Financing US Twin Deficits: Reliance On The Kindness Of Foreigners

If ever the United States needs to rely on the kindness of strangers, it is now while it runs twin deficits. The trade deficit has been widening as exports weaken and imports rise in response to the strong U.S. dollar. The resulting current deficit cuts into GDP growth. The proposed ramping up of fiscal stimulus programs is expected to increase the federal government’s budget deficit. With both deficits likely to deteriorate further this year, the Trump administration could not have chosen a worst time to antagonize its major trading partners. These partners, collectively, will be called upon to finance these deficits.In a sense, the administration has picked a fight with its bankers, something smart business people avoid at all costs.

The Trade Deficit

The United States runs trade deficits with nearly 100 countries (Chart 1). As the world’s main reserve currency, the United States gets to exchange printed paper (dollars) for goods and services produced by its trading partners. In the case of the trade deficit, the incoming U.S. dollars balance its international books in the capital account as money flows either into portfolio investments ( e.g. stocks , bonds ) or into long term investment(industrial capital expenditures). The current account deficit will widen should the U.S. dollar appreciate in response to the Fed’s policy of rate increases in 2017 and 2018. At the same time, protectionist policies will harm its trading partners and this will reduce the amount of excess savings that would normally flow to the United States.

Chart 1 US Current Account

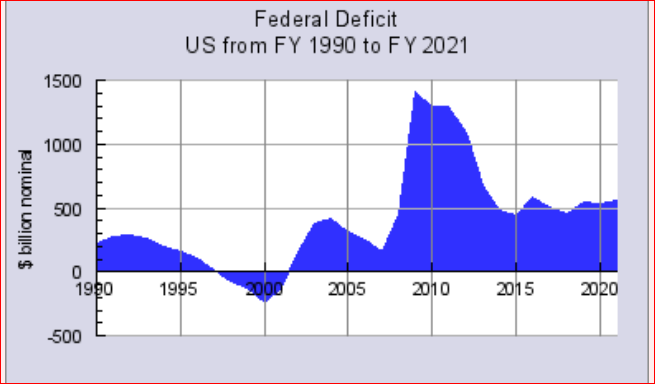

More importantly, the U.S government looks to these strangers to help fund its budget deficit (Chart 2).

The United States has been able to fund its budgetary deficits at low interest rates with the help of foreign governments, sovereign wealth funds and large foreign institutional investors. These entities have been aggressive buyers of U.S. Treasury bonds over the past decade and have played a major role in supporting the Treasury market. Without their support, U.S. long term rates would likely be much higher today.

Since the 2008 financial crisis, the U.S. government has been successful in working down its annual deficit to about $500 billion. However, with the expectation of major tax cuts and a ramping up in spending on infrastructure, the annual deficits would likely return to much higher levels. Again, greater foreign savings will be needed to support an expansion of the supply of Treasuries.

Reliance on foreign savings to finance U.S. growth would not be necessary if the United States increased its domestic savings rates. To date, the rate remains less than 5 per cent of total income and that is nowhere the rate required to provide financial capital to support investment in physical facilities.To the degree that the United States does not generate sufficient savings to fund its economic growth, these strangers will be needed to make up the shortfall.

The concern is that Trump’s trade and fiscal policies have the potential to force long term interest rates higher in an effort to attract the financial capital from abroad, required for domestic economic growth.In fact, the market was saying as much in recent months as the 10 -year bond yield moved in anticipation of a worsening of these twin deficits. It remains to be seen just how willingly and, more to the point, how able these strangers are to support U.S. growth. The heavy-handed trade policies pursued by the Trump administration will slowdown international trade and this will impact negatively on the foreign savings that the U.S. has come to rely upon.

If rates move too high, the bonds used as collateral will have to be augmented by more bonds! Without banning bonds as collateral, the new normal will throw Trump to the mat. A credit crisis will result, and it could be the biggest one of all time. Capital formation could be impacted. Big Banks and counterparties will fail or be bailed out. Jobs will be lost in the hundreds of thousands and maybe more.

I think your scenario of a full blown crisis is at the extreme end of the spectrum. But I am worried that Trump could blow up both deficits to the point where the rising capital costs will be a killer in many respects.

I am surprised that Trump's chaotic beginning is being totally ignored by the equity and capital markets--- they seem to conduct business as usual!

#Trump's acts inhibiting free trade and creating trade barriers by taxes will have an even worse chilling effect on growth and cause inflation to boot. That said, his budgetary ambitions are only acceptable when compared to #Hillary Clinton. The Republicans have elected a Democrat when it comes to spending. It is up to them to reign him in.