Market Briefing For Monday, Dec. 3

Ripples in markets are not as confounding as 'ripples in the Earth', which actually requires taking at least note of, whether associated with the horrific Alaskan earthquake or not. In Argentina, which incidentally 'also' had a 'not so huge' temblor during the start of the G20 gathering; we have the obvious (and important) signing of the 'new NAFTA' (President Trump prefers not to call it that; but that is what is really amounts to); and optimism ahead of the final outcome (I've though a deal was basically structured with China during or after a little-discussed trip by Dr. Henry Kissinger to Beijing recently).

While this comment is prepared before all is known, the market essentially it seems has discounted much of the optimism ahead of time, which suggests a more muted response to a favorable outcome; or a devastating one in the event things fall apart in utter failure (which is highly unlikely). Saturday we got a communique (at least the 'draft' is known); which omits 'protectionism' as a topic, but does touch upon 'climate change' (which even Trump sort of recognizes; as long as one doesn't dare say 'global warming'). The member states had to sign-off on this 'communique' perhaps later on in the day.

While we know the alternating views about 'tonight's dinner' with China; this market has already moved up to levels perhaps anticipating more than it will get; at least in the near-term. If so; the response other than 'relief', may well tend to be muted beyond; setting up a decent but not explosive seasonal lift if nothing untoward occurs.

Regardless, the market pattern can be disrupted within sectors impacted by either the Chinese tariff talks; or for instance any Congressional blockage of weapons sales to Saudi Arabia; especially as relates to defense industries. I nevertheless have felt the S&P was working for two weeks to set up rallies, even if they're not particularly sustainable, and struggle into early 2019.

Basically that's why I've suggested for two weeks that the Street engineered a secondary test / double-bottom (or sort of 'W' formation if you prefer) off a plunging retest of October's 'fund fiscal-year-end' washout lows. But aside a seasonal bias (that I've outlined for weeks); there's not that much favorable to deduce out of this; beyond the obligatory knee-jerk reactions to news.

In sum: Pending an update Sunday after things are sorted out with China, I'll get right to the point, since you all know where things stand up to now. As we mourn the passing of President George HW Bush; news from Argentina is relatively scarce..

I know most of you are of an age that does appreciate what this serious President (formerly CIA head before becoming Vice President) did for the Nation; and his courage in playing-down the 'Fall of the Berlin Wall', so as not to rile hard-line elements in Eastern Europe and Russia. Historic decision, as well as reflecting a type of humility that some today should try to learn, if they're not too set-in-their-ways. That effort, and whether or not it was wise to stop the Army in Iraq before toppling Saddam in Desert Storm, should be reflected upon. He didn't want to gloat over the Soviet Union, as he knew their days were ending; and the Summit with Gorbachev thereafter (very soon actually) is often marked as the Official End of the Cold War.

Meanwhile we mourn President Bush; and also note the market will close in observance of a national day of mourning, on Wednesday December 5th. He will lie in state in the U.S. Capitol Rotunda from Monday until the memorial service in D.C. on Wednesday, after which he will go back to Texas for a final funeral service and burial on Thursday.

My bottom line suspicion is that we get sort of 'half a deal' with China; that saves face and looks good on the surface. However, the 'die-is-cast' with respect to corporate trends; and that suggests a long-term gradual shift in supply chains to other countries (aside major products being intended for sale in China itself; not just export). To a degree this is already underway.

China knows this; and puts on a good show with the idea of increasing their domestic consumption and not needing the U.S. market so much; but really it is just a facade. They seriously need our markets; and don't want trends, to a degree already initiated, that move production out of the Mainland over to Taiwan, South Korea, or Vietnam. Or might I mention India or Philippines, which has been particularly successful at attracting 'call center' operations.

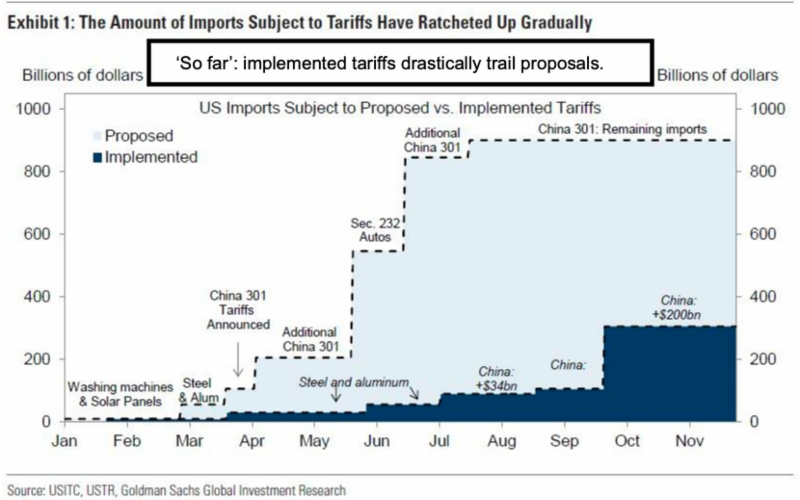

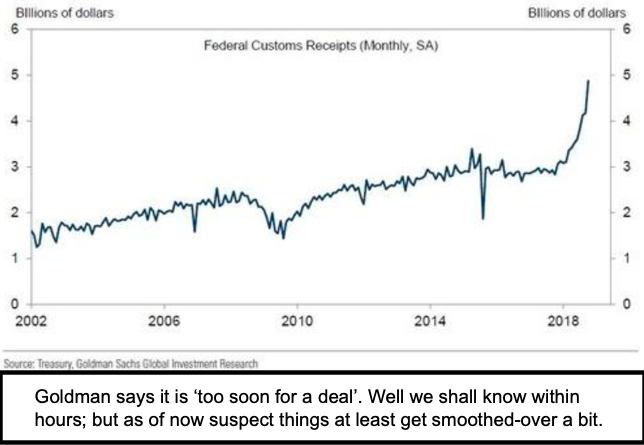

Almost regardless of a deal between Trump & Xi, overall awareness is out there; even if a full-out trade war is averted on the surface. For that reason it makes sense for the USA to 'perhaps delay' tariff impositions. The market will like that; however the 'real reason' might well be so as to enable 'time' for 'supply chain' adjustments to be facilitated. Just saying time for talks is extended misses the point: that's time to facilitate movements away to other countries (or back to the USA); hence China wants and needs a deal 'now'.

In this regard, it's an 'extend and amend' situation with China; and the answer to the extent of repositioning by manufacturers and so on, will only become evident in the much longer time. So maybe this won't be a 'flash point' for the moment (as markets and pundits speculate); but rather the eye-opening shift has already been decided by corporate decision makers, and that means the global slowdowns persist but in a process of 'transition'.

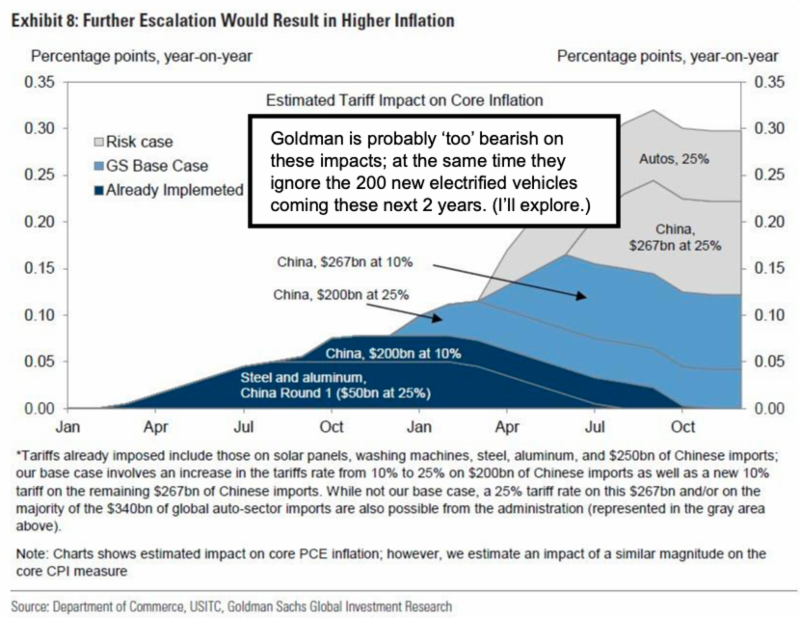

If that's the case you get a relief rally; maybe the overall seasonal effects; in a pattern that sets the stage for more difficulties in 2019; which already is a challenge given the transition to 5G and other tectonic shifts on the horizon.

There is also a lot of leverage in the economic system; and that's the credit market issues for 2019. It will be a huge transitional year not only because of long-term trade shifts (or China becoming more of a consumption nation); but the equity aspects that may favor 'other' nations in Asia for investment, rather than China. Triple B risk is out there.

Meanwhile the 'new NAFTA' as Canada's PM Trudeau properly describes it, really is a big deal; an achievement borne with some rancor (and insults of the Prime Minister by Trump); and an unknown quantity ahead, with the new Mexican (leftist) President coming on-board this weekend, in the midst of all of this, and the migrant pressures at the border.

Conclusion: the market anticipates success or at least face-saving; and we agreed for the past couple weeks; because I suspect the framework for any deal was set-up well before you get the two Presidents together. After all of this, markets might shift focus to 'political upheaval' concerns, and OPEC.