EconoFact: Bringing Facts And Data To Policy Debates

EconoFact is a new non-partisan online publication, designed to bring key facts and incisive analysis to the national debate on economic and social policies. It is written by leading academic economists from across the country who belong to the EconoFact Network, and published by the Edward R. Murrow Center for a Digital World at The Fletcher School at Tufts University. The co-editors are Michael Klein and Edward Schumacher-Matos.

Inaugural memos tackle Trump’s promise to bring back manufacturing jobs, the prospects for the big, beautiful wall, charter schools, the destination based border tax, whether the trade deficit is a drag on growth, and whether China is now manipulating its currency.

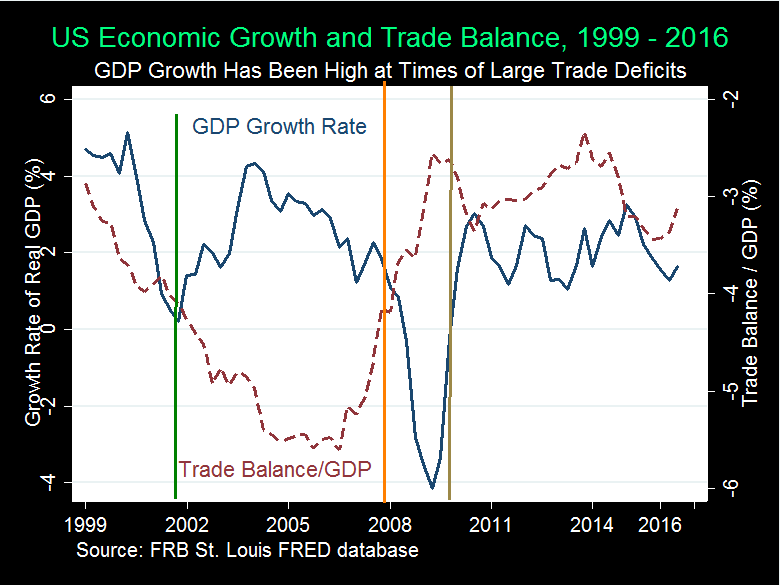

Here is a graph from the Chinn-Klein memo on trade deficits:

New memos will appear as conditions and proposals warrant.

Memos Currently Online

- Will Manufacturing Jobs Come Back? David Deming, Graduate School of Education and Kennedy School of Government, Harvard University

- Is the Trade Deficit a Drag on Growth? Menzie D. Chinn, Robert M. La Follette School, University of Wisconsin-Madison and Michael W. Klein, Fletcher School, Tufts University

- House GOP Plan Aims to Boost Competitiveness, May Also Violate International Trade Laws Joel P. Trachtman, Fletcher School, Tufts University

- Is China a Currency Manipulator? Michael W. Klein, Fletcher School, Tufts University

- Should the United States Build a Wall on the Mexican Border to Reduce Unauthorized Immigration? Jennifer Hunt, Rutgers University

- Charter Schools: The Michigan Experience and the Limited Federal Role Nora Gordon, McCourt School of Public Policy, Georgetown University

* Full disclosure: I am a former coauthor with Peter Navarro [ more

I thought this one was interesting: Whether the border tax adjustments in the blueprint are deemed legal from a World Trade Organization perspective will depend on a key interpretation: Is the tax in question an income tax or a tax on a product? It does not seem possible to characterize the new tax as a tax on a product. It is calculated by reference to firm-based attributes under a new and simplified definition of net income, but a definition of net income nonetheless.

The fact that imports would face 20% tax on their price with no deductions while domestic producers would be able to deduct most expenses — including payroll — from the tax base could also make the import border adjustment illegal under the international rules. econofact.org/house-gop-tax-plan-aims-to-boost-competitiveness-might-also-violate-trade-law