growth.

That does not mean the bubble won't burst; in fact the market might decline while the economy goes up, if we can get a spike and reversal on a tax Bill; for instance. Stay tuned, as I suspect this is just starting to get interesting.

Tuesday should see more of the same; perhaps stronger if Oil kicks-in a bit with the OPEC story getting more chatter (and Oil bears running away), but can be sensitive to 'intelligence' stories if any more of that comes to light. Of course aside that it's just stable-to-firm pending a Tax Bill that's 'vote-able'.

Disclosure: None.