Gas And Housing-Powered Inflation Mean Real Wages Are Going Nowhere

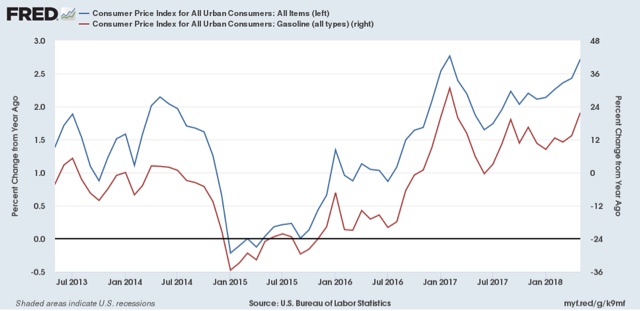

This morning consumer price inflation for May was reported at +0.2%. YoY inflation was 2.8%. This is tied for the highest in six years (blue):

The cause of the increase was primarily twofold — and neither one reflective of wage inflation. First, gas prices have increased by over 20% in the past year (red, right scale above).

Second, the costs for shelter (housing) are picking up steam again, up 3.5% YoY(red):

Note that, courtesy of gas prices, inflation for everything else except for shelter has also been rising (blue).

Most everyone assumes the Fed will raise rates again later this week. Let me point out, as others have as well (e.g., Dean Baker) that this will only make housing costs *more* rather than less expensive, and so will not serve to bring inflation down, short of causing a recession.

Meanwhile, while *nominal* wage growth for ordinary workers has finally been rising in the last few months, up 2.8% YoY:

Today’s 2.8% YoY consumer inflation means that *real* wages haven’t grown at all, up less than 0.1% YoY:

Further, since gas prices bottomed in winter 2016, *real* hourly wages have barely risen at all, as shown in the below graph normed to 100 as of February 2016:

Since that time, real wages have increased only 0.3%.

We’ll get our best clue as to whether the ordinary American household is simply holding its own, or is in actually undergoing increased stress, when retail sales are reported later this week.