Does Anyone Still Trust The GDP Deflator?

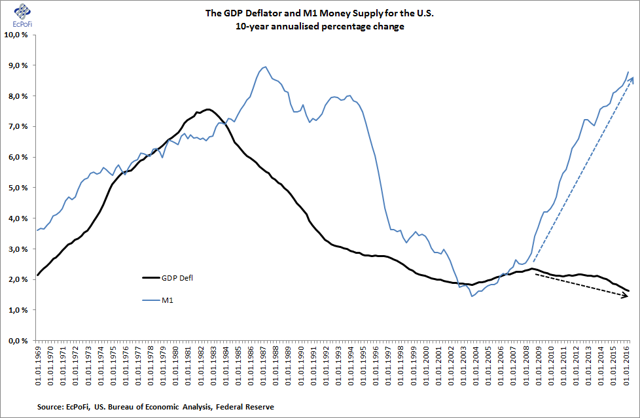

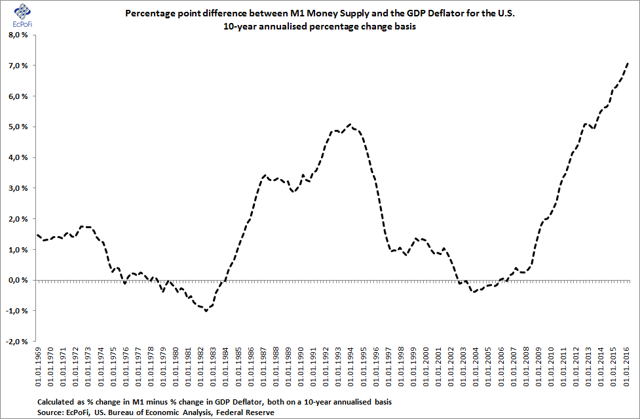

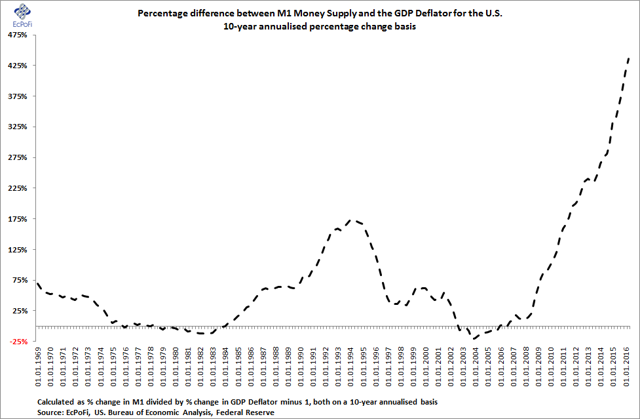

The charts below illustrate how the money supply growth rate has vastly outpaced that of the GDP Deflator for the last eight years or so. As money supply growth is a key driver of price inflation, the great disconnection between the two, now the highest ever based on data starting in 1959, indicates that price inflation as estimated by the GDP Deflator could be vastly underestimated (charts updated as of Q3 2016).

On the other hand, if the GDP Deflator is correct, then surely it must soon turn and head upward. And should it ever gather significant momentum, this just might force the Federal Reserve to tighten monetary policy leading to a slowdown in the money supply growth rate and a collapse in asset prices.

In any case, there are more headaches ahead for economic policymakers as the U.S. economy surely must now be a step closer to a period of (official) stagflation, perhaps on an unprecedented scale.

If 7 in 10 Americans have little savings, the money is obviously not floating around in the real economy. A lot of it is in big corporations, and in big banks. It becomes a rainy day fund for big business. Without adequate demand on main street, it is likely to stay where it is now.