Dividend Income Update December 2018

The start of every month is exciting for all dividend income investors as we look back at the previous month and see how much passive dividend income our portfolios generated. December was exciting as ever as my year over year numbers continue to highlight the trifecta magic of dividend investing which includes, adding fresh capital, dividend raises and basic compounding to create an ever increasing passive income stream. Even if I stopped adding fresh capital today and every dividend stock I owned kept all distributions flat, without a single raise, my passive income stream would continue to grow.

With that being said, let’s take a look back at my December 2018 dividend income.

Dividend income from my taxable account totaled $768.19 up from $746.07 an increase of 3.0% from December of last year.

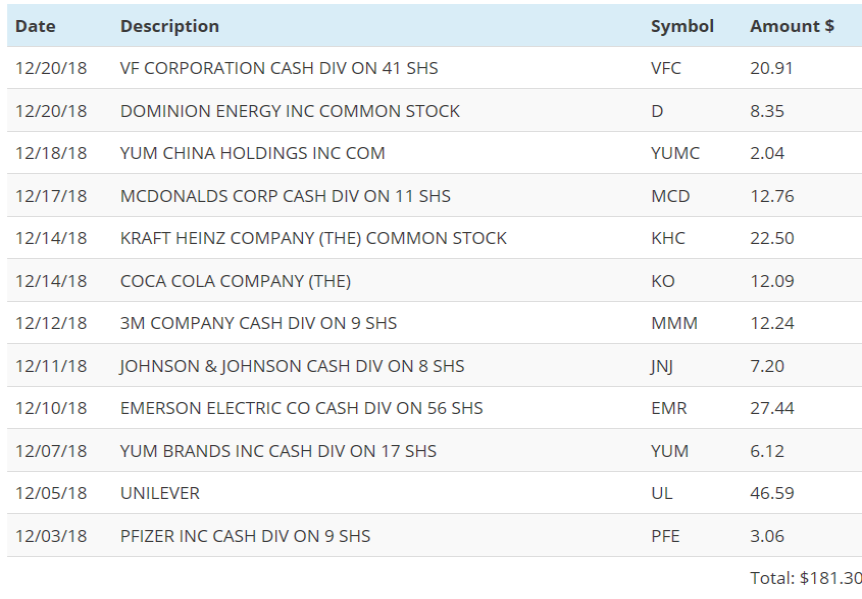

Dividend income from my ROTH account totaled $181.30 up from $167.17 an increase of 8.5% from this time last year.

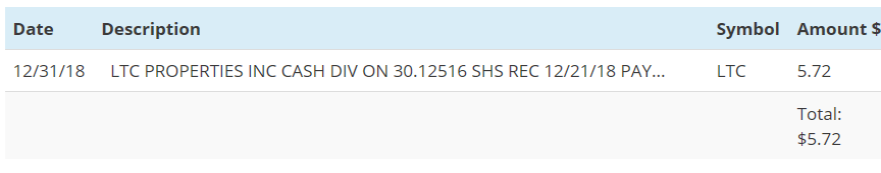

Dividend income from my IRA account totaled $5.72 up from $1.97 from this time last year, an increase of 190.4%.

Grand total for the month of December: $955.21 an increase of 4.4% from December 2017.

Grand total for 2018 dividends: $9,086.69 an increase of 21.0% from 2017. You just have to love the very real results of dividend growth investing.

Brokerage Account

Year to date dividends: $5,925.29

ROTH Account

Year to date dividends: $2,224.32

IRA Account

Year to date dividends: $937.08

I have to stress that dividend compounding can work over time and can create an ever increasing passive income stream despite holding dividend cutters and eliminators. While 2018 saw my portfolio receive many dividend raises, stocks like GE, ADNT, APY and TEVA either reduced or eliminated their payments. We all know that diversification is the key to mitigate these circumstances that every long term dividend investor will inevitably face.

I hope everyone had a great 2018 with a renewed sense of what can be accomplished with patience, not panicking, common sense and general investing consistency and discipline. These traits enable consistent dividend income results you see above as well as the knowledge that with high, moderate or even low income levels passive income growth can be achieved.

Disclosure: Long all above.