Employer Health Benefits And Wages: The Good News And The Bad

How much have increasingly expensive health benefits slowed the growth of wages? How much have they added to employer costs? There are good news and bad news in the latest numbers.

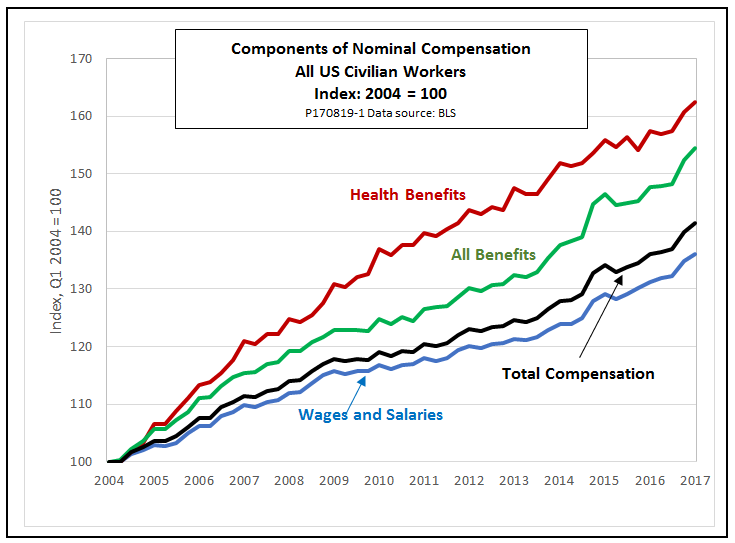

The following chart, based on data from the Bureau of Labor Statistics, shows that employee health benefits have been the fastest-growing segment of compensation costs for US employers in recent years. The cost of health benefits has risen by 62 percent, compared with an increase of just 36 percent in wages and salaries. Over the same period, the consumer price index has increased by 31 percent. Wages have barely outpaced the cost of living, while the cost of health care benefits has grown twice as rapidly as the average price of all goods and services.

There is a disconnect in the way that workers understand the relationship between wages and benefits and the way employers see them. Workers tend to see benefits as something their employers give them in addition to what they earn. Accordingly, workers think of the cost of healthcare and other benefits as coming out of their employers’ pockets. Employers, on the other hand, see benefits as part of the total cost of the compensation they pay per worker. They know that if they have to pay more for health insurance, there is less left to put in workers’ pockets as wages and salaries.

Economists have long argued that the employer perspective is the correct one. In the long run, workers bear the cost of benefits. Policies like tax deductibility may influence the way employers split total compensation between cash wages and benefits, but it does not affect the total compensation per worker than they are willing to pay, or can afford to pay.

Economists consequently view the rising cost of employer-sponsored health insurance as one reason for the slow growth of wages. The data in the chart imply that if the cost of healthcare benefits had remained unchanged since 2004, cash wages would now be almost 5 percent higher than their actual level.

The statistical details contain both good news and bad news. The good news is that recently, the growth of health benefit costs has slowed a bit. Over the past year, health benefit costs have slipped from 8.4 percent of the total cost of compensation to just 8.3 percent. Over a five-year period, the growth of nominal wages has edged out the rising cost of health benefits by 13.3 percent to 13.1 percent.

The bad news is that the average cost of health benefits has slowed, in large part, because fewer employers are offering coverage, and because they are shifting a growing share of health insurance costs to their workers. A recent report from the Kaiser Family Foundation makes these points:

- Since 2006, the premiums for employer-sponsored health insurance have increased by 58 percent, while workers’ share of those costs has increased by 78 percent.

- The share of workers facing an annual deductible of $1,000 or more has increased from 10 percent to 51 percent over the same period.

- The share of firms that provide health insurance to their workers has fallen from 66 percent to 56 percent.

The bottom line: High healthcare costs are dragging down their wages even while higher out-of-pocket costs take a bigger bite out of their take-home pay. America’s unique system of linking healthcare coverage to jobs is not working, either for workers or employers.