Housing Disinflation Isn’t Happening Yet

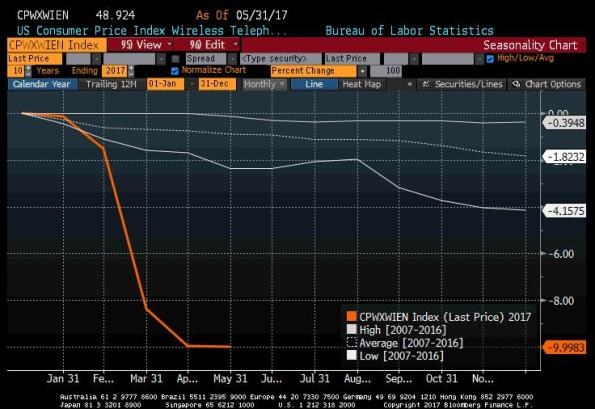

Before everyone gets too animated about the decline in core inflation, with calls for central banks to put the brakes on rate normalization, let’s realize that the main drivers of lower inflation over the last few months – zero rise in core CPI over three months! – are not sustainable. I’ve written previously about the telecommunications-inflation glitch that is a one-off effect. Wireless telephone services fell -1.38% month-over-month in February (not seasonally adjusted), -6.94% in March, and -1.73% in April. In May, the decline was -0.06%. Here is a chart, courtesy of Bloomberg, showing the year-to-date percentage declines for the last decade. The three lines at top show the high, average, and low change over the prior decade, so you can see the general deflationary trend in wireless telecom services and the historical outliers in both directions. The orange line is the year-to-date percentage change. Again, the point here is that we cannot expect this component of inflation to deliver a similar drag in the future.

The other main drag comes from a less-dramatic decline in a much-larger component: Owners’ Equivalent Rent. In this month’s CPI tweetstorm, I pointed out that this decline is mostly just returning the OER trend to something closer to our model (see chart below), but many observers (who don’t have such a model) have seen this as a precursor to a more-significant decline in rents.

This is actually a much more-important question than the dramatic, and easy-to-diagnose, issue of wireless telecommunications, because OER is a ponderous category. You can’t get high inflation without OER rising, and you can’t get deflation or even significant disinflation without OER declining. It’s just too big. So what are the prospects for OER rolling over?

Here are two reasons that I think it’s very unlikely that this is a precursor to a significant decline in housing inflation.

First, while I understand that rent increases in some parts of the country are moderating, they are always moderating somewhere in the country. Owners’ Equivalent Rent tends to parallel primary rents (“Rent of Primary Residence,” which measures the actual price of a rental unit as opposed to implied rent of an owner-occupied dwelling) reasonably well, and when home prices are rising it tends to imply that rents – as the price of a substitute, at least for the consumption part of home prices – are also rising. (A house is both an investment asset and a consumption good, and the BLS’s method for separating these two components of a home recognizes that the consumption component should look a lot like the substitute). And the fact is that Primary Rents are not (yet?) decelerating much (see chart, source Bloomberg).

Yes, I understand and agree that home prices are already too high to be sustainable in the long run. Either incomes need to outpace home prices for a while, or home prices need to decline again, or we need to become accustomed to housing becoming a permanently larger part of our consumption and asset mix (see chart, source Enduring Investments).

But is that going to happen? Well, here are two charts that should make you somewhat skeptical that at least on the supply side we are about to see a decline in home prices. First, here is the index of Housing Starts, which last month took a nasty drop. Even without the nasty drop, though, notice that the level of starts was not only far below the level of the last few peaks in the housing market, but actually not far above the troughs reached in the recessions of the mid-1970s, early 1980s, and early 1990s. The only reason the current level of starts looks high is because homebuilders basically stopped building for a few years after the housing bubble.

Homebuilders stopped building because there was suddenly plenty of inventory on the market! In the immediate aftermath of the bubble, the homes that were available for sale were often distressed sellers and as prices rose, more and more of the so-called “shadow inventory” (people who wanted to sell, but were now underwater and couldn’t sell) was freed. This kept a lid on overall housing starts, but the net effect is that even now, when most of that shadow inventory has presumably been liquidated (a decade after the bubble and at new price highs), the inventory of existing homes available for sale has become and has remained quite low (see chart, source Bloomberg).

The supply side, then, doesn’t seem to offer much cause to expect home prices to moderate, even if their prices are relatively high. I’d want to see an overreaction of builders, adding to supply, before I’d worry too much about another bust, and we haven’t seen that yet. So we have to turn to the demand side if we expect home prices to decline. On that side of the coin, there are two arguments I sometimes hear: 1) household formation in the era of the Millennial is low, or 2) households don’t buy as much housing as they used to.

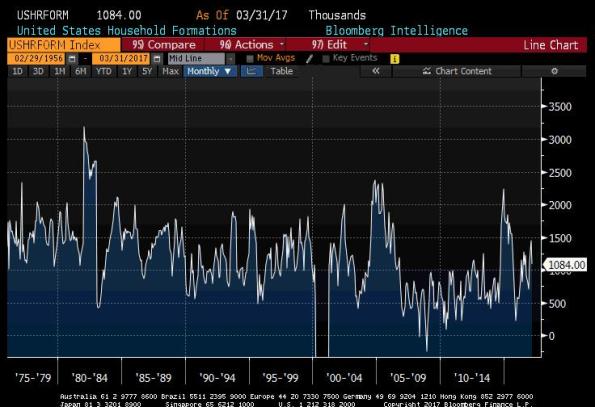

There is no evidence that household formation has slowed in recent years. As the chart below (source Bloomberg) shows, household formation has been rising since 2009 or so, and is back in line with long-term trends. Millennials may have weird notions of home life (I don’t judge!), but they still form households of their own.

As for the second point there…notice that I phrased the question as whether Millennials are buying less housing, rather than as buying fewer homes. I think it’s plausible to suggest that Millennials might demand fewer homes to buy, but it’s hard to imagine that they’re neither going to rent nor buy homes – and if they do either, they are demanding shelter as a consumption item. It just becomes a question of whether they’re demanding rental housing or owned housing.

The upshot of this is that there’s no sign yet of a true ebbing in housing/rental inflation. And until there is, there’s scant need to fear a disinflationary trend taking hold.