Basic Materials Seem To Be On Sound Footing With Home Construction Boom

Thirty-year mortgage rates might have ticked up in the past 12 months, but for now, that doesn’t seem to be weighing on new home demand. According to the Commerce Department, housing starts climbed to an 11-year high of 1.35 million units in May, a clear sign that the market has continued to improve following the subprime mortgage crisis a decade ago. This is constructive—pun fully intended—not only for the economy but also consumption of building materials, energy and resources.

According to home-construction services firm Happho, for every 1,000 square feet of new housing, nearly 8,820 pounds of steel are required, as well as 400 bags of cement, 1,800 cubic feet of sand and 1,350 cubic feet of gravel and other aggregates. This doesn’t begin to touch on finishers such as brick, paint and tiles, or fittings such as windows, doors, plumbing and electrical.

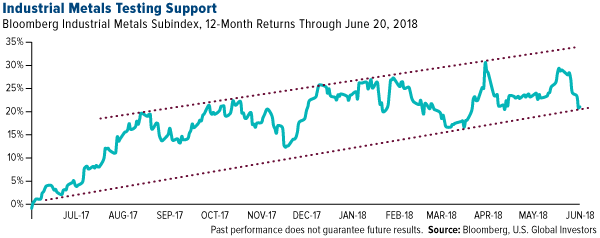

I believe metal miners and manufacturers of basic materials could very well be beneficiaries of the construction surge. For the 12-month period through June 20, a basket of industrial metals such as aluminum, copper and nickel are already up 21 percent, with technical support on a clear uptrend.

Is the Rental Housing Explosion Over?

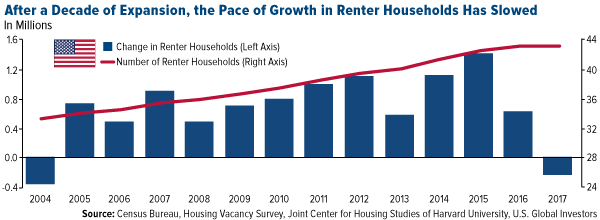

One sign that the growth in homebuilding might be sustainable is that the rate at which Americans are renting instead of buying appears to be slowing. For the first time since 2004, the number of renter households actually declined last year, according to a report by the Joint Center for Housing Studies of Harvard University.

This could be the result of an improved economy and the unemployment rate being at historically low levels. After nearly a decade, consumers may finally feel financially secure enough to get out of their apartments and make a down payment on a new home.

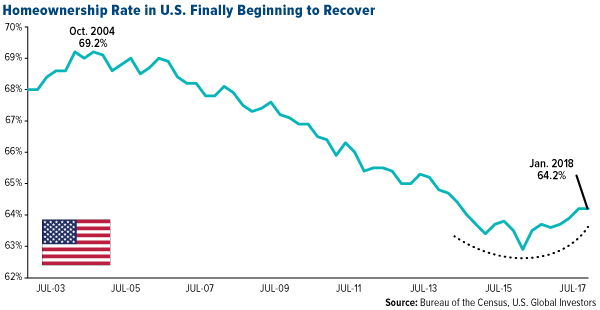

Likewise, we see the homeownership rate in the U.S. beginning to recover after hitting a floor in the second quarter of 2016. From its peak in October 2004, the rate fell to a 50-year low of only 62.9 percent. It might be too early to tell if this marks a significant rebound, but the upturn suggests at least that the homeownership rate has stabilized.

Lumber Prices Appear to Have Peaked

A strong headwind to further demand growth right now is higher material prices. A forest fire in Canada last summer severely disrupted the lumber supply chain, while the Trump administration’s tariffs on imports of Canadian softwood lumber, aluminum and steel have somewhat softened homebuilders’ confidence.

But lumber prices appear to have peaked and are currently in decline. After hitting $651 per 1,000 board feet in mid-May, prices have dropped close to 20 percent and have posted losses in seven of the last eight trading days through June 19.

Disclosure: Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com ...

more