In Fed We Trust, Fed-Led '08 Meltdown Exposed, It's Setting Up Again

(Picture: To prepare you for the information that you are about to learn we have to quietly and slowly use some psychological methods to ease you into this. We warn you that after reading this it will be difficult to remove these concepts from your investment process. Let us walk you through something incredible that a follower/commenter pushed us on.)

After this work, I am worried that the market is almost solely in the hands of decisions made by the Fed, but not through rates. Yellen holds our financial fate in her hands. Is that the way ("free") markets are supposed to work? We are in incredibly dangerous territory.

We think this has implications for banks, the consumer, investors, the economy and the world.

But we'll give you the facts of what we are looking at and you come to your own conclusion. Let's start.

To start, I want to give an incredible call out to SteveMDFP. He read our work better than we did yesterday.

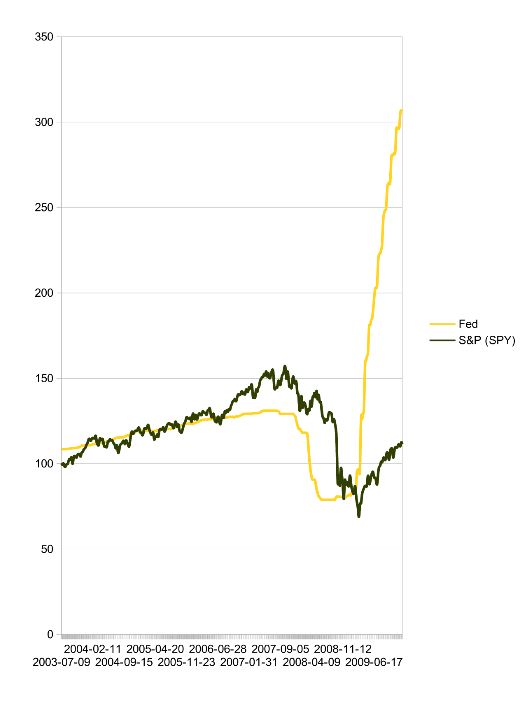

In our report, Is The Fed Buying Stocks, we showed how the Fed's open market operations and balance sheet was the key driver to stock market moves. In fact, if you look at the correlations of Fed balance sheet changes to S&P 500 (NYSEARCA:SPY) returns, they hauntingly line up almost to a "t."

We'll show it again because it's a great chart. Here you go. Scroll slowly so you see each year's performance versus the "YOY Change" of Fed balance sheet assets.

You can see how the Fed changes in positions almost precisely told you how much the S&P 500 ETF would be up or down.

To this chart, SteveMDFP asked an amazing question. Buckle your seat-belts. He asked,

"I found the shocking number to be the 41% DECREASE in the balance sheet during 2008. My guess is they shrank the money supply with this step to rein in the overheated excesses in real estate financing--but precipitated the 2008 crash.

Of all the finger pointing that's been done about the crash, few have been blaming the Fed for actions in 2008 itself, but maybe they deserve the lion's share of blame for taking this precipitous action."

Looking deeper into our report, SteveMDFP caught on to a scary reality that the Fed themselves may have induced the '08 crash. Have you heard that before? We're about to show why that may be true.

We want to show a close up to his question. My hands are shaking writing this because it is just so powerful.

The green line is the S&P 500 ETF. The yellow line is the size of the book of open market operations (Fed buying is up, Fed selling is down).

I'm still shaking. If you put on your glasses you can see the Fed stopped buying and started selling (reducing its holdings) before the peak in October 2007. (Big disclaimer, please excuse my less-than professional charts, I'm jamming to show you a point).

The yellow line ticks down for the first time in years August 15th, 2007.

The yellow line starts its bigger slide down December 12th, 2007 and steeper on March 19th, 2008. Those are the times when the Fed stepped up selling.

Here's the numbers (we adjusted the Fed numbers to fit the SPY numbers, we divided the Fed balance sheet number by 6,000,000,000 so it would line up close to the SPY price). Watch the Fed number drop. That's the Fed selling taking liquidity from the market. Those sales matter and helped the market go down. And watch our key dates, Dec 12th, and worse, March 19th, for the change.

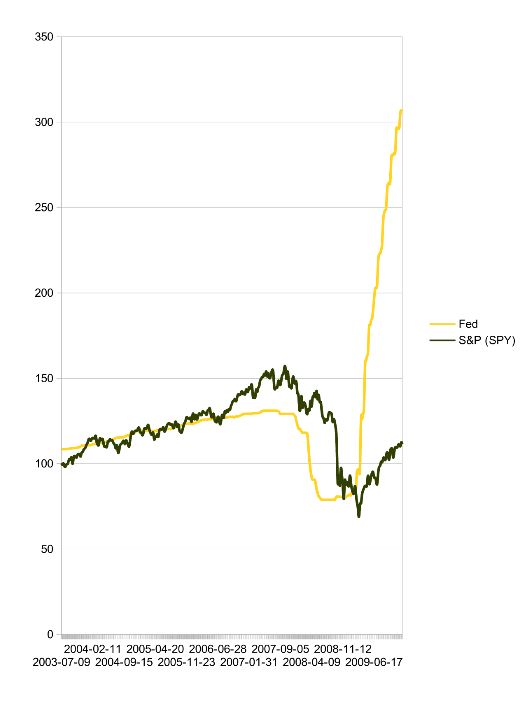

And here's the S&P chart in that timeframe.

(Click on image to enlarge)

The first line is August 13th which was the little baby drop in the yellow Fed line. The Fed barely started selling after a long string of a several year buying spree.

The second line is when the Fed really started selling securities, sapping liquidity from the market.

The third line is the Fed, we call it, panic selling of US assets. (Look at the numbers, that's not what you'd call it?)

Continue reading on Seeking Alpha.

Disclaimer: All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you ...

more

Excellent article! This truly blew me away. A must read.

thx Dick