Inflation Misses Estimates

Core PCE Below 2% Target

The all important June PCE report, which is chock full of useful economic data, was released Tuesday. In this article, I will look at the inflation section of the report. It is the most important part since the Fed is deciding whether it should have contractionary policy. To simplify this point, the Fed is deciding whether it should keep the Fed funds rate near the natural/long run rate or raise it above that rate. The natural rate is where policy neither supports, nor constricts the economy. We don’t know exactly where the natural rate is, but with the Fed funds rate coming close to the inflation rate, it seems to be getting close.

The strong GDP growth in Q2 suggests Fed policy isn’t constricting the economy at all. However, countering that point is the fiscal stimulus. Fed policy might be neutral or slightly contractionary, but it might be overwhelmed by the extremely stimulative fiscal policy. To conclude, we don’t know exactly whether the Fed funds rate is too high or too low, but the rate hikes in the medium term (next 12 months) will probably push Fed policy towards being contractionary. The positive effects from the fiscal stimulus will start wearing off in 2019. When this is combined with rate hikes, it could create a scenario where the economy weakens.

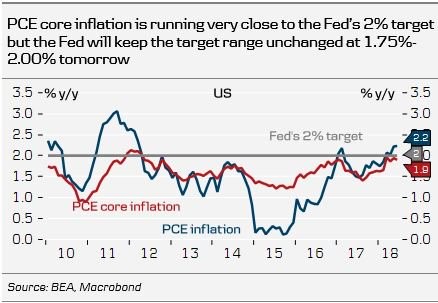

As you can see from the chart below, the PCE price index was up 2.2% year over year. I was wrong to suggest inflation would beat estimates as it missed the consensus for 2.3% inflation. The prior report was revised lower from 2.3% to 2.2%. This is good news for real wages if you use PCE inflation to deflate them. It also means the Fed shouldn’t raise rates faster. Month over month PCE inflation was only up 0.1% which met estimates and was below last month’s rate of 0.2%.

Core Inflation Decelerates

Core PCE was up 0.1% month over month which missed estimates for 0.2% and was below last month’s improvement which was also 0.2%. Furthermore, core PCE was only up 1.9% year over year which was below the consensus for 2% inflation. May’s year over year inflation was revised down from 2% to 1.9%. Technically, inflation was 1.94% in May and 1.9% in June; there was deceleration of a few basis points. Every single bout of inflation this cycle has been short lived as tough comparisons end the chances of the rate staying near the Fed’s target.

This report makes me more confident that year over year core PCE won’t stay near 2% for long once we start lapping tougher months. That’s because the 2 year stacked inflation rate was 3.54% in May and 3.52% in June, showing there is no acceleration in inflation despite the nominal improvements in wage growth. June 2017 core PCE was 1.62%. The July, August, and September comparisons are easy, allowing for a quick chance to rise above 2% before the fall. It was 1.5% in July, 1.41% in August, and 1.48% in September. To be clear, I expect core PCE price inflation to be at or above 2% in the next 3 months. After that, this bout of inflation will be over despite the worries about the economy overheating because of tariffs and a low unemployment rate.

Fed To Hold Rates Pat On Wednesday

Since I’m analyzing the data points, I need to review what happened and why it happened. Don’t let that confuse you into thinking this inflation report was a game changer. It was a minor miss in a period where some would expect inflation to be beating estimates because many consider the economy to be late in the cycle. The economy is at least in the middle of the cycle according to Fed policy since it has raised rates 7 times.

Speaking of the Fed, it won’t raise rates at its meeting on Wednesday. The white line in the chart below shows there is about a 0% chance of a rate hike in August. There are always murmurs of a surprise hike, but there is no point in hiking rates with inflation below the target for 2 months. The highest probability of a hike is in September as there is a 91.4% chance. The potential December hike, which has a 75.1% chance of occurring, could be the one which pushes Fed policy towards being contractionary.

(Click on image to enlarge)

Personally, I think that will be the March 2019 hike, but we don’t know for sure which one will do it. Since core PCE inflation is still below the target, I don’t understand the rush to hike rates now that the Fed funds rate is significantly above the zero bound. The fears of the Fed not having enough room to cut rates were ill-founded as it will likely end the cycle with the funds rate at least 2.5%.

That’s still a real concern for Europe and Japan because they are at negative rates. If America falls into a recession in the next few years, those countries will be in a tough situation because they won’t be able to stimulate themselves out of the recession. It seems like America is one of the few advanced economies which still has a normal business cycle. It has heightened economic growth and near 2% inflation unlike Europe. America has better demographics than Europe and Japan. America also has thriving large internet companies which drive innovation and equity markets higher.

Treasury Reaction To Inflation

I was also wrong to suggest the treasury market would have a reaction to this inflation data. The 10 year yield fell 1 basis point and the 2 year yield increased 1 basis point which means the curve flattened again. The difference between them is 29 basis points. If the Fed makes any comment on the yield curve, it will be the top news coming out of the Fed meeting. I don’t expect the Fed to alter guidance based on the yield curve because the past few meetings with both Yellen and Powell as chair have shown us that neither are concerned enough about an inversion to slow rate hikes.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more