Does Weaker Homebuilder Sentiment Signal Higher Macro Risk?

The hard data on the US housing market has been weakening for most of this year but the blowback for sentiment in the homebuilder industry has been mild – until now.

The Housing Market Index (HMI), a monthly benchmark of survey results, fell in the November update to the lowest reading in more than two years. “For the past several years, shortages of labor and lots along with rising regulatory costs have led to a slow recovery in single-family construction,” says Robert Dietz, chief economist at the National Association of Home Builders (NAHB), which publishes the data. “While home price growth accommodated increasing construction costs during this period, rising mortgage interest rates in recent months coupled with the cumulative run-up in pricing has caused housing demand to stall.”

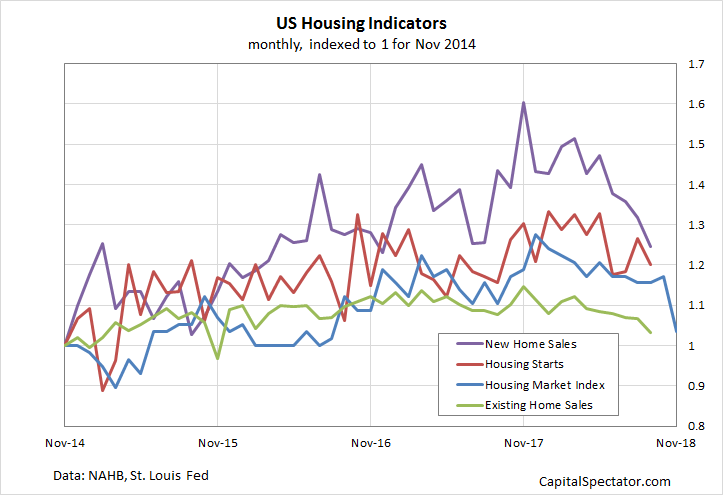

HMI is still close to the post-recession peak reached last December, but it’s clear that sentiment, along with hard data from other corners of the housing market, has been trending down this year. As the chart below shows, housing starts and home sales have weakened in 2018 and the latest tumble in HMI suggests that the downshift will continue in the months ahead.

The weakness in this key slice of the US economy can’t be denied, but the warning signs have been bubbling for months. In July, for instance, I considered the possibility that the wobbly housing data would act as a brake on economic growth generally.

Fast forward four months and it’s becoming clear that the stellar 4.2% increase in second-quarter GDP will probably mark a growth peak for the foreseeable future, in part because of the headwinds from housing.

Today’s update on new residential housing construction is expected to post a moderate rebound in October activity, according to the consensus forecast via Econoday.com. But the trend for housing starts is expected to remain weak for the foreseeable future, based on a set of combination forecasts for the one-year trend. Today’s release is projected to reflect year-over-year growth slipping into modestly negative terrain after rising 3.7% in September.

The downturn in housing market is worrisome given the industry’s critical role in economy. As Edward Leamer advised in a 2007 research paper, “Housing IS the Business Cycle.”

Of the components of GDP, residential investment offers by far the best early warning sign of an oncoming recession. Since World War II we have had eight recessions preceded by substantial problems in housing and consumer durables.

There’s always room for debate about using one slice of economic data as a fail-safe indicator of recession risk and so it’s premature to draw any conclusions about the outlook for the US business cycle from housing alone, at least for now. Indeed, using a broad set of indicators continues to reflect low recession risk. The current issue (Nov. 18) of The US Business Cycle Risk Report estimated a virtually nil probability that a new NBER-defined downturn had started, based on data published through last week.

Projections for GDP, however, point to an ongoing deceleration in growth. The Atlanta Fed’s GDPNow model, for instance, is currently estimating output rising 2.8% in the last three months of this year, reflecting expectations for a second round of slower quarterly growth.

The bottom line: the case is still weak for expecting a new recession in the near term, using data published to date. But incoming data could change the calculus. For now, the long-running assessment on these pages that US growth peaked in Q2 is alive and well. The question is whether the deceleration deteriorates into deeper trouble for 2019.

Disclosure: None.